Abstract

The National Broadband Network (NBN) has the potential to transform economic and social relations. But realising that potential requires universal take-up and significant utilisation of the NBN. This paper examines how NBN wholesale pricing can help to do this. It introduces a mark-up concept to build a bridge between wholesale and retail prices, provides a yard-stick for how we might define affordable retail pricing and suggests how an entry level wholesale price can be specified to deliver that and enable low income customers to access the NBN.

Introduction

The following sections of the paper discuss:

-

How NBN wholesale prices flow through to retail broadband prices

-

Some benchmarks for what is ?affordable?

-

Simpler wholesale pricing that will encourage both adoption and use of the NBN

-

The role of mobile broadband

-

Australian customers? needs ? some scenarios

The Mark-up

To discuss the NBN and affordability, we need a link between wholesale pricing and retail pricing. This link is the mark-up; defined as the difference between the retail price (excluding GST) and the cost of (usually regulated) wholesale inputs divided by wholesale input cost. This means that with a mark-up of, say, 50% the retail ISP adds 50 cents for every $1 of wholesale costs to cover its own costs and make a profit.

Mark-ups on copper and the NBN

On the existing copper network, the mark-up is quite large. This is shown in Table 1 below for iiNet; chosen because it uses both unbundled local loop and line-sharing in its business model.

Table 1. Cheapest broadband plans for iiNet on the copper network

|

Unbundled Loop (ULLS) |

Line Sharing (LSS with WLR) |

|

|

Retail price: B?band |

$59.95 (100 GB pm) |

$29.95 (100 GB pm) |

|

Voice line |

nil (VoIP ? free local & STD) |

$29.95 (PSTN - 20 cent local calls) |

|

Total |

$59.95 |

$59.90 |

|

Less: |

ULLS $16.21 |

WLR $22.84 |

|

LSS (+ 8.9 cents/local call) $1.80 |

||

|

Mark-up after GST (Excluding calls) |

$38.29 (236%) |

$29.81 (121%) |

Source: ACCC and iiNet sites, July 2013

The mark-ups of 121-236% above are 3 to 9 times as high as the 30-40% mark-ups that Optus claimed would be necessary back in 2008i.

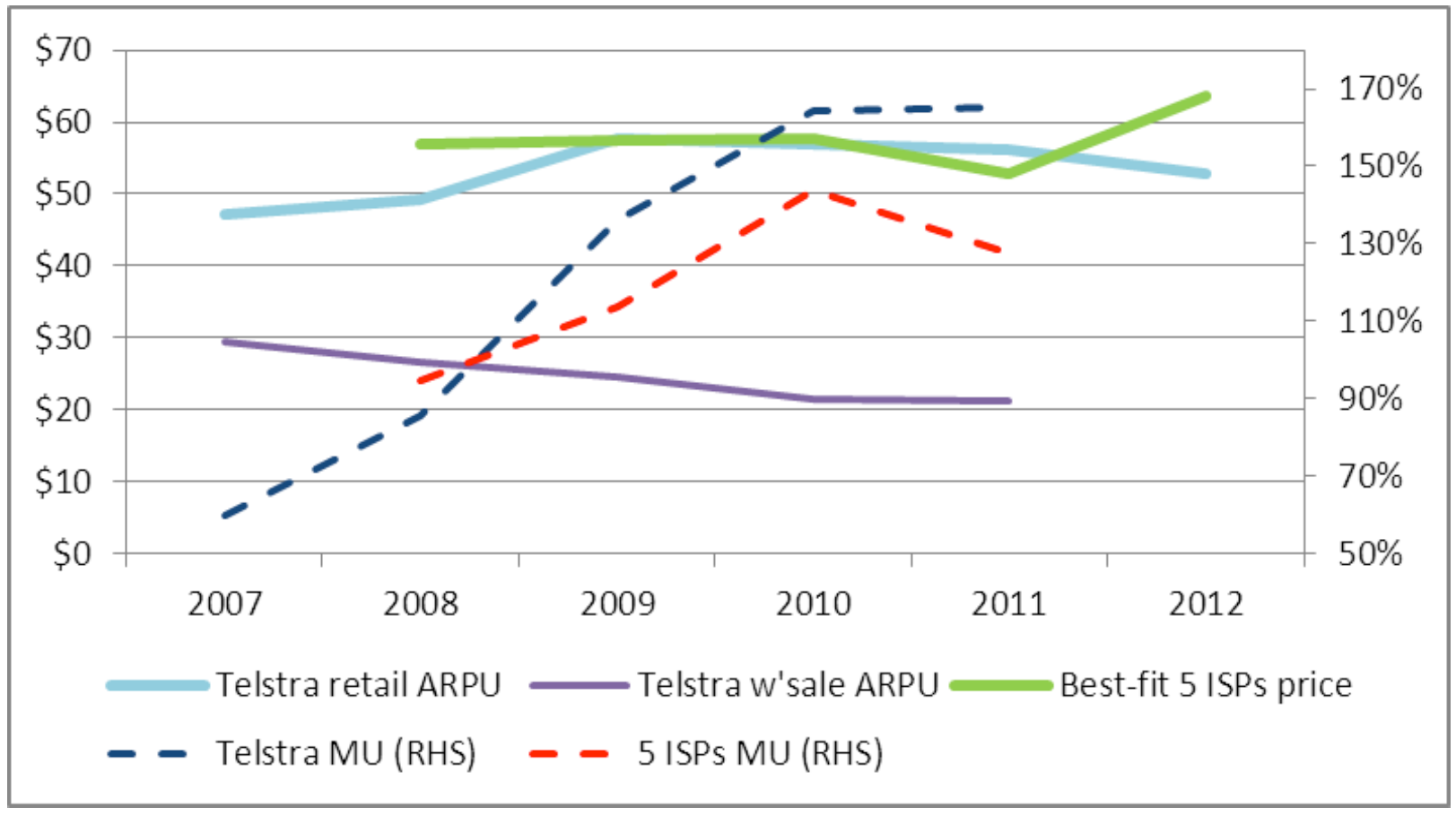

The increased mark-up appears to have emerged over time, as shown in Figure 1 below, where the solid blue line shows Telstra?s average retail revenueii per user (ARPU) and the solid red line shows the typical ARPU (including GST) for the top five ISPs. Typical ARPU is derived from the ?best-fit? across retail plans of five ISPs (Telstra, Optus, iiNet, Internode and TPG) at September of each year and average downloads at June each year reported by the ABSiii.

The dotted blue and red lines show the mark-ups for Telstra and the Top Five ISPs respectively assuming Telstra?s wholesale broadband ARPU (the solid purple line) represents their wholesale input costs.

Figure 1. Movement in mark-ups for Telstra and Top 5 ISPs

Source: Telstra Annual Reports, ABS and author?s calculations

Between 2007 and 2011, wholesale ARPU declined 30%, but for both Telstra and the Top Five ISPs retail ARPU more than doubled. This may have been due either to a lessening of competition as the industry consolidates or to ISPs not passing through reductions in wholesale prices in order to cushion themselves against expected increases in wholesale rates on the NBN.

ISPs? fears about future wholesale prices may yet be realised. But, initially NBN Co. has not based its wholesale prices on cost but on existing wholesale prices; as shown in Table 2. The true cost of the NBN has been hidden by deferring cost recovery and over-estimating the internal rate of returniv.

Table 2. The NBN and current wholesale prices

|

Price per month/user |

Comments |

|

|

NBN for 12/1 AVC |

$26 = $24 (AVC) + $20/Mbps (CVC) |

NBN case studies suggest about $26 per line for its lowest speed tier (12Mbps down) |

|

Wholesale (resold) ADSL |

= $24.56 (port) + $36.08/Mbps (AGVC) |

Draft ACCC decision for Zone 1 ( metro areas) to June 2014 |

|

Unbundled local loop (ULLS) |

$16.21 |

ACCC decision for Bands 1-2 to June 2014 |

|

Line sharing (LSS) plus wholesale line rental |

$24.64 = $1.80 (LSS) + $22.84 (WLR) + calls |

ACCC decision to June 2014. Combined with local call resale (8.9c/call) |

Source: NBN Co. and ACCC

NBN Co.?s decision to price below cost, combined with the ISPs? understanding that costs must be higher with the NBN, could explain why mark-ups are higher than a few years ago. The current mark-ups on the retail plans (excluding GST) for NBN?s entry-level 12/1 service for some of the major ISPs entry-level plans are shown in Table 3 belowv. The mark-up in Table 3 averages 105% which is nearly three times as high as a few years ago (Figure 1) and about three times as high as what Optus assumed would be the case with the NBN ? because wholesale costs are less than expected and ISPs are not prepared to cut mark-ups knowing wholesale prices will have to increase.

Table 3. Mark-ups on entry-level NBN plans

|

Optus |

Telstra |

iiNet |

Internode |

TPG |

|

|

Peak cap |

50GB |

25GB |

20GB |

30GB |

n.a. |

|

$pm |

$65.00 |

$60.00 |

$49.95 |

$49.95 |

n.a. |

|

Mark-up |

127% |

110% |

92% |

92% |

n.a. |

Source: ISP web sites at 18 August 2013 and author?s calculation of mark-up

Reducing the cost of the NBN (e.g. by using fibre-to-the-node instead of fibre-to-the-premises where this saves money) would help make prices more affordable. But, there must also be a reduction in mark-ups; which can only be brought about by increasing competition. Figure 1 suggested a weakening of competition in recent years, and this will get worse with the barriers to new entrants posed by the current CVC wholesale pricingvi approach.

What should we expect with real competition?

First, we should note that the communications world has fundamentally changed. The provision of networks and services are no longer linked. With a fast transparent IP network, all services can be delivered ?over-the-top?. An ISP provides connectivity and a tariff including a data cap; but all other value-add can be obtained ?over-the-top?. You can easily by-pass your ISP to get an email address, storage, games and video directly from other service providers.

Mark-ups in electricity retailing

Digitisation with choice provided over-the-top means that ISPs will increasingly look like electricity retailers: providing connectivity under a tariff. If so, the retail market for providing broadband could become as competitive as that for electricity retailing.

Victoria has the largest number of active retailers selling to small customers?both for electricity (16) and gas (7)vii. While other states regulate both wholesale and retail prices, in Victoria retail pricing of both electricity and gas was de-regulated in 2009. Standing offer prices available to all customers have to be published in the Victoria Government Gazette. But 75% of customers take market offers. Both types of offer include three different tariff options across five distribution regions; so there are 30 different tariffs for each of the 16 electricity retailers.

In Table 4 belowviii, Tier 1 consists of the 3 major retailers: AGL, Energy Australia and Origin Energy. Tier 2 represents larger entrants such as Australian Power & Gas while Tier 3 the rest (e.g. Dodo). The mark-ups on single rate market offers are higher than for the dual rate and time-of-use offers to cover uncertainty in peak and off-peak use. The mark-ups are a simple average across distribution zones. What is interesting is that (unregulated) retail competition between vertically integrated retailers and pure resellers like Dodo has led to similar mark-ups over regulated input costs.

Table 4. Mark-ups, Victorian electricity, 2013 (%)

|

1st Tier retailer |

2nd Tier retailer |

3rd Tier retailer |

|

|

Single rate |

29.9 |

28.1 |

26.5 |

|

Dual rate |

18.9 |

16.5 |

16.3 |

|

Time-of-use |

21.1 |

18.0 |

15.3 |

Source: Table 2.4, Essential Service Commission, May 2013

The decline of ISP mark-ups towards those of electricity retailers will be essential to mitigating the likely growth in NBN access costs for consumers. For the purpose of discussing affordability, this paper assumes that vigorous competition induced by new ISPs causes the mark-up to fall towards the 30 to 40% level foreshadowed by Optus in 2008 (see Endnote 1).

What is affordable?

In 2011, 6.2 million households had fixed broadband Internet access, according to the Australian Bureau of Statisticsix. That is 27% of all households and 46% of households with an annual income under $40,000 did not have fixed broadband access at home.

The situation is only slightly better in the survey conducted by the World Internet Project which found that 38% of Australian households with less than $30,000 income (and 42% for households in this group without children at home) did not a fixed broadband connection in 2011x.

Income and affordability

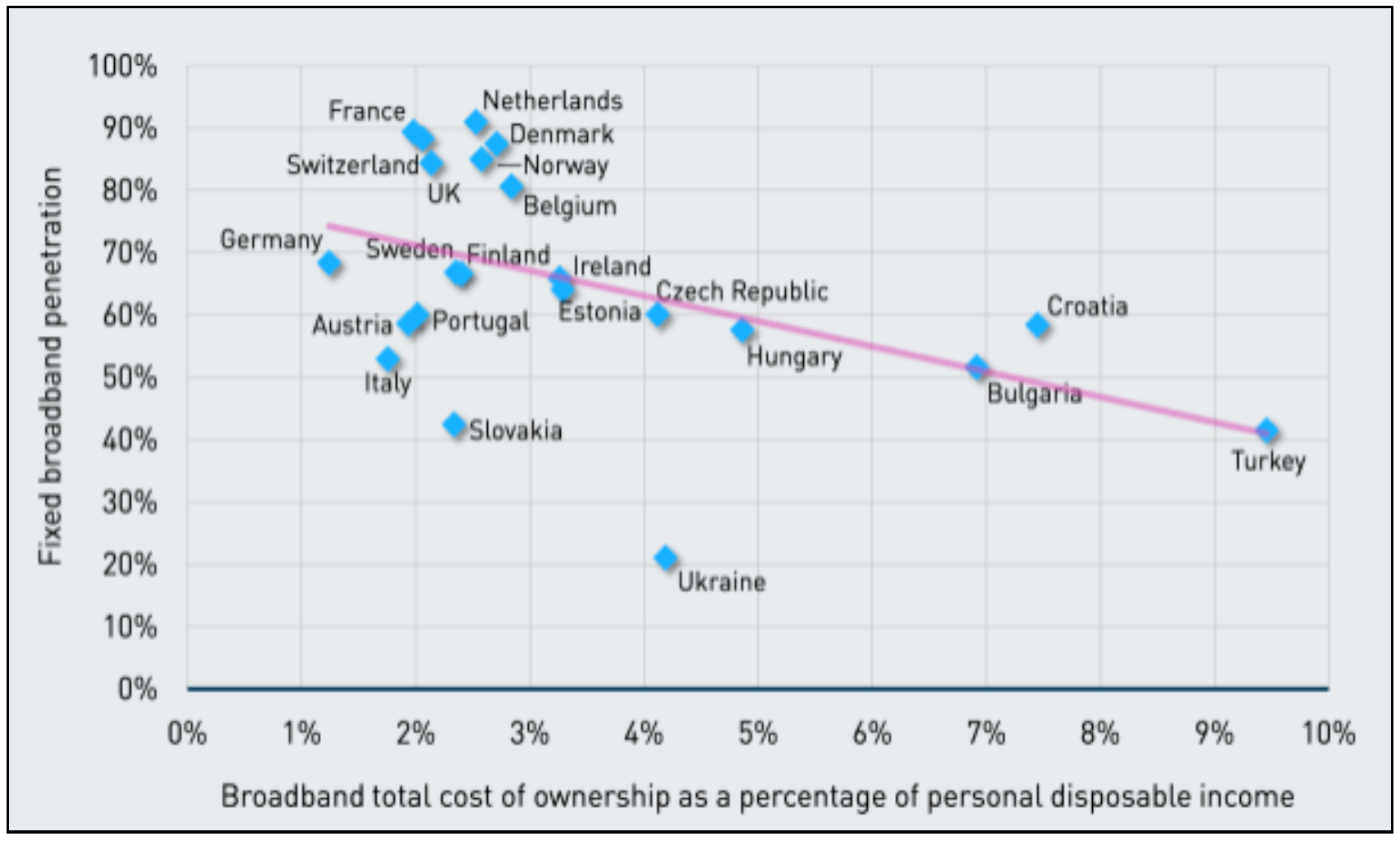

We know that income, PC adoption, education and age all affect the take-up of broadband service. We cannot do much about some of these factors, but we can address affordability because Figure 2xi shows about a 4% improvement in take-up for every 1% reduction in the total cost of ownership (i.e. includes more than the broadband plan) expressed as a share of disposable income.

Figure 2. Relationship between affordability and fixed broadband penetration

Source: Analysys Mason, 2013

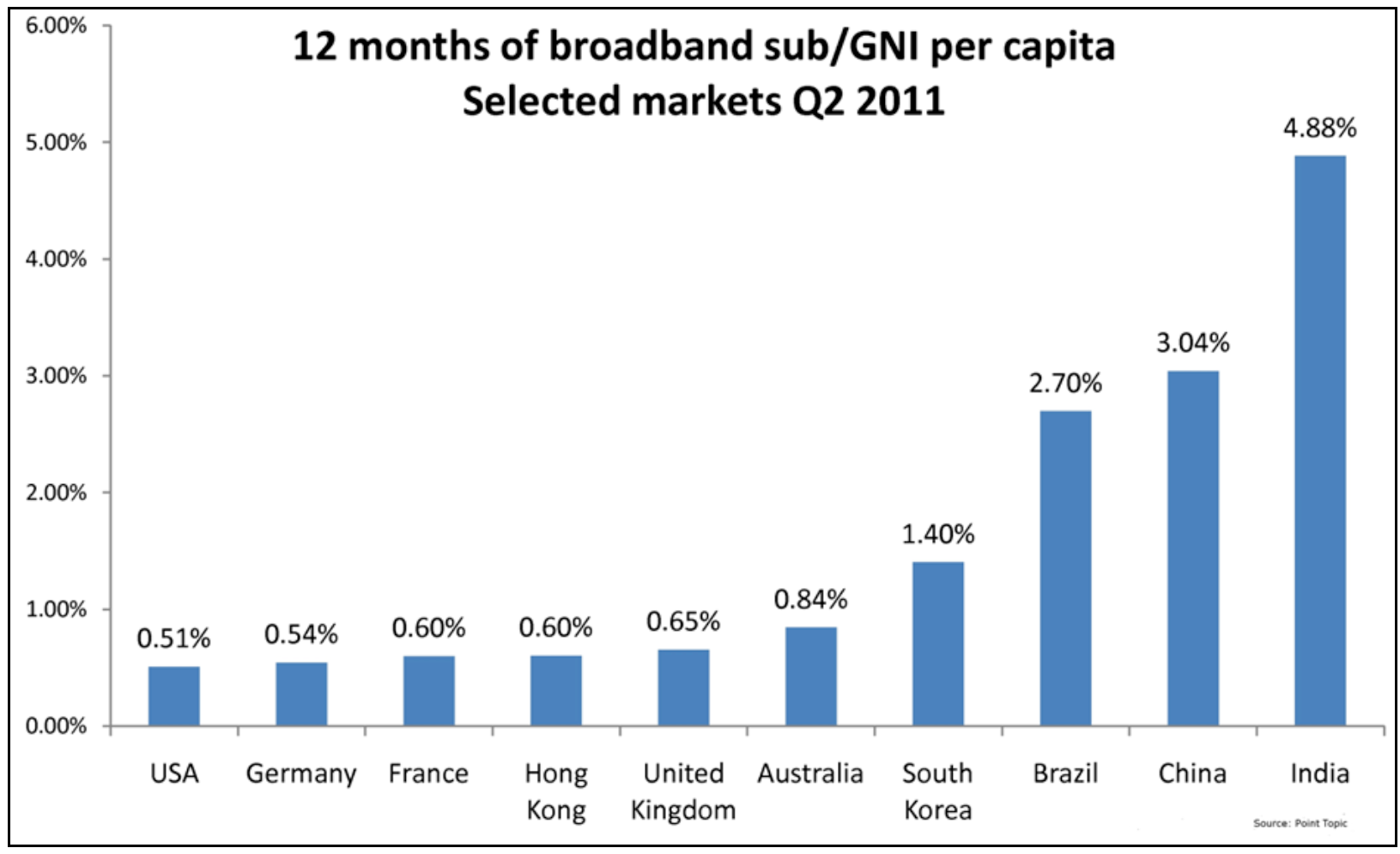

Point Topic takes a similar approach to income in defining affordability. It analysed broadband pricing data in 64 countries to compare the costs of twelve months of service of the most inexpensive broadband plan available - usually the slowest speed. These prices were converted to a "purchasing power parity" (PPP) figure and compared with the gross national income per capita (GNI/capita- also converted to a PPP equivalent)xii.

Figure 3. Affordability of the cheapest broadband plan

Source: Point Topic, September 2011 at http://tinyurl.com/k5563p8

Australia is shown at 0.84% on the cheapest broadband plan. But the cheapest entry level retail plan on the NBN from the top five ISPs is currently Internode?s at $49.95 per month; which translates to 1.49%. Using the relationship reported above Figure 2, the difference could lead to about a quarter of a million fewer low-income NBN usersxiii.

Target low-income customers or let them self-select?

If the affordable pricing initiative is targeted, very affordable pricing is possible. Analysys Mason notes that almost half of the UK?s adult population who do not use the Internet live in social housing and are in lower socio-economic groups. Australia has about 350,000 households in social housingxiv.

A good example of this approach is provided by Rogers Communications which in June 2013 announcedxv that youth living in Toronto community housing could pay just C$9.99 per month (versus C$41.9 for the cheapest planxvi) for broadband internet speeds of 3Mbps and usage allowance up to 30 GB. Microsoft Canada and Compugen are supporting the program with a computer for C$150 that will come pre-loaded with complimentary software along with access to technical support. The C$9.99 translates to just 0.3% on the Point Topic measurexvii.

Another local example of assistance targeted to users in social housing is that provided by infoxchange in Melbournexviii. For $15 pm, the user gets a 256Kbps service with 15GB pm. This translates into 0.45% on the Point Topic measurexix.

Other targeting options are suggested by Table 5 which links take-up rates to sources of income supportxx.. The importance of mobile phones to youth is striking.

|

All |

Age Pension |

Disability Support Pension |

Parenting Payment |

Newstart Allowance |

|

|

Number of recipients 2010-11 |

2,158,000 |

793,000 |

440,000 |

513,000 |

|

|

Number with Internet at home |

5.6% |

12.5% |

24.5% |

26.3% |

22.2% |

|

Number with mobile phone |

2.4% |

8.1% |

16.7% |

5.3% |

0% |

|

Number with telephone |

2.9% |

0.4% |

14.6% |

21.1% |

17.7% |

Table 5. Deprivation by income source, 2010

Sources: ACOSS and Morsillo from a PEMA survey

To rank well globally for affordable broadband, Australia needs current best entry level retail pricing on the NBN (Internode noted above) to drop from the present 1.49% of GNI/capita to around 0.5%.

It is not necessary to quarantine the entry-level plan to a target group (e.g. low income households). It is possible to have an affordable wholesale entry-level price which translates (via the mark-up) into affordable retail prices. This entry level wholesale price can be made available for all households (i.e. not restricted) by designing it such that many will move up to other plans as they use more.

The NBN Wholesale Plans

The proposed wholesale Entry Level Plan is discussed in the context of a proposed new NBN tariff structure: the ?Traffic Model?xxi. There are two fundamental differences to what NBN Co. offers currently. First, NBN Co. charges more for different speeds (AVCs) while the Traffic Model bestows full available speed to all end users ? which would probably catapult Australia to the top of the global ranking in delivered speeds calculated by agencies such as Akamaixxii. Second, NBN Co. charges for increments of capacity (CVCs) to carry traffic while the Traffic Model charges a flat fee per gigabyte (GB) of traffic carried over the NBN.

In addition to unleashing the full potential of the NBN, the Traffic Model ensures greater retail competition and allows more affordable pricing. There are two main wholesale prices.

The Standard Plan

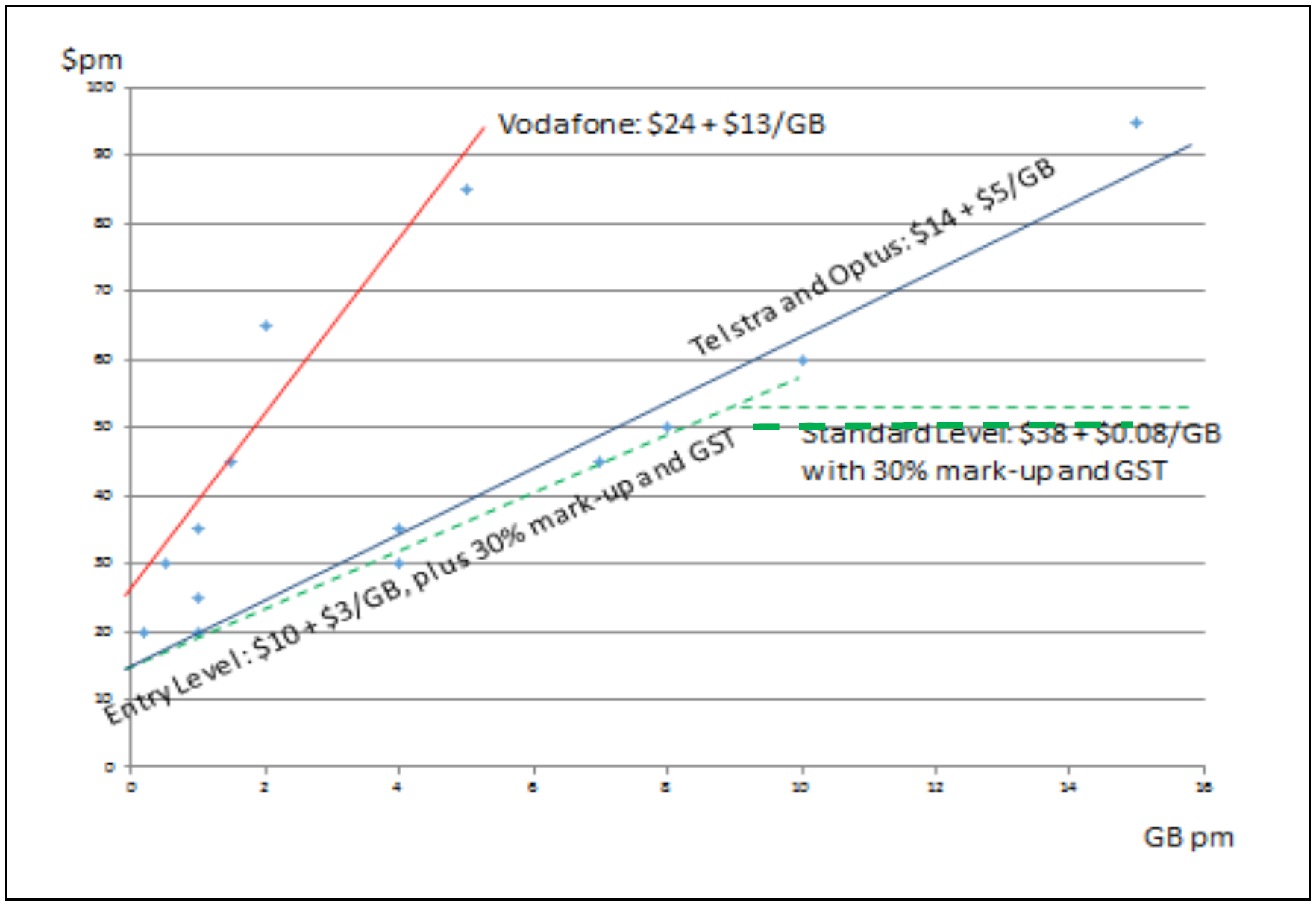

The proposed Standard NBN wholesale plan is designed to support existing retail pricing in the broadband market, as illustrated below.

Figure 4. Retail Broadband Plans at September 2012

Source: de Ridder?s Submission to the ACCC on the SAU, December 2012 (Figure 5)

The dots in the upper chart of Figure 4 show ADSL2+ (blue) and NBN 25/5 (red) retail broadband plans. The ?best-fit? (regression) lines have not been drawn but are reported in the blue box. This box says that a typical NBN 25/5 retail plan costs $66 pm plus 8 cents a GB. In practice, the customer pays a flat fee per month which includes a data-cap. So, for a 50GB plan the best-fit line predicts a price of $70 pm; which is close to the current price for Optus in Table 3 above.

NBN Co has set its wholesale tariffs close to existing wholesale rates so that the retail plans for the NBN 25/5 service and ADSL2+ plans can be similar and so encourage migration to the NBN.

To support the retail plans, wholesale prices have to be parallel to and below the ?best fit? line through retail plansxxiii. These have been drawn for the Traffic Model and for NBN Co.?s pricing.

The same Traffic Model wholesale price line has been added to the lower chart showing retail prices for NBN 100/40 service (shown as blue dots). The vertical gap between the Traffic Model and best-fit line for these NBN retail plans is $41 compared with $24 to $28 on the upper chart because the Traffic Model does not charge more for speed while current retail plans do charge more.

NBN Co.?s Corporate Plan shows that it expects over half of new customers to opt for the cheapest 12/1 speed plan initially but the proportion remaining on that entry level speed option remains over one third by 2028. The only incentive to switch to higher speeds (more expensive AVCs) is said to come from new applications requiring higher speed; yet the NBN Co business plan forecasts most staying on lower speeds. Are the applications unattractive, or unaffordable to most?

The Traffic Model (i.e. both Standard and Entry Level wholesale pricing) bestows unconstrained speeds on all customers because the experience in Australia and overseas is that few users are prepared to pay the premium for speed forced on retail prices by current NBN Co. wholesale pricing. The introduction of FTTP in Japan at higher prices than ADSL shows the futility of this.

The rational reason for this reluctance to pay for speed is that the experience of two customers, one on FTTP and another on FTTN, will often be identical ? limited by the server rather than by access. For example, Netflix, the most popular movie streaming service in the world, encodes movies at speeds between 1.5Mbps and 8.0Mbps. Even the highest speed is readily accommodated by most broadband connections ? FTTP or FTTN. In August 2013, users of Google fibre had the highest average speeds of 3.58Mbps versus an average for the USA of 1.98Mbpsxxiv. This is likely to reflect a higher propensity to choose higher definition movie options and more advanced CPE rather than the access network. To the extent that there is a bottleneck, it is likely to be downstream in the backhaul. NBN Co.?s CVC pricing provides an incentive for ISP?s to minimise backhaul costs and exacerbate the bottleneck, while the Traffic Model gives NBN Co an incentive to deliver every possible Gigabyte (high revenue for minimal cost).

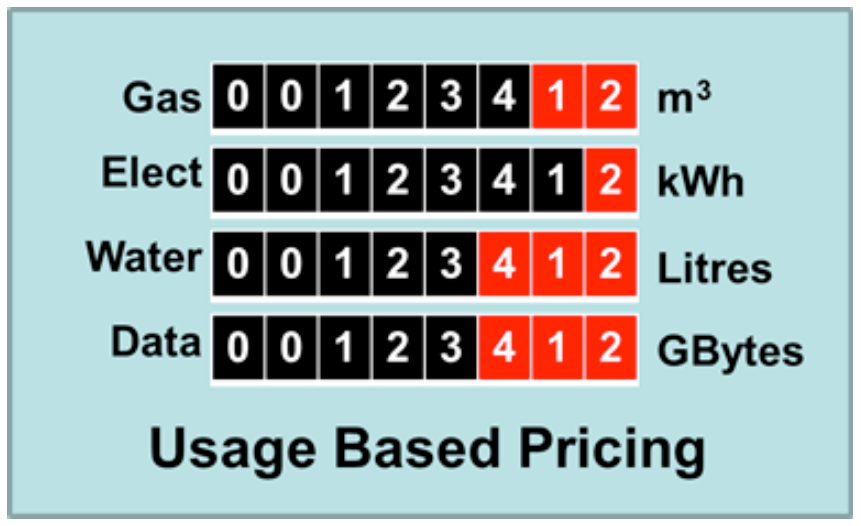

Australians will upgrade fixed or mobile plans to get more gigabytes. "Gigabytes consumed" is a good measure of value ? like litres of water and megajoules of gas and kilowatt hours of electricity.' The combination of the Traffic Model (or usage model from consumer perspective) and an NBN that bestows the highest available speed on all customers ensures that all pay for what is delivered at the same price, but speed is never needlessly withheld from the majority to extract more dollars from a few.

Australians will upgrade fixed or mobile plans to get more gigabytes. "Gigabytes consumed" is a good measure of value ? like litres of water and megajoules of gas and kilowatt hours of electricity.' The combination of the Traffic Model (or usage model from consumer perspective) and an NBN that bestows the highest available speed on all customers ensures that all pay for what is delivered at the same price, but speed is never needlessly withheld from the majority to extract more dollars from a few.

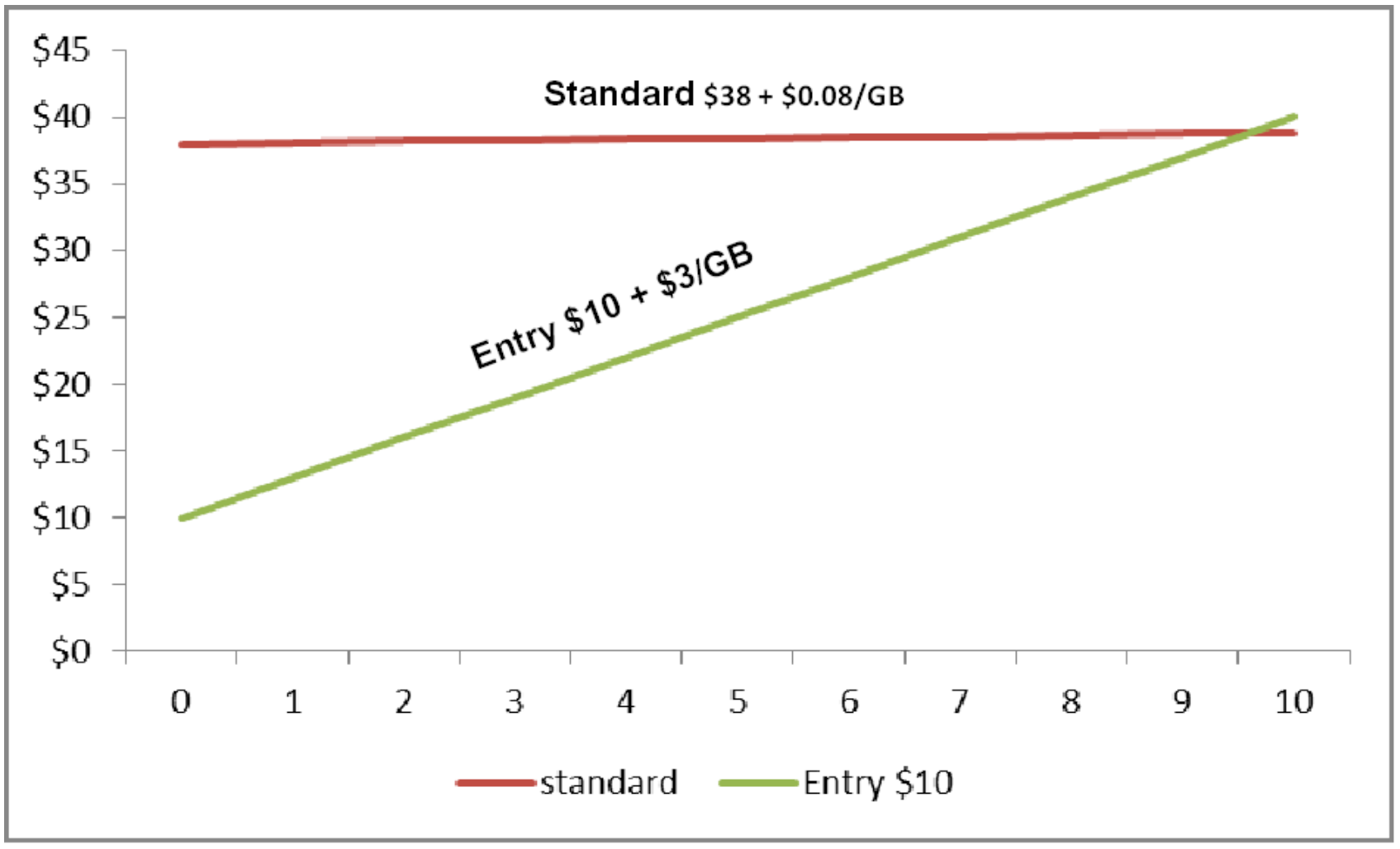

The Entry level Plan

The proposed Standard NBN wholesale price of $38 + $0.08/GB has to be complemented by an Entry Level Plan to ensure that broadband is affordable for those on low incomes or simply with low needs (e.g. voice only). It is desirable to have a plan that does not rely on pre-qualification (e.g. the customer has to be a social housing tenant) but administers itselfand which all of the Top Five ISPs will wish to provide so that affordable broadband really is readily available where broadband is normally sold. This can be accomplished with an entry-level wholesale price of $10/month plus $3/GB. This is much cheaper than the current NBN wholesale prices, which start at $24/month for 12/1 service.

As can be seen below (Figure 5), once usage exceeds 9.6 GB per month, the wholesale customer will move the end user from the proposed wholesale Entry Level plan to the Standard wholesale plan to save money ? and, hopefully, those savings will be passed on to the end customer.

Figure 5. The Proposed Standard and Entry Level Wholesale Plans

Source: the authors

Assuming a 30% retail mark-up and 1GB pm usage, the retail cost of the Entry Level plan would then be $18.59 pm after GST or 0.55% on the Point Topic metric. This should hit the sweet spot for those with little income or need for broadband.

The Entry Level wholesale plan should be made available not only to those connected by fibre but also to those on wireless or satellite consistent with a philosophy of maximising the benefits for all of Australian users regardless of income level, place of residence or technology used.

According to the World Internet Project?s Australian survey mentioned in Section 2 above, only 62% considered their service to be affordable in 2011, 14% are paying $30 or less for their connection and round 20% said they would ?probably? or ?definitely? not connect to the NBN when it was available.

The low-cost Entry Level Plan obviously helps in the broader context of the total cost of ownership. Table 6 is reproduced from the paper by Robert Morsilloxxv with substitution by the proposed Entry Level Plan in red.

|

NBN+PC (new) |

NBN+PC (recon) |

Wireless+Tablet |

Pre-paid Mobile |

|

|

Device |

937 |

220 |

679 |

99 |

|

Software |

63 |

31.47 |

||

|

NBN/WiFi/SIM |

25 |

25 |

30 |

|

|

Internet ($pm) |

49.95 18.59 |

49.95 18.59 |

15 |

30.42 |

|

Total 2 year $pm |

92.66 61.30 |

60.16 28.80 |

45.85 |

34.55 |

Table 6. The total cost of ownership ? options for low income households

Source: Morsillo, 2012

Higher adoption and use due to low entry-level prices reduces the average cost per customer. The NBN is a largely a fixed cost so the more end customers there are and the more they use, the lower the unit cost per customer; increasing the potential for affordable prices for all.

Higher adoption and use also make new applications for, say, e-government and other services more viable which leads to more innovation and more benefits from investing in the NBN.

Mobile broadband

The longer it takes to build the NBN, the more attractive mobile broadband will become. For low levels of use, mobile broadband is already competitive with the proposed Entry Level NBN plan. The dots on the following chart show BYO mobile broadband plans for the three main operators. All the points clustered around the Vodafone ?best-fit? belong to Vodafone. The retail plans for Telstra and Optus are all close to the blue line.

Figure 6. Mobile broadband and NBN retail prices

Source: Author and web sites at July 2013

Telstra and Optus plans have a similar implicit GB charge and are competitive with the NBN for low use. Note the NBN Traffic Model?s wholesale prices have been marked up by 30% to get retail prices in the above chart.

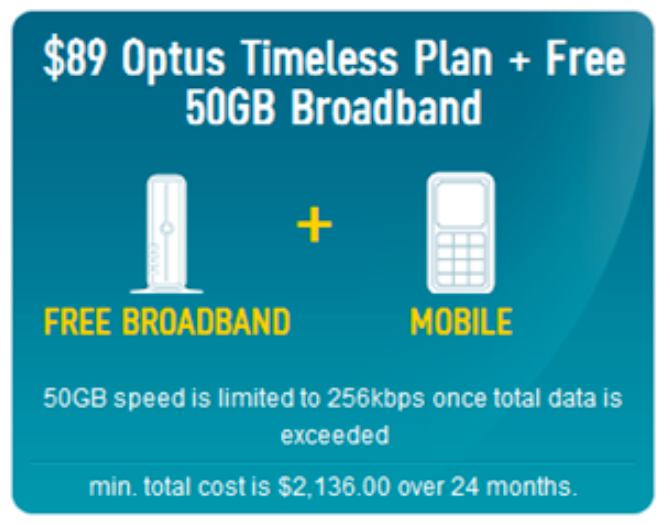

However, it is likely that the NBN will complement mobile broadband services. It is expected that most households will take multiple mobile broadband services plus a household fixed broadband connection to access cheaper data through home WiFi. We could even expect fixed broadband to be bundled as aggressively as Optus did ? briefly ? in 2012 with the advertisement shown here.

However, it is likely that the NBN will complement mobile broadband services. It is expected that most households will take multiple mobile broadband services plus a household fixed broadband connection to access cheaper data through home WiFi. We could even expect fixed broadband to be bundled as aggressively as Optus did ? briefly ? in 2012 with the advertisement shown here.

Entry level NBN pricing gives low usage customers a viable fixed network alternative to mobile plans should their needs be unusually low or their ability to pay constrained.

Having a similar monthly fee and similar gigabyte charges for entry level fixed broadband and mobile broadband is a means of minimising mobile substitution primarily for price. It also anticipates how fixed and mobile plans might develop with time ? monthly fees for places and devices, different gigabyte fees for fixed and mobile usage. Multi-SIM personal Plans, multi-SIM family and business plans and fixed & mobile bundles are already showing how this might evolve.

Australian customers? needs

Consider three urban Australian scenarios of households with limited incomes ? a suburban family migrating from an existing ISP to the NBN, a pensioner household without a PC but needing a phonexxvi, and a young couple starting out in a flat.

The suburban family would appreciate the bestowal of the fastest available speed under the Traffic Model. If they were on a very low plan before migrating, they would likely benefit from the entry-level plan. But most would start on a standard plan and see a rise in speed without a significant rise in monthly charges. The family usage might surge or rise progressively over time driven in part by the speed of delivery. Those who use more pay more, as is the case for other utilities. Those wishing to save would also have the option of using less. This example simply illustrates that this typical family would see immediate benefit from the NBN and that their costs would rise (or fall) under their control, as they would expect.

The pensioner household will have the option of being connected on a cheaper plan just for voice thanks to the Entry Level Planxxvii. Currently, the pensioner pays $22.95 pm for Telstra?s budget telephony plan, 30 cents for local calls and 25 cents/minute for STD calls with a 45 cent flag-fall on each STD call. On the NBN, Telstra?s budget voice offer has the same pricing but fewer features than the current voice service (which would not be the case with continued use of copper for voice only service)xxviii.

Telstra still has to pay NBN Co. $24 plus CVC charges to support voice only services on the NBN. Under our proposed Entry Level plan, the wholesale charge will be only $10 + $3/GB.

The Entry Level plan brings the option to start using broadband at no initial incremental cost ? just pay for what is used on the increasingly standard smartphone or smart TV. A PC or tablet might come later.

A young couple will already each have mobiles and will have to choose whether to increase their individual plans for mobile broadband or take an Entry Level or Standard fixed plan on the NBN. A significant number will choose to use only their mobile, but the lower entry level price with gigabyte prices that are better than cellular will encourage more to take fixed NBN service too.

Conclusion

This paper has shown how wholesale pricing for the NBN can be set to encourage the ubiquity of take-up and stimulation of use that leads to the economic and social outcomes expected of the NBN. It introduced the mark-up concept to build a bridge between wholesale and retail prices, while also suggesting that vigorous retail competition could help ensure greater affordability. The paper also defined, for the first time, a possible yard-stick or target for retail broadband affordability and a way of making that possible with wholesale pricing on the NBN.

Endnotes

i The Age, 18 July 2008 reports Maha Krishnapillai of Optus telling AAP that a high-speed broadband network could cost consumers between $32.50 and $105 pm ? with a wholesale rate between $25 and $75 pm per customer allowing a return on capital of about 12% pa? Retail prices would be set at 30 to 40 per cent above the wholesale price.

ii Revenues reported in Telstra accounts do not include GST.

iii Some ?best-fit? results for September 2012 are shown in Figure 4 of this paper. Results for earlier years used in Figure 1 are taken from Table 6 of de Ridder?s ?NBN pricing should be rejected?, a submission to the ACCC on the NBN SAU in December 2012; available at www.deridder.com.au. As the retail plans include GST, this is backed-out before estimating the mark-up shown in the dotted red line.

iv See de Ridder?s ?NBN Comments on ARPU and the ICRA? (April 2013) and ?NBN ? Internal rate of return? (March 2013)

v Wholesale cost of $26 used (and in Table 2) from NBN Co. case study for 12/1 which cites $25.82 pm at p33, Product and Pricing overview, December 2010. TPG only provides (Telstra) fibre in Brisbane exchange area.

vi See de Ridder?s ?NBN pricing discriminates against smaller players? (May 2013) and ?CVCs ? A final (?) word? (July 2013) at www.deridder.com.au

vii Queensland, New South Wales and South Australia each have 11?12 electricity retailers and 3 to 6 gas retailers; see http://tinyurl.com/mj32bb4

viii Essential Service Commission, Retailer Margins in Victoria?s Electricity Market, Discussion Paper, May 2013

ix ABS Cat 8146, 15 December 2011

x The ARC Centre of Excellence for Creative Industries and Innovation (CCi) based at Swinburne University of Technology. http://www.cci.edu.au/projects/digital-futures

xi Analysys Mason, Bridging the digital divide: connecting the unconnected, 8 July 2013 at http://tinyurl.com/lxoq4wt

xiiThe shares of income for Germany, France and the UK are lower than for Figure 2 looks at the total cost of ownership and Figure 3 looks only at the monthly fee for the cheapest broadband plan in the market.

xiii(1.49-0.84)*4*9m households

xiv ABS Cat 4102 shows 3.9% of households in public housing in 2010. http://www.abs.gov.au/ausstats/abs@.nsf/mf/4102.0

xv Rogers Communications, 13 June 2013 at http://tinyurl.com/lm335ms

xvi LITE home internet gives 8Mbps/256Kbps and 20GBpm http://www.rogers.com/web/link/hispeedBrowseFlowDefaultPlans

xviiCanadian GNI is C$39,710

xix The Point Topic measure is relative to national GNI per capita. Obviously, the percentage is higher relative to the incomes of the target group. Australia?s GNI is $40,270 pa

xx The first line is from page 7 of ?Who is missing out?, ACOSS Paper Number 187, March 2012 at http://acoss.org.au/images/uploads/Missing_Out_2012_ACOSS.pdf and the rest is taken from Table 1 ?Affordable broadband for all Australians?, 2012, by Robert Morsillo and published in the Telecommunications Journal of Australia, Volume 62, Number 5.

xxi This is discussed in de Ridder?s Submission to the ACCC on the NBN SAU, December 2012.

xxii Of course, while the constraint on speed was traditionally in the access network it will now be in the customer equipment or backhaul or some other choke-point. But it would no longer be the access network.

xxiiiNBN Co. current wholesale prices are also shown in red. The step changes are due to CVC pricing.

xxv Morsillo, R, ?Affordable broadband for all Australians?, in Telecommunications Journal of Australia, Vol. 62, Number 5, 2012. http://doi.org/10.7790/tja.v62i5.363

xxvi There were 282,000 customers still on dial-up at Dec 2012; down from 463,000 a year earlier.

xxvii Telstra is obliged to provide an affordable voice service on the NBN ? see http://www.dbcde.gov.au/telephone_services/information_for_people_with_special_needs