Abstract

Australia?s fixed broadband services performance and takeup is continuing to fall behind other comparable countries in international benchmarks. This is despite broadband being a hot topic of debate at three Federal Elections and the creation of a new broadband utility company by the Australian Government. The recent change of government, in 2013, prompted reviews into the structure of Australia?s fixed telecommunications market. A move away from utility style broadband to infrastructure competition has been recommended but the Australian Government has not embraced such a move, preferring instead to keep the utility structure for fixed broadband. While the new Coalition Government is investing in more fibre infrastructure as part of its Multi Technology Mix, there is no commitment to build a ?deep fibre? network that would have ?natural monopoly? characteristics. Competition from new technologies, wireless and fixed, may limit the financial viability of the utility broadband provider. Indecision about the structure of Australia?s broadband market is likely to continue to retard medium to long term investment in the fibre infrastructure needed to improve Australia?s broadband rankings against its international peers.

Introduction

Broadband is a key political issue in Australia. The last three Federal Elections, in 2007, 2010 and 2013, have seen Australian broadband policy as one of the key debating issues between the Labor and Coalition parties. At the core of this development is the awareness amongst the Australian public that we are lagging the rest of the world when it comes to broadband performance and quality. As in any vibrant democracy the political process has recognised this and sought to respond.

This article will look at how Australia has struggled to define a sustainable model for the fixed access sector of its telecommunications industry since the de-regulation and privatisation of Telstra in the 1990s. Australia, like many other countries, moved away from the public utility model for telecommunications as technology opened up opportunities for competition in the fixed telecommunication sector. However, the infrastructure competition model failed to develop sufficient scale and momentum to create an environment where the private sector would invest in modern fibre based broadband fixed networks.

Instead, a Labor Government in 2009 decided that government should re-enter the market and fill the investment gap by creating its own new utility company to upgrade the nation?s fixed telecommunications infrastructure. However, the tension between competition and utility frameworks for telecommunications continues to grow as the new Coalition Government grapples with upgrading the infrastructure at less cost within the same utility company structure.

Australia?s fixed broadband deficit

Australia has a proud history in telecommunications (Moyal 1984). The difficulty of providing basic telecommunications to all citizens in a country with huge geographical challenges and extremely low population densities was overcome by pioneering engineers and technicians by the mid 1970s. More recently, Australia has become a world leader in the takeup and rollout of mobile phone (OECD 2013) and, more recently, mobile broadband networks (Akamai 2014).

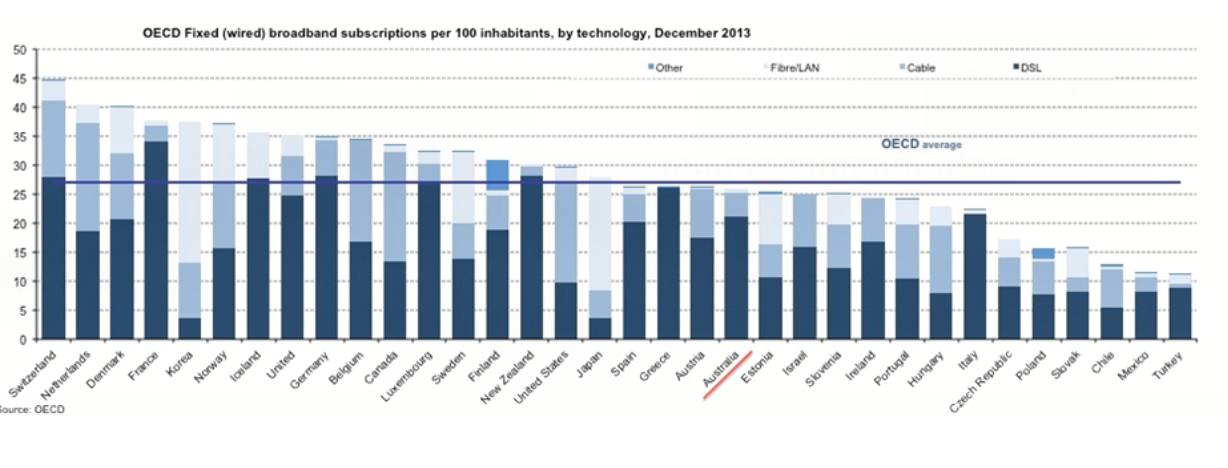

However now, some significant way into the 21st century, Australia is well behind the rest of the world in the delivery of modern fixed broadband telecommunications services. Australia?s fixed broadband penetration is low compared to other OECD countries, ranking just 21 out of 34 countries and below the OECD average.

Figure 1 ? Fixed Broadband Penetration in OECD countries (Dec 2013)

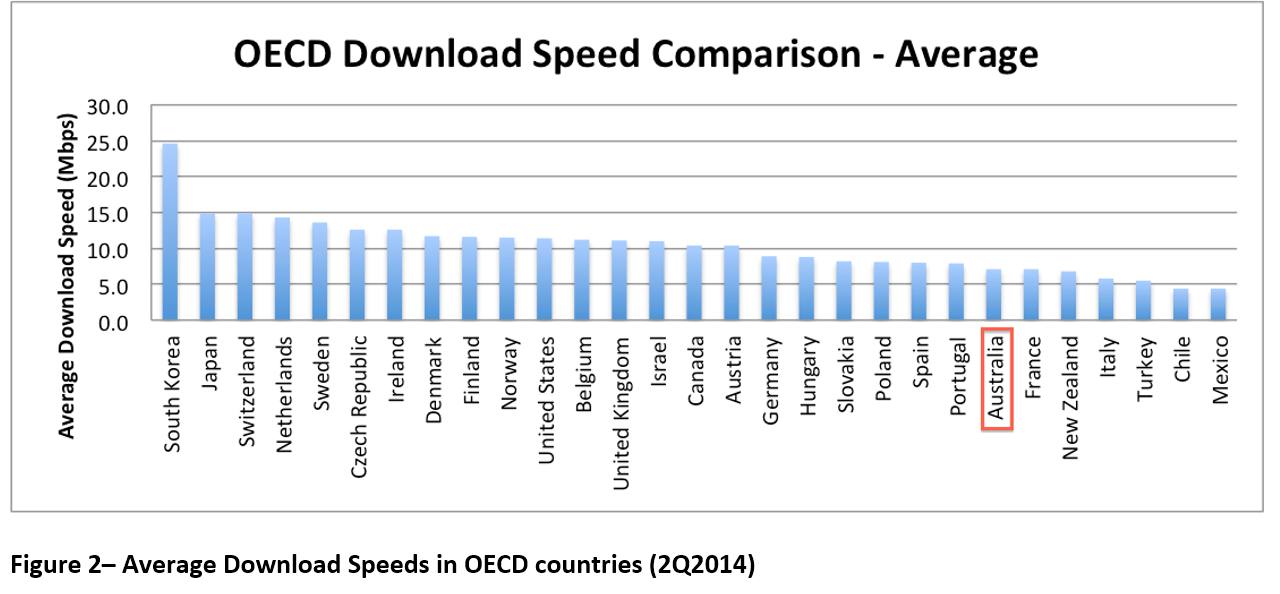

Average download speeds are also low, ranking 23 out of the 29 OECD countries reported on by Akamai.

Figure 2? Average Download Speeds in OECD countries (2Q2014)

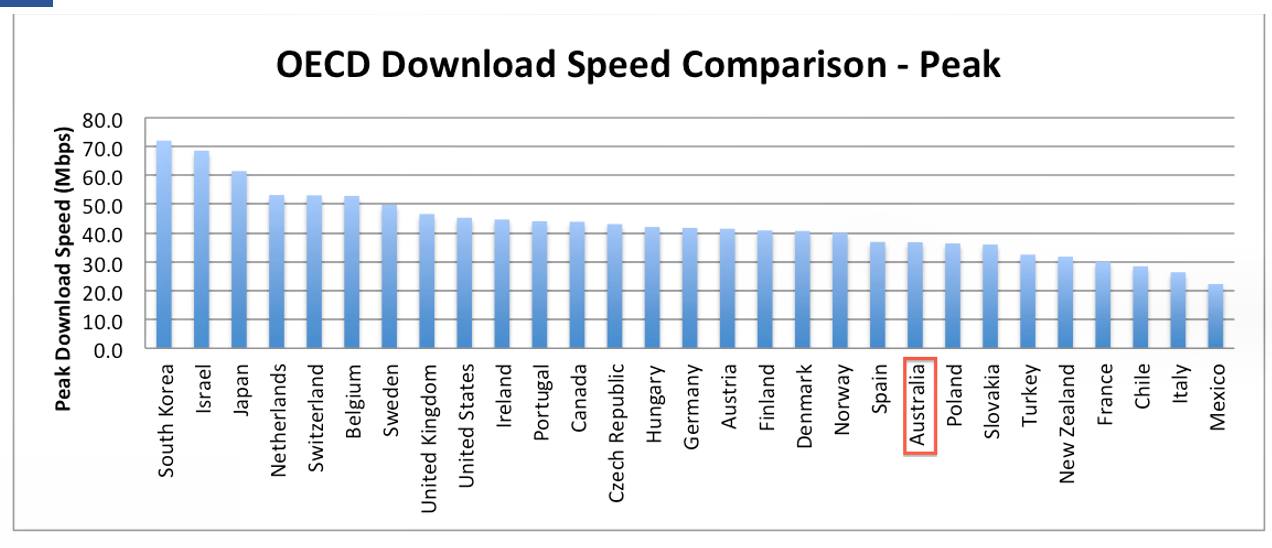

Peak download speeds are also low, with Australia ranking 21 out of the 29 OECD countries reported on by Akamai.

Figure 3? Peak Download Speeds in OECD countries (2Q2014)

This is not a recent phenomenon. Back in 2002, at the start of this digital century, the then Minister of Communications, Richard Alston was interviewed by Alan Kohler on the ABC?s "Inside Business" program. When asked about the then recent reports showing Australia?s broadband penetration was falling behind other leading countries by a significant margin, the Minister responded with ?The fact is we?re at the beginning of a very long race? (Australian Broadcasting Corporation 2002). Well, that race is still going now in late 2014 and Australia is probably further behind than ever.

Australia has since seen three Federal Elections, in 2007, 2010 and 2014, where broadband was a significant policy area differentiating the two major political parties. Broadband has become fertile political ground because the Australian public have become keenly aware of the country?s broadband ?deficit?. Now, some 15 years into the 21st century, Australians are aware they are trailing in the ?long race? towards a digital economy supported by access to high quality broadband.

More fibre deployment necessary

Australia?s fixed telecommunications network, built over many decades from the early 1900s, is predominantly a twisted-pair copper network purpose built to provide basic telephony services. In the 1990s and 2000s a range of technologies (initially ISDN and more recently DSL) were introduced to allow digital transmission of data over this copper network. Today?s ADSL2+ services can achieve maximum peak download speeds of 24Mbps and upload speeds of 1.4Mbps. Speeds experienced by end users depend primarily on the length of the copper run from the telephone exchange to the end user. In its most recent report on broadband availability and quality in Australia, the Department of Communications reported that 4.62 million premises (or 47% of ADSL served premises) receive a median peak download speed of less than 9Mbps (Department of Communications, Australia 2014).[1]

More recently, Telstra and Optus have rolled out Hybrid Fibre Coaxial (HFC) cable networks, predominantly for subscription pay TV services. These networks are also broadband capable and with the latest DOCSIS3 technologies they can support download speeds of 100Mbps and upload speeds of 5 to 8Mbps. The major limiting factor for increased speed in HFC networks is contention on the cable segments that are shared by many users simultaneously.

Although the limiting factors in both copper and HFC networks are different, one being distance and the other being user contention, the solution to both is ultimately to install more optical fibre closer to the end user to reduce the copper distance or the number of users contending on a cable segment. In copper networks there are various FTTx acronyms describing the depth of fibre deployed to various points closer to the customer where various DSL technologies can be deployed. For HFC networks we are seeing the implementation of digital transmission techniques that enable a transition to Ethernet distribution technologies (rather than radio frequency channels), thereby lowering the upgrade and operational costs of deeper fibre HFC networks (Salinger 2014).

In fact this need for more fibre is common for all networks, even those using wireless spectrum such as mobile broadband or public WiFi networks. Ultimately, broadband quality and performance is directly related to the degree or ?depth? to which fibre is deployed in any network.

So, Australia?s problem with broadband quality and performance can only be solved by deployment of more fibre, ?deeper? into the network and closer to the end user.

But installing more fibre is a costly and time-consuming task. The job of designing, constructing and installing this fibre to run through the hundreds of thousands of kilometres of Australian suburbs and towns is daunting. It is similar in many ways to the building of the initial copper telephone network. In reality it is more difficult, as the suburbs and towns are now well established and it is costly to disturb these neighbourhoods in this day and age. The original copper network grew, more or less organically, with Australia?s suburbs over many decades.

But this problem is common in most countries, especially the OECD group of countries that Australia is best compared with. How is the telecommunications industry approaching this challenge of the 21st century and more particularly what ?models? exist for the structure of the industry to create incentives to undertake this large, but important task?

Utility Model

The first option to be discussed is the ?Utility Model?. Today?s modern cities and towns owe their existence to three basic utilities that are provided to almost 100% of residences, namely electricity, water and sewerage. An optional fourth utility of natural gas is also available in many areas but not universally. These utilities were installed over decades, if not centuries, as the cities and towns grew. A mixture of government departments, government owned companies or heavily regulated private companies provide these utilities. Economists like to refer to these utilities as natural monopolies.

In many respects the original copper telephone network was built and managed as a utility service. In Australia, this was firstly done through the Postmaster General?s Department (PMG), then by a wholly government-owned company (Telecom Australia) and more recently by the privatised Telstra. However, unlike the electricity[2], water and sewage utilities mentioned above, the copper telephone network has come under challenge from newer competing technologies such as mobile and HFC networks. This development has been obvious since the 1980s and was part of the reason policy makers have moved towards privatisation and de-regulation of the telecommunications industry ? that is, a departure from the public utility model for telecommunication infrastructure ? as technical advances opened up possibilities for competition. The transition of telephony from being a utility service to an ?application? provided over a broadband network has accelerated this trend.

But as we now move firmly into the broadband era, some are calling for a return to the utility model in telecommunications. Interestingly, much of this discussion is coming from the USA as part of the ?net neutrality? debate. The dominance of the cable companies in particular has caused concerns that their growing monopoly power requires utility-style regulation (Crawford 2013). President Obama has weighed in, arguing that the industry?s regulator, the Federal Communications Commission (FCC), should seriously consider re-introducing the regulatory structures created for telephony into the broadband arena (Australian Broadcasting Corporation 2014).

Australia?s 2009 National Broadband Network (NBN) policy predates some of this debate in the USA, but its wholesale only Layer 2 access model and anti-cherry-picking legislation is a definite ?utility? style framework. The goal was the creation of a monopoly broadband infrastructure network that would underpin a competitive retail or value added services market. In addition to creating a broadband utility company, the 2009 fibre to the premises (FTTP) version of the NBN was aimed at solving two fundamental problems in the Australian market. Firstly, it would remove Telstra?s dominance of the fixed telecommunications market; and secondly it would provide the ultimate ?end-game? investment in fibre necessary to jump to the front of the broadband race internationally. Australia is not alone in following this approach ? others countries such as Singapore and New Zealand are following a similar model.

An important aspect of this broadband utility model approach must, in the author?s opinion, be a commitment to invest in a ?deep? fibre network that can satisfy the majority, if not all, the application needs for the next 30 to 50 years. Operators of competing technologies (such as mobile or public WiFi) would be permitted, encouraged and incentivised to use this ?deep? fibre network rather than build their own duplicate networks. Only a ?deep? fibre network can establish a true long-lasting natural monopoly by making the fibre network the most efficient (ie. lowest long-run average cost) for delivery of future broadband services. A broadband network that has limited deployment of fibre will suffer from the effect of ?cherry picking?, where alternative technologies will be deployed to compete ?surgically? with the utility. This will have the effect of undermining the utility?s economics by eroding its natural monopoly position.

The commitment to invest in a ?deep? fibre network need not require that such an investment be made immediately, but may instead involve the network rollout or implementation being made over a long period of time. The optimum timeframe should be determined by economic considerations. What is important is that the fibre investment should be done ahead of, or in line with the demand for broadband performance and not trail the demand. This will dissuade investment from cherry pickers who will be deterred by the risk of having their early investment stranded as the utility broadband provider quickly deploys fibre networks ahead of demand.

Funding for the utility may come from the public or private sector, but in either case the investment rate of return will need to be regulated and monitored to ensure monopoly rents are not extracted. Furthermore, in most cases, especially in geographically challenged countries like Australia, government will have to provide or manage cross-subsidies or outright subsidies where the cost of such broadband deployments becomes intolerable on social equity of access grounds.

Australia?s public telephony network was developed along such utility model lines by the PMG and then Telecom Australia. Much of the high-cost regional network was built during the Coalition?s long post-war reign from 1949 to 1972. As Doyle recounts, ?Country Party MPs excelled at channelling telecoms equipment and funds to rural areas and burying the ever-spiralling costs within the PMG?s impenetrable network of cross-subsidies? (Doyle 2014). The Labor NBN model unashamedly borrowed this technique in its plans for NBN Co to build the fibre utility network to over 90% of Australian households and provide wireless and satellite services to the remainder. The ?impenetrable network of cross-subsidies? would now be inside NBN Co rather than the PMG or Telecom Australia.

However, now in the early 21st century the utility model is out of favour amongst economists and most right-leaning politicians. Transparency and good governance demands that taxpayer funding of utility style infrastructure costs should occur only after extensive cost benefit analysis. Subsidies should be transparent and judged on the extra societal benefits they provide that are not captured by the pure economics. Both of these hurdles make a utility style telecommunications model very difficult to justify. Firstly, it is difficult to predict today what consumers and businesses will need in the future in terms of broadband performance. It requires a ?leap of faith? to believe that high-performance broadband networks will stimulate more innovation in applications that will then make use of the higher performance that justifies the extra investment. The symbiotic-like growth in computing power, data storage and bandwidth over the last 20 to 30 years would seem to support such an argument. Technologists can see the opportunities for new applications ? ?if you build it they will come?. But many economists will argue if you can?t ?see? the application ? don?t build the network.

Politically, the divide between left and right (or government intervention in markets on the one hand and free market policies on the other) will mean that the use of taxpayers? money to build and/or subsidise the cost of the network will be hotly debated. Arguments highlighting the high cost and risk of the rollout will be more tangible and easier to make compared to the (largely future-orientated) benefits of the applications made possible by such a network. Extra societal benefits in such areas of education, health and transport are difficult to analyse and weigh up against the high costs.

Australia?s most recent Federal Election in 2013 saw the defeat of the ?leap of faith? vision. However, the utility model is not dead and buried. As described further below, the new Coalition Government is continuing to pursue a utility model approach, primarily using existing network assets and technologies rather than committing to build a ?deep fibre? network.

The Vertigan infrastructure competition model

As part of its reviews into the NBN after gaining power in the 2013 Federal Election, the Coalition Government created a panel of experts, the Vertigan Panel, to provide advice on the future structure of Australia?s telecommunications market and in particular NBN Co.

In its last report, released in October 2014, the Vertigan Panel recommended that NBN Co?s technology assets (FTTx, HFC, Satellite and Fixed Wireless) be disaggregated and eventually divested to different private sector owners. In essence, the Vertigan Panel has recommended that the Utility Model be disbanded and competition at the infrastructure level (in addition to the retail level) be pursued in Australia (Vertigan 2014). This would be a dramatic change in Australia?s current telecommunications landscape, but not necessarily a new one for the country.

Firstly, Australia?s mobile phone networks have essentially followed this model since the 1990s. Telstra, Optus, Vodafone (and for a time Hutchinson before merging with Vodafone) have built and operated separate competing mobile networks. Competition between these providers has stimulated both the marketing of services and new technology rollouts. Australia has some of the highest penetrations of mobile phones and mobile broadband in the world and has been a leader in the adoption of 3G and 4G/LTE technologies (OECD 2013).

Secondly, infrastructure competition has been a policy goal for the fixed telecommunications market since the de-regulation commenced in the 1980s. Some early infrastructure builds were attempted by Optus, Transact and Neighbourhood Cable but with limited success. Telstra through its domination of the retail market, its aggression in defending its control of access network infrastructure (particularly through its competing rollout of HFC in Optus HFC areas) and its alliance with content holders through its Foxtel partnership with News Ltd, has continued to hold significant, arguably dominant, market power in the Australian fixed telecommunications network.

Other comparable markets have seen their once dominant telecommunication incumbents become significantly less powerful than Telstra. Most face competition in significant areas of their network footprint from HFC networks. The effect of infrastructure competition in fixed broadband markets has been a clear increase in investment in more fibre networks in these markets. Incumbent telcos have rolled out FTTN and FTTP networks to avoid losing market share to other network technologies. The development of DOCSIS3.0 on HFC networks and delivery of 100Mbps download speeds has been the biggest spur for this investment. The opportunity for telcos to become media players and distribute content has also been a significant driver.

Economists favour such an infrastructure competition model. By letting the market decide the appetite for broadband and the necessary investment in fibre, economists will argue, such investments are more efficient and timely than via a utility model. Competition also spurs innovation and increases operating efficiencies between competing companies and technologies. There is no need to perform cost benefit analyses, as each competitor is in effect doing its own business cases based on a wide degree of factors and responding as they see fit in their best interests. Politically, the conservative right favours the infrastructure competition model. Taxpayers are not burdened with the cost and risk of the investment in fibre and the private sector investment is encouraged.

However, such a model needs to be actively managed to ensure that over time competition does not wane through mergers, acquisitions, agreements or market oligopolies. Government policy and regulators need to actively push against any tendencies towards market concentration given the high barriers to entry in telecommunication networks.

But what of the need for high-performing broadband infrastructure in regional areas that is clearly uneconomic due to the high costs associated with Australia?s challenging geography? Absent any subsidy mechanism for the private sector, it is clear that a large proportion of Australia?s households would not be able to afford the high costs of the services necessary to fund such investments. Economists will argue that subsidy schemes can be created to incentivise the private sector to build such infrastructure if this is required for social or political reasons. However, politicians on both sides of the political divide baulk at the manner in which such schemes highlight the high costs of such subsidies, which inevitably must be borne by taxpayers generally or by the metropolitan households via higher telecommunication prices. The concept of such an explicit ?broadband tax? used to fund investment in regional telecommunication infrastructure appears to be a non-starter for any political party.

It would appear that it is this difficult policy and political question that it at the core of why Australia cannot embrace a move away from the old ?utility model?.

The risks of a Multi Technology Monopoly

The Coalition Government has not yet embraced the Vertigan Panel recommendations to pursue infrastructure competition. It has in fact been actively seeking to discourage it via proposed licence conditions on superfast broadband networks (Australian Government 2014).

The current policy, described as the NBN Multi Technology Model, is essentially the old NBN Utility Model with the minimal fibre investment required to achieve minimum download speeds of 25Mbps for all and 50Mbps for 90% of the population. While this model may provide a quicker initial upgrade to Australia?s broadband performance it leaves in doubt the longer term model for continuing investment in fibre infrastructure.

Of particular concern is the continuing monopoly characteristic of NBN Co under this policy. What incentive will NBN Co have to continue to invest in fibre infrastructure after achieving its broadband download speeds goals? NBN Co, although wholly government-owned, is run on commercial business principles and in particular is tasked with making a modest return on its investment. In this situation, the cost of more fibre investment will only be justified if it will mean less operational cost. But such an analysis depends entirely on the timeframe used. Over a long timeframe, say 20 to 30 years, the discounted operational cost of the increasing maintenance costs of copper and HFC networks, may be greater than the initial capital expenditure required to install more fibre infrastructure. But funding restrictions and technology risks will more than likely mean the timeframe is dramatically less, probably under 10 years. As a result the commercial business case will be hard to make.

NBN Co is likely to come under threat from small-cell wireless networks and cherry picking rollouts of fibre-based networks. In areas where this is a risk, NBN Co may respond by investing in more fibre itself. Or it may exit these markets, especially if it can access subsidies to cover shortfalls needed to fund obligations in other loss making geographies. The former scenario would stimulate investment in more fibre and would create some semblance of the infrastructure competition recommended by the Vertigan Panel, but at the same undermining the natural monopoly principles of the utility broadband provider. The latter scenario would leave the new entrants as the monopoly broadband provider with minimal incentive to invest in more fibre infrastructure when it is required.

However, absent such competing networks, NBN Co is likely to sit and wait after its initial MTM investment until higher speed benchmarks are mandated and additional government funding is provided. Such higher speed policy objectives will likely only come as a result of cost benefit analyses showing tangible benefits from applications that require such speeds that outweigh the costs. The applications with increased benefits will come from international markets where higher speed networks will become the norm ? not from Australia. Once Australians become aware of such applications they will demand the government do something about it and hence the cost benefit analysis ?proof? that further fibre investment is justified will only come well after Australia?s international competitors have the benefit of these higher performing broadband applications. Hence, after a process which will probably take many years after the new applications appear internationally, NBN Co will be given instructions and funding to increase its investment in fibre. The end result is Australia will continue to lag the rest of the world in its broadband network performance.

If NBN Co is privatised under the Multi Technology Model approach we can probably expect this process to take longer and maybe even stall. On reflection this is actually what happened in Australia in the 2000s. Telstra, privatised and the dominant player of all fixed network technologies, would not invest in the FTTN unless the government provided the funding and certain guarantees around investment returns. The general public became aware of Australia?s falling broadband performance as the new broadband era applications (such as Facebook, YouTube and Skype) grew in popularity internationally but suffered on Australia?s slow broadband networks. This low grade broadband performance became a political issue that has carried through until the most recent Federal Election in 2013.

The reluctance of the Coalition to embrace the recommendations of the Vertigan Panel appears to be inextricably linked to question of subsidies for improving broadband in the non-economic regional areas of Australia. As with the PMG and Telecom Australia before it, NBN Co is being used as the vehicle to hide the cross-subsidies necessary to provide a uniform price of broadband across Australia. The ?broadband tax? is hidden within NBN Co, rather than being exposed through the federal budget or industry levies. But in order for NBN Co to make a return on its investment it must be protected from competition or cherry picking in the metropolitan areas.

The Utility Model provides a convenient mechanism to maintain this political goal of hiding the ?broadband tax? necessary to keep the price of an upgraded broadband experience uniform across Australia. However, the compromise is that the monopoly so created will have little incentive to continue to invest in ?deep fibre? over the medium to long term.

Conclusion

Australia has ranked poorly in comparison with other similar countries in terms of its broadband takeup and performance since the early 2000s. While the ?long race? towards a broadband enabled digital economy may be still under way, Australia is in a difficult position at the back of the OECD pack.

The NBN policy debate of the last seven years is testament to the awareness of the Australian public to this state of affairs. The Labor ?deep fibre? NBN policy did seek to address this by building a network that would return Australia?s telecommunications infrastructure to a natural monopoly structure. However, the recent Coalition NBN model based on the use of existing networks puts in jeopardy the path to investment in the necessary fibre infrastructure over the medium to long term. Any temporary uplift in broadband performance will most likely give only temporary relief to the Australian voting public ? better, more data intensive applications in the fields of entertainment, education, health and business generally will eventually demand a raising of the bar on broadband speeds. And then the debate will start again on how to pay for the fibre investment needed to achieve these higher speeds.

The retention of the utility model and protection of the natural monopoly appear to be motivated by political concerns regarding the exposure of the high ongoing cost to subsidise uniform pricing of broadband services in regional areas. Any introduction of private sector infrastructure competition would appear to be blocked by the inability to devise a subsidy scheme that can be justified to the Australian electorate. But the only alternative to private sector investment is public funding through either government owned companies such as NBN Co or direct government subsidies to private sector monopolies.

The consequences are significant. Australia?s position in the global digital economy is at stake. Without high quality, high performance broadband no economy can expect to hold its own, let along strive for success in the new digital world.

Australians can expect to see broadband remain a key part of the political discourse for many years to come.

References

Akamai. 2014. State of the Internet Q2 2014 Report. Available at: http://www.akamai.com/dl/whitepapers/akamai-soti-q214.pdf?campaign_id=F-MC-22494&curl=/dl/whitepapers/akamai-soti-q214.pdf&solcheck=1&WT.mc_id=soti_Q214&, retrieved November 14, 2014.

Australian Broadcasting Corporation. 2002. Inside Business 25th August 2002 edition. Transcript at http://www.abc.net.au/insidebusiness/content/2002/s658096.htm retrieved 14th November 2014.

Australian Broadcasting Corporation. 2014. Net Neutrality: Barack Obama says broadband internet should be treated like public utility, November 11, 2014, Available at: http://www.abc.net.au/news/2014-11-11/barack-obama-says-broadband-internet-should-be-treated-like-a-u/5881058 retrieved November 17, 2014.

Australian Government, 2014. Carrier Licence Conditions (Networks supplying Superfast Carriage Services to Residential Customers) Declaration 2014 (Draft). Available at: http://www.communications.gov.au/__data/assets/pdf_file/0016/243520/Draft-Carrier-Licence-Condition.pdfretrieved November 17, 2014.

Crawford, S. 2013. Capitive Audience: The Telecom Industry and Monopoly Power in the New Gilded Age, Yale University Press, New Haven.

Department of Communications, Australian Government. 2014. Broadband Availability and Quality Report, 3-8.

Doyle, J. 2014. The long, covert history of rural telecoms policy, Inside Story, Available at: http://insidestory.org.au/the-long-covert-history-of-rural-telecoms-policy/ retrieved November 17, 2014.

Moyal, A. 1984. Clear Across Australia, Nelson, Melbourne.

Organisation for Economic Development. Dec 2013. Available at: http://www.oecd.org/sti/broadband/oecdbroadbandportal.htm retrieved October 20, 2014.

Salinger, J. 2014. Remote PHY: Why and How, National Cable and Telecommunications Technical Papers, Available at: http://www.nctatechnicalpapers.com/Paper/2014/2014-remote-phy-why-and-how, retrieved November 17, 2014.

Vertigan, M. 2014. Independent Cost-Benefit Analysis of Broadband and Review of Regulation. Available at: http://www.communications.gov.au/__data/assets/pdf_file/0009/243387/NBN-Market-and-Regulatory-Report.pdf retrieved November 17, 2014.

Endnotes

[1] According to the Broadband Availability and Quality report, Australia has 10.9 million premises [p8] of which 91% or 9.9 million have access to ADSL technology [p3]. 3.7 million or 37% of ADSL served premises have estimated median peak download speeds of less than 9Mbps and 920,000 or 9.2% of ADSL served premises have estimated median peak download speeds of less than 4.8Mbps.

[2] In recent times the electricity distribution utility model is coming under threat from the viability of co-generation or self-generation of electricity on both commercial and residential premises. New, cheaper technologies for generation and storage of electricity on site, using renewable energies in particular, may in the medium to long term provide viable competition to an industry long thought to exhibit natural monopoly characteristics.