Abstract

No national goal has been set for how the National Broadband Network should provide competitive advantage for Australian small or medium enterprises (SMEs) participating in the global digital economy. This paper proposes robust national goals for how the NBN should serve both our digital society and our digital economy. From this perspective it considers the merits of merging NBN Co with InfraCo, and the pros and cons of public versus private ownership of the merged entity, “NetCo”.

Introduction

The author was invited to discuss the merger of NBN Co with Telstra's InfraCo as one of four options proposed at TelSoc's NBN Futures Forum held in Melbourne on 31 July 2019.

A reason for this mission was evidently my authorship of the paper 'Revisiting the Structural Separation of Telstra' (Gerrand, 2004), which had some impact on policy discussions in the industry. In this paper I had advocated, ahead of the full privatization of Telstra in 2005, the structural separation of Telstra and the retention in government ownership of its fixed network wholesale business. The motivation was to create a self-funding entity which could roll out a high speed national broadband network without the need for additional government investment – as well as providing a level playing field for all retail service providers of fixed access broadband.

Graeme Samuel in his presentation at this same NBN Futures Forum suggested that 'the privatisation of Telstra had breached competition policy by not including either strong regulation or structural separation of Telstra. This historical example highlighted the market problem of vertical integration, something that must be avoided in the future ownership model for NBN Co.' (Campbell & Milner, 2019). I could not agree more.

However, in 2006 the Australian Government chose to maximise the short-term financial returns from the full sale of an unseparated Telstra over alternative policy options[i], and gained a net $15.2b from the 'T3' sale in that year (ANAO, 2008). The previous sales of 16% ('T1' in 1997) and 35% ('T2' in 1999) of the Government's shares in Telstra in 1998 achieved net returns of $14.0b (ANAO, 1998) and $15.9b (ANAO, 2000); thus, the total privatisation earned a net return $45.1b after deducting the costs of sales. Ironically, this figure exceeds the estimated cost to the government of funding the original NBN project, and comes close to the $51b expected to be spent on the project by its completion in 2020. But that is now water under the bridge.

The opportunity in 2006 to use Telstra's structurally separated, profitable wholesale fixed network business (now known as InfraCo) as the engine for rolling out a high-speed NBN was lost. Telstra's continuing dominance as a vertically integrated carrier not only prevented the entry of any significant infrastructure competition in the fixed broadband market, but kept most residential premises restricted to the entry-level ADSL technology, at a time when much higher speed access technologies were being introduced overseas.

When finally the Rudd government bit the bullet in 2009 and decided to fund a government-owned NBN, it planned to expend $41b on its national rollout, with future-proof FTTP to be connected to 93% of all premises. Due in part to major changes in the NBN's design in 2014 by Communications Minister Malcolm Turnbull under the Abbott government, the total government investment in the NBN has increased to $51b, with a legacy of the original FTTP now being available (but not necessarily connected) to only 21% of all premises (NBN Co, 2018).

Many would have considered that the InfraCo horse had bolted. However, in 2018 Telstra announced (Penn, 2018) that it planned to structurally separate most of its wholesale fixed network business as a stand-alone business unit, InfraCo, with the potential for divesting it. This raised afresh the policy option of merging InfraCo with the new broadband access network business, NBN Co, to create an end-to-end wholesale network business ('NetCo'), with possible added value to national infrastructure building in the future.

This is the background to the talk I gave on 31 July 2019. The following sections flesh out the presentation I made at that NBN Futures Forum. (A glossary of abbreviations is provided at the end of the article.)

Why Do We Need National Broadband Networks?

Before we consider any of the future ownership options for the NBN, we should ask the fundamental question: 'Why do we need the NBN?' Or, indeed, 'Why do we need NBNs?' in the plural: because in the ten-year time frame of this policy discussion, several other networks will emerge, in my view as early as 2020, that will satisfy most definitions of a 'national broadband network'.

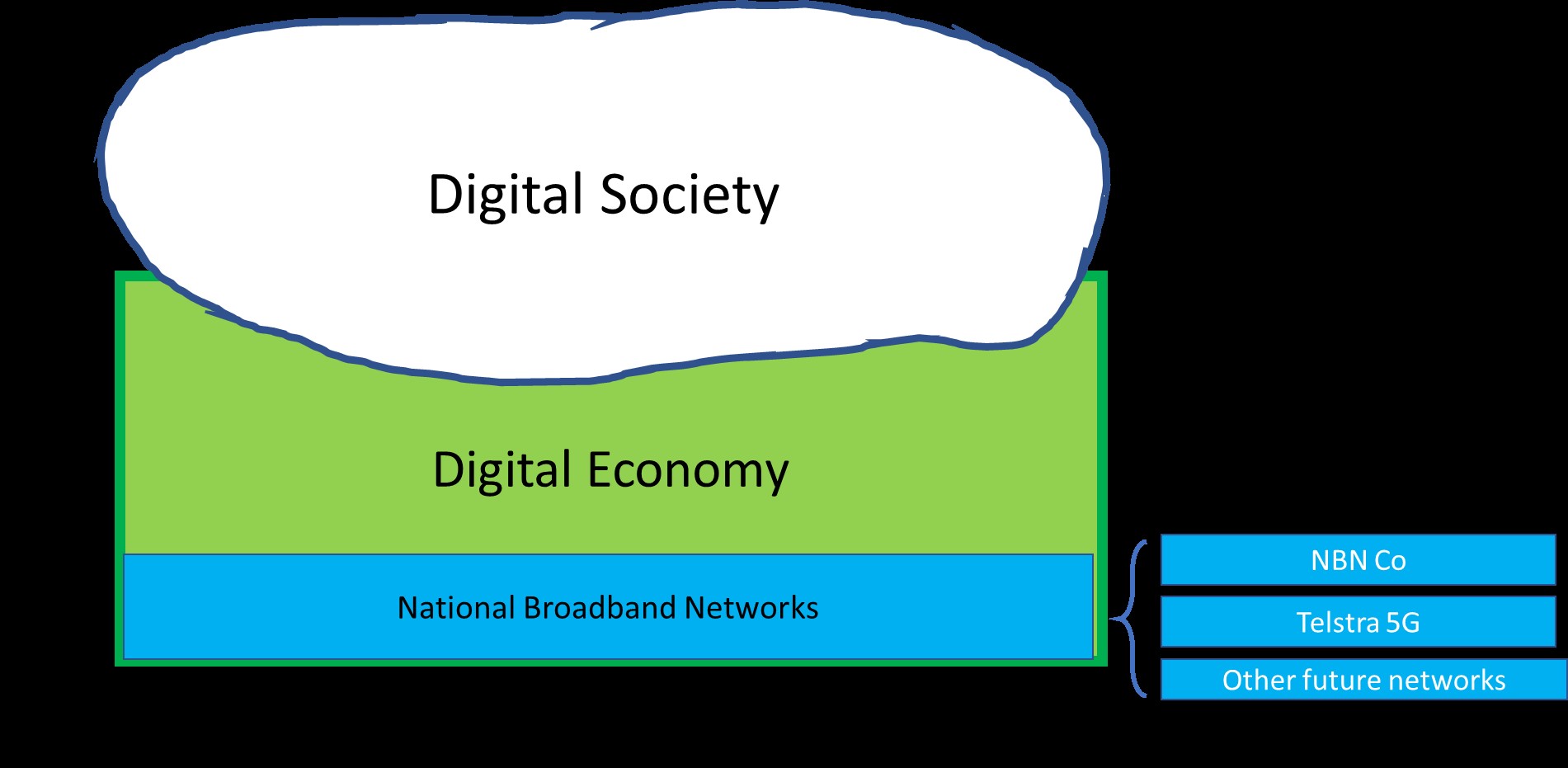

My answer to that question is simple: we need NBNs to support national policy goals for both our Digital Economy and our Digital Society. I illustrate that point with Figure 1.

Figure 1. Why do we need the NBN?

A reasonable policy goal for our Digital Society is:

All residents should have affordable broadband access to essential online services, irrespective of the location of their residence (to the maximum extent possible).

This goal is more focussed explicitly on consumer needs than the Universal Service Guarantee announced by the federal government on 5 December 2018 (Fifield, 2018), intended to replace the former Universal Service Obligation legislation after the NBN has been fully rolled out (Reichert, 2017). The Universal Service Guarantee will commit the government to providing affordable broadband (peak speeds unspecified) and telephone services in rural and remote areas. However, if essential e-health services for remote residences require, for example, 25/25 bandwidth in order to provide a high-quality video signal upstream for diagnostic purposes, the current rural NBN and hence the USG itself will not be fit for purpose.

A reasonable policy goal for our Digital Economy is:

All Australian businesses should have access to broadband infrastructure at internationally competitive bandwidths and prices, irrespective of their location (to the maximum extent feasible).

Why should they be offered less?

The original NBN plan satisfied this objective for the 93% of premises intended to be served with FTTP, an access technology that can be upgraded cost-effectively to Gbps speeds as required. The current NBN, as we shall see in the next section, will probably only satisfy this policy objective in about one in four premises across Australia, in service areas that are largely located in the capital cities.

The government's most recent Statement of Expectations for the NBN, dated 24 August 2016, 'expects the network will provide peak wholesale download data rates (and proportionate upload rates) of at least 25 megabits per second to all premises, and at least 50 megabits per second to 90 per cent of fixed line premises as soon as possible' (Department of Communications and the Arts, 2016). These speeds are fine for watching Netflix or SBS On Demand, but are ludicrously inadequate for innovative SMEs, and totally uncompetitive when compared with the 900/450 Mbps offerings now available, cheaply by Australian standards, to 70% of premises in New Zealand, as will be detailed in the next section.

Figure 1 also makes the point that we need to consider the co-existence of other NBNs in the near- to mid-term future, which could to some extent assist in satisfying national policy goals for both the digital society and (especially) the digital economy.

The first of these will be Telstra's 5G network, implemented through the T22 strategy which Telstra first announced in June 2018. T22 implies an investment by Telstra of $3b to, inter alia, 'lead the market and win in 5G'. Telstra has already achieved its milestone of being 'network ready' for 5G in the first half of 2019 and is already marketing it. Telstra plans to have 'full rollout to capital cities, regional centres and other high demand areas by FY20', i.e. by June 2020 (Telstra, 2019).

Needless to say, Telstra aims to have 'the largest, fastest, safest, smartest and most reliable next generation network' (Telstra, 2019). The sobriquet T22 suggests that their new 5G-based network and associated software applications will be fully implemented across the nation by June 2022.

Telstra's 'first mover advantage' in dominating the 5G market has been assisted considerably by the regulator ACCC's decision in May 2019 to block the proposed merger of TPG and Vodafone Australia, which left many industry observers surprised. Telstra has also been aided by the Australian government's decision in August 2018 to ban the use of the Huawei 5G network technology, which the TPG-Vodafone merger and other potential 5G market entrants were intending to use to provide significant cost advantage.

Telstra's CEO, Andy Penn, has recently made a point of saying that, if the NBN's wholesale pricing is not significantly reduced, 'the $51 billion project has left itself at risk of losing customers to competitors using high-speed mobile technology' (Duke, 2019b).

In the ten-year timeframe of this forum's policy discussion, we can expect other network technologies with superior cost and/or performance to arise and provide further infrastructure competition to the current NBN.

However, it will be very difficult for new entrants to the 5G market to compete with the firmly entrenched and dominant Telstra T22 network. Many of the following next generation network technologies may also be first introduced by Telstra, once it has entrenched a dominant and profitable lead with 5G.

What We've Got: the Current NBN

At the time of this forum, on 31 July 2019, the most recent public information we have on the status of the NBN is regrettably more than a year old, as it appears in the company's FY 2018 Annual Report (NBN Co, 2018), issued in October last year.

Table 1 shows the progress by NBN Co in achieving 'ready for service' status in designated service areas using seven alternative access technologies. Unfortunately for external analysts, the FTTN technology, widely found to be unfit for purpose, is mixed with the more versatile FTTB and FTTC access technologies.

Table 1. NBN statistics (Source: NBN Co (2018))

|

Technology |

Premises 'ready for service' (million) |

Percentage of all premises |

|

FTTP |

1.7 |

21% |

|

FTTN/FTTB/FTTC |

4.0 |

49% |

|

HFC |

1.4 |

17% |

|

Fixed Radio |

0.6 |

7.4% |

|

Satellite |

0.4 |

4.9% |

|

Total |

8.1 |

|

One can conclude from the current bandwidth limitations of NBN's FTTN, HFC, Fixed Radio and Satellite services, and the pricing of NBN Co's most popular product offerings, that the NBN is currently largely a network for a nation of Netflix watchers, using 25/5 or 25/10 peak speed products.

One cannot blame NBN Co's management for this: they have simply been responding to the market, in the absence of national policy goals[ii] that aim to provide competitive advantage to SMEs participating in the global Digital Economy. The broadband market is dominated by the millions of residential users largely needing downstream speeds for video entertainment. This swamps the needs of the thousands of innovative SMEs (in scattered locations across the country) needing symmetric speeds of at least 100 Mbps (preferably much higher) in order to send their high-density data files to customers, suppliers and collaborators.

By comparison, in New Zealand the majority of RSPs are offering a 900/450 Mbps Ultra Fibre service to SMEs, available to 70% of residential premises (i.e. across New Zealand's 'Ultra Fibre Broadband' FTTP footprint, serviced largely by Chorus). See for example Vocus's Fibre 900/450 product priced at NZ$137.42 per month, including GST, for unlimited data (Vocus, 2019).

If we set a national goal of providing competitive advantage to our SMEs operating in the global digital economy, one concludes that only the FTTP, FTTC and FTTB access technologies will provide the necessary symmetric and ultra-highspeed services they need. By this criterion, more than half of the current NBN is not fit for purpose.

To be fair to NBN Co, they are working on upgrade paths for their HFC and FTTN technologies, for when their RSP customers start demanding higher speeds. (The upgrade path for FTTN is basically FTTC or FTTB.) But upgrading the NBN to provide the broadband services at a par with those being offered in New Zealand, as just one competitive example, will require significant additional investment by the current or future owner of the NBN (Gregory, 2019).

What is the sale (or purchase) value of the NBN likely to be, on completion of its rollout? NBN Co's estimate for 2021, made in July 2018, is a net value of $10.4b (NBN Co, 2018). On the other hand, PWC made an estimate of $27.0b for the NBN's net value in 2024, in a report to Infrastructure Australia in February 2016 (Ramli, 2016). Just prior to publication of this paper, NBN Co released its 2020-23 Corporate Plan, forecasting an EBITDA of $3.2m in 2023, suggesting a net value of $19.2b (NBN Co, 2019), using the same x6 multiplier.

However, these estimates ignore the expected $49b debt to the Commonwealth, and the allowed $2b debt to the private sector, which would need to be brought to account following any sale of NBN Co (Department of Finance, n.d.). For example, the sale of NBN Co for $27b in 2024 could lead to a loss of $24b being added to the federal budget's bottom line in the financial year of the sale. Given the current government's aversion to incurring any budget deficit, one can understand their unwillingness to privatise the NBN within the term of the current parliament (Pearce, 2019a).

The three estimates above also ignore the cost of upgrading the NBN in order to remain competitive against future 5G offerings – and future low-earth-orbit multi-satellite offerings (Ritchie, 2019) – over the next five years. Mark Gregory has recently considered three alternative strategies for the upgrade. He concluded that the cheapest strategy, in which the retail customer would be expected to pay for the pit-to-premises lead-in, would cost NBN Co between $10b and $12.2b for a total upgrade of its existing FTTN, HFC and FTTC technologies to at least FPP (Fibre Premises Passed) (Gregory, 2019). Some fraction of this cost needs to be factored into any realistic evaluation of NBN Co's future liabilities.

Telstra's InfraCo

InfraCo is a business division within Telstra that consists of the following fixed network assets (Telstra, 2019; Penn, 2018):

- Telstra's national transit network plus international undersea cables but not the fibre dedicated to supporting Telstra's mobile network.

- Telstra's fixed access networks: all its ducts, pits and pipes; and the residual copper and HFC networks yet to be transferred to NBN Co.

- Telstra's more than 5,000 exchange buildings and data centres;

- but not yet its own Operations Support System or its own billing system – these are located and managed in other divisions of Telstra.

InfraCo has more than 200 wholesale customers, including NBN Co (which contributed about $1b of InfraCo's revenues in FY 2018), Telstra's external wholesale customers (largely 'corporate and government'), and its internal retail businesses (consumer, small business and enterprise) (Telstra, 2019; Penn, 2018).

At InfraCo's launch as a stand-alone business division in July 2018, Telstra's CEO, Andy Penn, valued its book value (i.e. replacement value) at $11b (Chirgwin, 2018). However, its EBITDA of $1.225b in FY19 (Telstra, 2019, p. 41), if annualised as $2.45b, suggests a conservative net value of $15b, possibly a lot more, provided it were not saddled with any of Telstra's corporate debt prior to sale.

In short, InfraCo itself is a large, profitable wholesale fixed network business – but one which Telstra regards as being surplus to its future requirements, and will consider 'divesting', i.e. selling off, when opportune (Chirgwin, 2018). InfraCo's network is nationally strategic: it comprises the major part of Australia's transit broadband telecommunications network, connecting all of Australia's major cities by very high-bandwidth optical fibre links, and supporting most of the country's digital economy.

Why Merge NBN Co with InfraCo?

The first thing to note is that the network assets owned by these two businesses are quite complementary: InfraCo owns Australia's largest optical fibre transit network, and NBN Co owns Australia's largest set of broadband fixed access networks. InfraCo's ownership of the pits and pipes that NBN Co uses is a further area of exact complementarity. It is significant that NBN Co already depends upon InfraCo's transit network, and is a major customer.

Secondly, the merged entity – let us call it 'NetCo' – would have greater managerial alignment in meeting Australia's national infrastructure goals, most of which require advanced telecommunications technology. A concerted national effort to grow the Digital Economy would particularly benefit from the merger.

There are some significant synergies that would add $ value to the merged entity, NetCo:

- Reduced costs with a single Operations Support System and single wholesale billing system;

- No need for profit between the backhaul network (InfraCo) and the access network (NBN Co), thus ensuring that either output prices to customers can be reduced or profits to the owner increased – or a balance between these two aims, to make the merger acceptable to the key stakeholders.

- NetCo would have greater resources – financial, technical and managerial – to plan and design the technology upgrades essential for the NBN access networks to remain fit for purpose.

But, in addition, there are two important strategic benefits that the merger would deliver, from a national competition viewpoint.

Firstly, NetCo can provide a level playing field of wholesale backhaul services to the whole industry, including Telstra – which would not be achieved while InfraCo remains owned by Telstra.

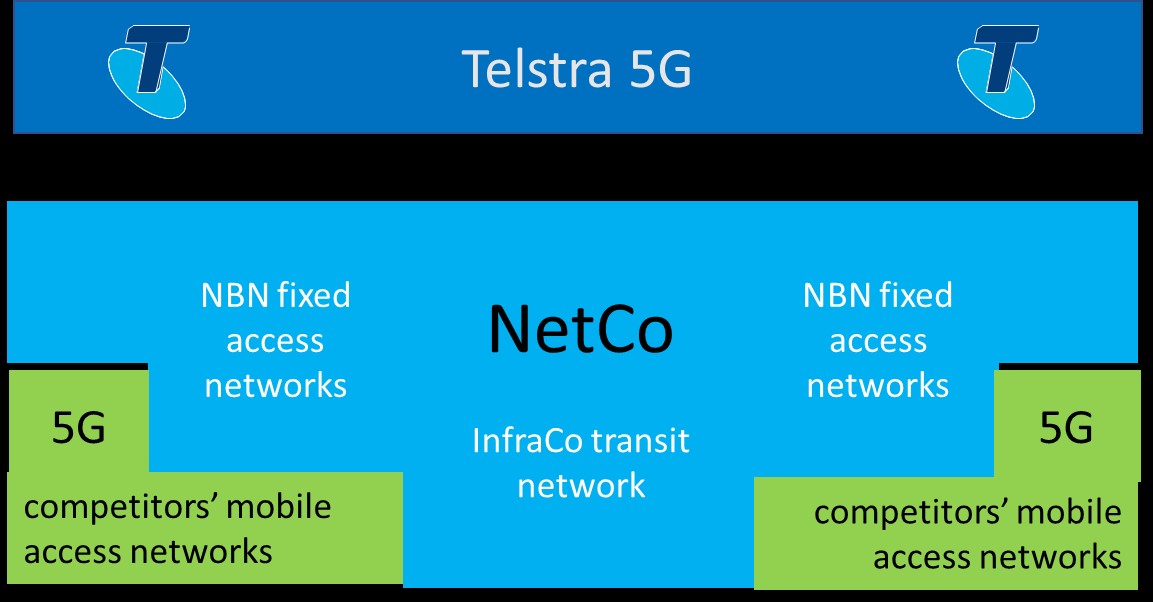

Secondly, NetCo can do what the NBN alone cannot do, and what a Telstra-owned InfraCo would not do. It can offer cost-effective transit network services to new entrants into the 5G market, which is likely to become heavily dominated by Telstra, as discussed above. How NetCo can achieve this will be explained with the help of Figure 2 below.

5G networks will provide picocells with very high data transfers taking place in small radio footprints, often requiring the 5G radio stations to be attached to buildings or other existing structures, e.g. along streetscapes. They are expected to be well suited to managing communications for moving vehicles, such as driverless cars and other vehicles. NetCo can use its NBN-derived FTTP and FTTN service areas to provide fibre connections to 5G radio stations, as well as using its InfraCo-derived transit network as the most cost-effective backhaul in the country, to provide a 'single shop' wholesale fixed network service to new entrants into 5G and later networks. This should be much more economical for new 5G players than investing in their own transit networks.

Figure 2. How NetCo can support new entrants to the 5G market

Telstra has chosen to publicly underplay the potential of 5G networks to substitute for NBN connections except in the context of warning of the likely consequences of NBN Co sustaining its current high wholesale prices (e.g. Kruger (2019)). However, a recent study of fixed-mobile substitution by Pugh (2019) with 1,446 participating households reveals that in 2017 '30% of existing fixed broadband households would consider switching to a wireless broadband service', in the context of existing retail prices for the NBN and for 3G/4G mobile services. The key reasons given by these respondents were 'concerns over the NBN', 'wireless faster than their fixed connection', 'wireless is cheaper' and 'portability' (Pugh, 2019). I take the view that 5G will be a considerable substitutional threat to the NBN in its poorer performing service areas – as well as providing opportunities to NBN Co as a 5G infrastructure provider.

Arguments Against Such a Merger

Infrastructure competition. The first counter argument arises from the traditional regulatory culture in this country, in which infrastructure competition is raised as being the highest policy goal[iii] – far higher than the goals of greatest interest to consumers or citizens, such as reduced retail prices, or more reliable performance, neither of which is necessarily guaranteed by infrastructure competition, but are simply expected to flow from it. Because NetCo, whether publicly or privately owned, will be a monopoly, this will be considered to be an extremely undesirable outcome. The traditionalists would rather InfraCo and NBN Co continued as separate entities, encouraged to invest competitively in each other's monopoly area.

But infrastructure competition does not necessarily lead to better outcomes for end users. Some of us remember the frantic competition between Optus and Telstra in the 1990s, to gain an early advantage in what was then called the cable TV market. The result was both carriers laying parallel HFC access networks in essentially the same streets to serve essentially the same set of two million premises, located in the most affluent suburbs of Australia's four largest cities. Any rational person would see that this duplication was a wasteful allocation of nationally valuable infrastructure, because another eight million homes missed out.

The obvious counterexamples to the belief in infrastructure competition as the essential solution for reducing prices occur in the electricity and energy distribution markets: it simply hasn't worked. If your prime aim is to control prices, then surely the best mechanism is price control. Ditto for control of service performance, in this case via the monitoring and regulation of Service Level Agreements.

Perceived lack of innovation. An argument is sometimes raised, usually by textbook economists, that monopolies lack the ability to innovate. This was clearly not true for the US private monopoly AT&T, whose Bell Labs produced a cornucopia of both fundamental discoveries and practical inventions from its founding in the 1920s onwards. Nor was it true in Australia for either the PMG Department or its successor, Telecom Australia, both public monopolies, which were sources of ongoing sequences of innovation in new network services and technologies, over a span of seventy years.

The obvious means for ensuring that NetCo, as either a public or private monopoly, would continue to innovate to remain fit for purpose, would be to ensure firstly that its management encouraged it, and secondly that its budget included the funding of a small R&D division to assess ongoing customer needs and evaluate new solutions for them. NBN Co has recently created an 'insightLab' to find ways to improve its services (Crozier, 2018).

NetCo too large to be manageable? I was surprised that this objection was raised at the forum. The obvious response is to note that, if NetCo were created today, it would be significantly smaller in both size of workforce and range of business activities than Telstra has been during its most commercially successful years.

Anticompetitive structure. Communications Minister Paul Fetcher has emphatically (and understandably) ruled out the NBN being owned by any vertically integrated telco, such as Telstra: 'That's baked into the legislation' (Duke, 2019a). But that does not rule out InfraCo purchasing NBN Co if Telstra's ownership of InfraCo were previously reduced, e.g. via an IPO, to a level at which Telstra had no effective control, e.g. below 10%. This is a scenario which Telstra's CEO, Andy Penn, seems to be positively contemplating in the next few years (Pearce, 2019b). The sale of a network that is no longer essential for Telstra's T22 strategy would provide a valuable financial contribution to its bottom line.

Ownership of NetCo: Public or Private?

If the merger of InfraCo with NBN Co is seen as being in the national interest, the question remains as to whether the merged entity should best be in public ownership, i.e. by the Australian government, or in private ownership. The first outcome would be achieved by NBN Co buying InfraCo; the second either through InfraCo buying NBN Co, or through an independent investor buying both and merging them.

As the pros and cons of the third possibility (the action of a third party) are virtually the same as for the second (InfraCo buying NBN Co), only the first two scenarios will now be examined.

Option A1: NBN Co, under government ownership, to buy InfraCo

Advantages. Firstly, the government's AAA investment rating gives it cheaper access to the ongoing finance necessary to keep the combined entity (NetCo) fit for purpose, with appropriate technology upgrades.

Secondly, NetCo under government ownership should be able to put the needs of users above the need to raise maximum dividends for its owners, enabling it to offer a cheaper range of wholesale products than if it were privatised.

Thirdly, the government as owner would have greater governance control over NetCo to comply with its national policies, either via legislation, regulation or simply Ministerial direction. The memory of the fully privatised Telstra's CEO, Sol Trujillo, locking horns with the federal governments in 2007-2009 over national broadband policy remains a good history lesson.

Disadvantages of government ownership. Firstly, there is the political risk of the investment returning a net loss to the federal budget if the government continues to allow infrastructure competitors to 'cherry pick' the most profitable parts of the market.

Secondly, we have seen in recent years considerable political aversion to any form of electoral risk; and we have observed a large amount of public criticism over the NBN's underperformance being directed towards the government rather than to NBN Co.

Thirdly, there is the tendency for Ministers to interfere in engineering and financial decisions for perceived electoral benefits, such as the mistakes in choosing FTTN over FTTP as the preferred access technology in 2009, and indeed the extra costs to NBN Co of managing the Multi-Technology Mix (Quigley, 2019).

Option B1: a publicly listed InfraCo to buy NBN Co

In the following, it is assumed that any ownership of InfraCo by Telstra, or indeed by any other vertically integrated carrier, has been reduced to a level providing no effective control of InfraCo, e.g. less than 10%. I do not suggest 0%, as in floating InfraCo it may be strategically important to new investors to see that InfraCo's major wholesale customer, Telstra, retains some financial motivation in continuing to use InfraCo's network services.

Advantages. Firstly, the synergies between InfraCo and NBN Co, described above, would provide a significant financial boost to the owner of the merged entity, NetCo.

Secondly, the merger would provide some insurance to InfraCo regarding the potential of a future privatised and unleashed NetCo to attack InfraCo's core backhaul business, e.g. by focussing only on the most profitable intercity routes.

Thirdly, the transfer of NBN Co's nation-building role to the private sector may minimise its electoral risk to the government. However, to meet national policy objectives (in support of the digital economy and digital society), NetCo will need to be subject to strong regulatory control of its pricing, its reach and its performance (in the form of monitored Service Level Agreements with its customers).

Fourthly, the sale would generate a windfall of $27b or more to the federal government. However, this outcome could be seen as a major disadvantage by the government of the day. Federal accounting practices will crystallise the government's investment loss in NBN Co (of currently $51b minus $27b = $24b) onto its bottom line, possibly dragging the federal budget into deficit in that year. This would be an unattractive outcome to any federal government that places the avoidance of budget deficits as a very high priority. Hence, the timing of the sale of NBN Co becomes politically quite crucial.

Disadvantages of a privatised NetCo. Firstly, there is the loss of long-term utility revenue to the government.

Secondly, a privately owned NetCo is likely to prioritise profits over service. (We have seen this with other recent privatisations.) However, there is a solution to this: creating regulation 'with teeth'.

Thirdly, a privately owned NetCo can be expected to use its financial muscle to lobby to change its charter, e.g. to increase its profits at the expense of universal reach or universal pricing. The solution to this is to incorporate the government's intended national goals for NetCo into strong legislation.

Lastly, major foreign ownership of NetCo would tend to accentuate the push for profits over other goals. The solution is to legislate strict ownership limits, as for Telstra Ltd.

Conclusions

It is vital to clarify our national policy goals for our digital society and our digital economy before deciding the future of the NBN. Otherwise, its future will largely be left to the market – and we have seen how well that has worked over the past twenty years! In particular, we note how 'leaving it to the market', in the absence of national policy goals for how the NBN should support the digital economy, has created a national network which is largely optimised for passive Netflix watchers, given the government's weak statement of expectations for the NBN. Only the approximately 21% of premises who receive FTTP, as a legacy from the original NBN implementation, provide highly competitive advantage to SMEs operating in the global digital economy – and most of the FTTP service areas are located in the capital cities.

This paper suggests two worthy policy goals, one for the digital society and one for the digital economy:

- All residents should have affordable broadband access to essential online services, irrespective of the location of their residence (to the maximum extent possible).

- All Australian businesses should have access to broadband infrastructure at internationally competitive bandwidths and prices, irrespective of their location (to the maximum extent feasible).

If one supports those broad policy goals, one can assess and compare each 'NBN Future'option in the light of how well it will achieve them.

In considering the option of merging Telstra's InfraCo business with NBN Co, the following observations have been made.

Firstly, it would not be acceptable (under either competition law or good policy) to allow InfraCo to buy NBN Co until InfraCo ceases to be controlled by Telstra or by any other vertically integrated carrier. But this independence can in fact be achieved by a process which Telstra's CEO seems to be favouring: InfraCo's divestment from Telstra, either by an IPO or by sale to an independent investor.

Secondly, NBN Co and InfraCo have entirely complementary networks. Their merger (as 'NetCo') would serve the national interest better than NBN Co alone, creating an end-to-end fibre network that can support new entrants to the 5G (and later generation) mobile markets. Without this cost-effective assistance, new market entrants are likely to struggle to compete effectively with the market dominance which Telstra's 5G network is expected to achieve by 2022 at the latest.

Thirdly, NBN Co and InfraCo have synergies which can be crystallised via their merger to provide a balance between additional financial dividends to the new owner and reduced pricing to its wholesale customers. Or the owner can use the captured value of the merger to invest in the technology upgrades necessary for the network to become or remain fit for purpose, and hence more profitable.

Whether NetCo becomes a public or private monopoly, its pricing and performance will need to be strongly regulated. This is important because of NetCo's crucial role in supporting the national digital economy as a whole.

Lastly, the pros and cons of public versus private ownership have been considered. An economic rationalist (as distinct from a free-market religionist) would see that cost and governance advantages flow from public ownership. However, the aversion of governments these days to electoral risk and budget deficits may triumph over the need to achieve more practical policy goals for the country. The timing of the sale of NBN Co will therefore be quite crucial. The sale would seem to be an unattractive option until the fully rolled out NBN has time to pay off about half of the government's current $51b investment in it, in order that the net value of the transaction can have a negligible impact on the bottom line of that year's federal budget.

So, due to the perverse impact of federal accounting rules, it may be in the interests of both sides of politics for the NBN to remain in public ownership for an extended period of time.

Disclosure

The author has held shares in Telstra since 'T1'. This has not deterred him from authoring articles which favour the long-term interests of end users over the interests of shareholders.

References

ANAO [Australian National Audit Office]. (1998). Sale of One-third of Telstra, Audit Report No. 10, 19 October. Retrieved from https://www.anao.gov.au/sites/default/files'/anao_report_1998-99_10.pdf

ANAO [Australian National Audit Office]. (2000). Second Tranche Sale of Telstra Shares, Audit Report No. 20 2000-2001, 30 November. Retrieved from https://www.anao.gov.au/sites/g/files/net616/f/anao_report_2000-2001_20.pdf

ANAO [Australian National Audit Office]. (2008). Third Tranche Sale of Telstra Shares, Audit Report No. 43 2007-08, 24 June. Retrieved from https://www.anao.gov.au/sites'/default/files/ANAO_Report_2007-2008_43.pdf

Campbell, L.H. & Milner, M. (2019). The NBN Futures Forum. Discussing the Future Ownership of Australia's National Broadband Network, Journal of Telecommunications and the Digital Economy, 7(3), September. https://doi.org'/10.18080/jtde.v7n3.202

Chirgwin, R. (2018). Telstra reveals radical restructure plan, The Register, 20 June. Retrieved from https://www.theregister.co.uk/2018/06/20/yet_another_restructure_for_'struggling_telstra/

Crozier, R. (2018). NBN is building an 'insight lab', itnews, 6 April. Retrieved from https://www.itnews.com.au/news/nbn-co-is-building-an-insight-lab-488139

Department of Communications and the Arts. (2016). NBN Co Ltd Statement of Expectations, 24 August. Retrieved from https://www.communications.gov.au'/publications/nbnstatementofexpectations

Department of Finance. (no date). NBN Co Ltd (nbn), Commonwealth Government Business Enterprises. Retrieved on 1 September 2019 from https://www.finance.gov.au/gbe-directors-guide/gbe/nbn/

Department of Industry, Innovation and Science. (2018). Australia's Tech Future: Delivering a strong, safe and inclusive digital economy, 19 December. Retrieved from https://www.industry.gov.au/sites/default/files/2018-12/australias-tech-future.pdf

Duke, J. (2019a). Fletcher rules out NBN sale to Telstra, Sydney Morning Herald, 10 July. Retrieved from https://www.smh.com.au/business/companies/fletcher-rules-out-nbn-sale-to-telstra-20190709-p525j0.html

Duke, J. (2019b). 'Incredibly damaging for the NBN': Telstra boss warns 5G disruptors will take customers, Sydney Morning Herald, 31 July. Retrieved from https://www.smh.com.au/business/companies/incredibly-damaging-for-the-nbn-telstra-boss-warns-5g-disruptors-will-take-customers-20190731-p52cda.html

Fifield, M. (2018). Telecommunications Universal Service Guarantee, 5 December. Retrieved from https://www.minister.communications.gov.au/minister/mitch-fifield/news'/telecommunications-universal-service-guarantee

Gerrand, P. (2004). Revisiting the Structural Separation of Telstra, Telecommunication Journal of Australia, 54(3), 15-28. Republished online in Gerrand (2017).

Gerrand, P. (2017). Historical paper: The 2004 Proposal for the Structural Separation of Telstra, Australian Journal of Telecommunications and the Digital Economy, 5(4), 70-86, December. https://doi.org/10.18080/jtde.v5n4.134

Gregory, M. A. (2019). How to Transition the National Broadband Network to Fibre To The Premises, Journal of Telecommunications and the Digital Economy, 7(1), 57-67. https://doi.org/10.18080/jtde.v7n1.182

Kruger, C. (2019). Telstra CEO warns of NBN's 'unnatural distortion' of broadband market, Sydney Morning Herald, 30 July. Retrieved from https://www.smh.com.au'/business/companies/telstra-ceo-warns-of-nbn-s-unnatural-distortion-of-broadband-market-20190730-p52c3o.html?js-chunk-not-found-refresh=true

NBN Co. (2010). NBN Co. Business Case Summary, NBN Co Limited, 24 November. Retrieved from http://images.smh.com.au/file/2010/11/24/2061700/NBN%20Co%20%20'Business%20Case%20Summary.pdf

NBN Co. (2018). Annual Report 2018. Retrieved from https://www.nbnco.com.au/content'/dam/nbnco2/2018/documents/media-centre/nbn-co-annual-report-2018.pdf

NBN Co. (2019). Corporate Plan 2020-23. Released 29 August. Retrieved from https://www2'.nbnco.com.au/corporate-information/about-nbn-co/corporate-plan

Pearce, R. (2019a). Comms minister says NBN privatisation 'some way away', Computerworld, 11 June. Retrieved from https://www.computerworld.com.au/article'/662719/comms-minister-says-nbn-privatisation-some-way-away/

Pearce, R. (2019b). Path still open for InfraCo role in privatised NBN: Telstra CEO, Computerworld, 31 July. Retrieved from https://www.computerworld.com.au/article'/664799/path-still-open-infraco-role-privatised-nbn-telstra-ceo/

Penn, A. (2018). T22 – our plan to lead, Telstra Exchange, 20 June. Retrieved from https://exchange.telstra.com.au/telstra2022-our-plan-to-lead/

Pugh, N. (2019). The Wireless Threat to Fixed Broadband Services. Journal of Telecommunications and the Digital Economy, 7(1), 7-19. https://doi.org'/10.18080/jtde.v7n1.178

Quigley, M. (2019). What happened to broadband in Australia?, The Monthly, March. Retrieved from https://www.themonthly.com.au/issue/2019/march/1551445200'/michael-quigley/what-happened-broadband-australia

Ramli, D. (2016). NBN worth $27b despite $56b construction cost, says PWC, Sydney Morning Herald, 18 February. Retrieved from https://www.smh.com.au/business'/nbn-worth-27-billion-despite-56-billion-construction-cost-says-pwc-20160217-gmwbd5.html

Reichert, C. (2017). USO to be axed in 2020 for Universal Service Guarantee, ZDNet, 20 December. at https://www.zdnet.com/article/uso-to-be-axed-in-2020-for-universal-service-guarantee/

Ritchie, G. (2019). Why Low-Earth Orbit Satellites are the New Space Race, Bloomberg Businessweek, 9 August. Retrieved from https://www.bloomberg.com/news/articles'/2019-08-09/why-low-earth-orbit-satellites-are-the-new-space-race-quicktake

Telstra. (2019). Financial results for the half-year ended 31 December 2018. Retrieved from https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf%20F'/140219-Financial-results-for-the-half-year-ended-31-December-2018.pdf

Vocus. (2019). Business Broadband Plans. Retrieved from https://www.vocus.co.nz'/broadband-plans

Glossary

5G = 5th Generation cellular mobile network

ACCC = Australian Competition and Consumer Commission

EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization

FTTC = Fibre to the Curb

FTTN= Fibre to the Node

FTTP = Fibre to the Premises

FY18 = Financial Year 2018, i.e. July 2017 to June 2018

HFC = Hybrid Fibre Coaxial [cable]

IPO = Initial Public Offering, i.e. floating the business on the stock exchange

NBN = National Broadband Network

RSP = Retail Service Provider

SME = Small or Medium Enterprise

USG = Universal Service Guarantee

Endnotes

[i] The Telstra 3 sale objectives agreed by the then Minister for Finance and Administration in August 2005 were as follows (ANAO, 2008):

- achieve an appropriate financial return from the sale;

- promote orderly market trading of Telstra shares;

- secure a timely sale process, conducted to the highest standards of probity and accountability;

- support Australia's reputation as a sound international investment location;

- continue to build investor support for the Government's asset sale programme and broaden share ownership; and

- remove the Government's conflict of interest as owner and regulator of Telstra.

[ii] The federal government's Strategy for Australia's Tech Future, published in December 2018, aims to deliver 'a strong, safe and inclusive economy, boosted by digital technology'. It admirably proposes that 'Australians have access to world-class digital infrastructure in their personal and working lives' (Department of Industry, Science and Technology, 2018). Yet there is a major disconnect between the aim of 'world-class digital infrastructure' and what the NBN is actually delivering for the majority of premises in Australia, as evidenced by Table 1 above. This new government strategy appears to have emerged too late to influence the design of the current NBN; and it is perhaps significant that it was not issued jointly by the Minister for Communications, Cyber Safety and the Arts.