Abstract

The MNF Group has been operating in the Australian telecommunications market since 2004. The author of this paper is an employee of the MNF Group and the opinions expressed are those of the author and do not necessarily represent those of the MNF Group. Upgrading the infrastructure of an entire country is a huge undertaking and was deemed necessary with Government intervention in Australia. Had this task been left to private companies, the likelihood is that Australia would continue to experience a huge gap in the cost and availability of high quality, fast speed broadband services between metro and rural regions. The NBN rollout is several years into the project; a recently released report from the ACCC has given insights into the wholesale market and initial market indicators show that the market is becoming less competitive. This paper examines the costs of interconnecting with the NBN and demonstrates why the NBN has not achieved its goal of providing a level playing field for all telecommunication companies. By looking at the true cost of providing NBN services to NBN users, it is shown that the NBN pricing model is flawed and will affect the quality of service being provided to Australians. To succeed in the telecommunications industry, it is suggested that smaller RSPs will need to work hard to differentiate their brand and provide added value to consumers through additional service offerings. Selling NBN services alone will not be enough to enable smaller RSPs to survive in this tough market. It can be expected that there will be further RSP consolidation within the telecommunications industry as the smaller RSPs won?t be able to compete with the Big Four dominating the market.

Introduction

This paper examines whether four or five large companies operating in the telecommunications market is providing enough competition, taking into consideration how the telecommunications industry looked five years ago, how it looks now and what the purpose of the National Broadband Network (NBN) rollout project was in relation to competition.

For the purposes of this paper, when competition is examined, it refers to competition seen at a retail level i.e. the competition between organisations that benefits consumers when they make a choice about which telecommunications provider they will buy their broadband service from.

A recent report (ACCC 2016b) released by the Australian Competition and Consumer Commission (the ACCC) provides some insights into the current marketplace and demonstrates that there is a lack of competition. When we examine the multiple acquisitions that have taken place in the telecommunications industry and the high barriers to entry created by the NBN we can see why competition is being reduced.

This paper sets out the true cost to a company of providing an NBN plan to a residential user, showing that the pricing model for NBN is flawed and suggests that alternative technologies will further damage the business case for NBN in Australia.

The paper provides some insight into the NBN from a wholesale provider?s point of view as well as exploring the challenges for Retail Service Providers (RSPs), making suggestions as to how an RSP can compete in the market.

Unless otherwise indicated, prices are taken from the current NBN price list, version 2.9, issued 16th June 2016, which is publicly available on the NBN website. (NBNCo 2016b).

NBN and the Australian Telecommunications market

There are several large telecommunication companies that operate in the telecommunications market at both a retail and a wholesale level. What is meant by this is that they sell services directly to consumers via their own retail channels and they also sell their services on a wholesale basis to Retail service Providers (RSPs) who then on-sell these services to the same retail consumer market.

Not all wholesale business models look the same. The way a company operates may be largely dependent on their obligations to their shareholders, the amount of money they have invested in legacy infrastructure and their marketing strategy for their retail brand.

Consider the incumbent telecommunications provider in Australia, Telstra, before the NBN was conceived and how they would achieve the best Return on Investment (ROI) for their shareholders. It could be said that due to their large investment in their copper network, prioritising sales of their copper services at a retail and wholesale level, over investing in new technologies would provide the best ROI and a best result for their shareholders. There would be a lack of incentive to innovate even if this would provide a better experience or cost benefit to the consumer.

This scenario demonstrates why it would be difficult for multiple telecommunication providers in a country to invest in new technology and achieve the objectives that the NBN has been put in place to achieve: a nationwide rollout of new technology to all premises across Australia with no service delivery price differentiation based on geographical location.

Even if an NBN rollout had been attempted by private companies, it would most likely have resulted in preferential outcomes for metro-based consumers as this would represent a more profitable market. This is especially true in Australia where there are large geographical distances between consumers and the cost of providing services to regional consumers has always been more expensive.

By creating a Government-run corporation tasked with implementing a nationwide rollout of modern broadband services at wholesale prices fixed for all consumers regardless of location, the NBN should achieve what private companies were unlikely to ever achieve.

Insights into the NBN market

In April 2016, the ACCC released its first report on the NBN wholesale market (?NBN Wholesale Market Indicators Report? (ACCC 2016b).

The statistics contained in the report were alarming to many across the industry, as it clearly shows market dominance by four large players.

Market share

The report from the ACCC showed that Telstra had around 48% market share across the three fixed technology types: Fibre to the Premises, Fibre to the Node and Fibre to the Basement (FTTP, FTTN and FTTB); this figure is higher if only the newer technology types FTTN and FTTB are considered.

Telstra?s average retail market share for fixed DSL broadband services was an average of 41% from 2011-2015 (ACCC 2016a). Given that the NBN was supposed to reduce Telstra?s monopoly power, it has proved counter-productive in that Telstra has gained a higher market share of the NBN market than they previously held in the DSL broadband market.

Figure 1 ? NBN market share of current connections by Network Access Seeker for FTTP, FTTB and FTTN.

Source: ?NBN Wholesale Market Indicators Report? 2016

Number of providers at the POIs

The NBN Wholesale Market Indicators Report from the ACCC (ACCC 2016b) also showed that 71 Points of Interconnect (POIs) had just four Access Seekers (telecommunication companies) connected directly to them and providing services within the POI area.

The data also shows us that the maximum number of providers at any POI was 10, and that just 5% of POIs had more than 7 providers directly connected and providing NBN services.

The NBN website RSP list (List of NBN service providers, 2016) shows that there are currently 133 RSPs who are reselling NBN services to consumers, which means that even if hypothetically all 121 POIs had 10 providers directly connected to them, this would represent just 7.5% of RSPs.

The significance of being able to directly connect to NBN?s 121 POIs will be examined later in this paper.

CVC Bandwidth

Another insight from the ACCC report (ACCC 2016b) was an indication of the amount of Connectivity Virtual Circuit (CVC) bandwidth which was being purchased by Access Seekers in order to service end users.

In the report, for Service Class 4, Table 2 showed that total contracted CVC is 952,561 Mbps. Table 1 showed that the total number of Fixed NBN services (FTTP, FTTB and FTTN) for Service Class 4 is 805,396 services in operation (SIO).

Taking the total CVC and dividing it by the number of SIOs, gives an average CVC bandwidth per service of 1.18Mbps. This calculation does not take into account the different plans that services are assigned to, nor the fact that CVC has to be purchased in minimum blocks; however it does give a very approximate indication of the CVC that is being provided to NBN end users.

Whilst this amount of CVC bandwidth might not cause immediate concerns for industry or end users, consider when an end user requires 5Mbps to watch High Definition Television (HD TV), and to support multiple devices being connected to the same service in a household. This amount of bandwidth would result in buffering, slow speeds and a poor end user experience.

Creating competition or creating barriers?

Since 2010, we have seen the fixed market (that is, voice and broadband but not considering mobile services) consolidate from around 16 separate companies to just four large companies dominating the market[i].

Whilst this is not as a result of the NBN rollout, it is market consolidation at a wholesale level that has been approved by the ACCC, a Government organisation that is supposed to promote competition and fair trading.

Acquisitions

TPG acquired iiNet in 2015 after the purchase was approved by the ACCC; with ACCC chairman Rod Sims even stating that they expected this acquisition to lessen competition in the fixed broadband market in the short term (ACCC 2015a).

At the time, Sims gave the impression that the ACCC would be ?much tougher on any further consolidation of the telecommunications sector, especially if the deal involved Telstra, Optus, TPG or M2? (Sadauskas 2015). However, three months after approving this acquisition, the ACCC approved another when Vocus acquired M2 (?ACCC will not oppose? ACCC 2015b).

The ACCC stated that in this case, the merged firm will face competition from Optus, Telstra and TPG and therefore it was approved.

As a result there are now several large companies operating in the industry, which satisfies the requirement for competition, but does not take into consideration the effect of the acquisitions on the market.

The reality is that these companies are all very similar, and there is very little incentive for them to innovate or to support RSPs whilst they also own and operate large retail brands themselves.

Barrier to entry

One of the initial objectives of the NBN stated in the NBN Corporate Plan of 2010 (NBN 2010) was to create a level playing field for all Access Seekers. This objective was expected to be achieved partly by separating Telstra from its network assets, and partly by the decision to use Uniform National Wholesale Pricing (UNWP) so that all Access Seekers would pay the same wholesale price for a service from NBN.

When considering the cost of interconnecting directly with the NBN, we can understand why this objective cannot be achieved. The 121 Points of Interconnect model used for the NBN rollout means that there are many RSPs that are not able to interconnect directly and therefore cannot access NBN services at the UNWP fixed prices.

There are both upfront and ongoing costs to connect directly to an NBN POI. The upfront cost to connect to each POI is $1,000 per POI, based on the NNI 1000BaseLX Activation fee as per NBN?s price list (NBN 2016b). Therefore, to connect to all 121 POIs would require a substantial upfront investment of $120,000.

The minimum ongoing monthly cost of being connected to a POI in order to provide NBN services is $1,775 per month. This figure is based on the minimum commitment for RSPs for a CVC which is 100Mbps at the current price of $15.75 per Mbps (based on industry average, price as at June 16), plus the minimum NNI cost of $200 (1 Gbps ? 10 km range) (?Price List?, NBN 2016b). When you multiply this by 121 POIs the total minimum monthly cost is $214,775 per month regardless of the number of end users that are being serviced.

NBN Co announced in April that they would introduce a Dimension Based Discount (DBD) model to reduce the CVC costs paid by RSPs, claiming that CVC costs could be reduced to $11.50 per Mbps (NBN 2016a). Since this was introduced, industry has seen the price reduce from $17.50 per Mbps to the current DBD price of $15.75. Even if we use the lowest theoretical cost of $11.50 in the same calculation, it would be $1,350 per POI and a minimum monthly commitment of $163,350 to interconnect directly with all 121 POIs.

It should be noted that these calculations do not include the cost of network backhaul to transport data to the RSP?s core network Points of Presence (PoP), which adds further cost.

These high costs of interconnecting directly to the NBN have ruled out many companies from being able to compete at a Tier 1 level, resulting in a multi-tier market with price increases as we move down each tier as the large companies sell to the next tier level, who then on sell to the RSPs.

Whilst this has always been the case in the telecommunications market, the reason that creating competition is so difficult now is due to the huge amount of consolidation we have seen in the industry. Consider that the main large companies who can afford to interconnect with NBN directly and to enjoy these fixed wholesale prices also have their own retail brands. Ultimately, this enables the big players to buy cheaply and sell cheaply direct to their retail consumers; making it harder for RSPs to compete in the same retail consumer market.

The cost of providing NBN services

When supplying an NBN service to an end user, there are several elements that make up the final cost of an NBN service:

- Access Virtual Circuit (AVC)

- Connectivity Virtual Circuit (CVC)

- Network backhaul

- Other costs (staff, overheads, marketing etc.)

To demonstrate why the current pricing model for NBN is flawed, detailed below is the true cost to a business of supplying an NBN service, based on the assumption that the service is supplied at a Tier 1 level ? i.e. the provider is buying directly from NBN and is selling this to its own retail customers.

AVC

The Access Virtual Circuit (AVC) monthly access fee is the monthly price that a provider pays NBN to purchase a service from them. It is the port cost for the connection from the end user to the NBN network.

This AVC fixed price is only accessible to those who have directly interconnected with NBN. Anyone who is too small to connect will be buying at a higher price on a wholesale basis from a Tier 1 or Tier 2 provider.

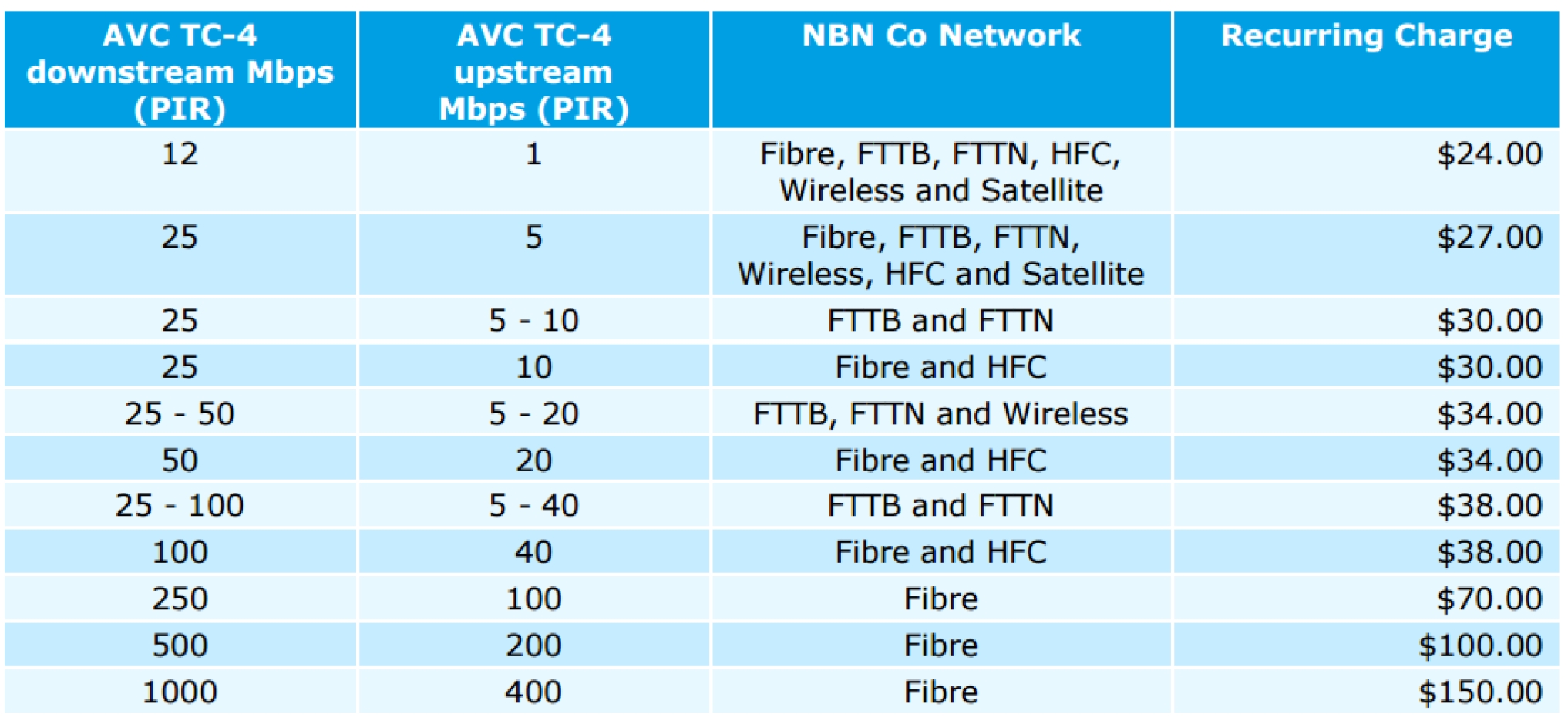

The pricing detailed below is publicly available information from the NBN Price List 2016.

The entry level plan with NBN is 12/1Mbps and costs $24 Ex GST.

Figure 2 - The recurring Charges per Billing Period for the AVC TC-4 and UNI bundle

Source: NBN Co Price List 2016.

CVC

The Connectivity Virtual Circuit (CVC) charge is the cost of aggregation from multiple households to the POI. It is effectively the bandwidth used by the end user and is currently set at $17.50 per 1Mbps of traffic (NBN 2016b).

To give some context to what the CVC charges might look like, take Netflix as an example of what consumer demands will be.

Netflix has provided on its website the recommended amount of bandwidth required for an Internet connection if an end user wishes to watch films and TV shows in High Definition (HD). The recommended bandwidth for viewing in HD is 5Mbps. (Netflix 2016b)

HD is already considered the standard in homes; in 2011 some 93% of households across Australia already had an HD integrated digital television (ACMA 2012).

Therefore, if an end user wants to watch TV or a movie in HD, they would need 5Mbps of bandwidth. If we apply the CVC charge of $17.50 per 1 Mbps then this equates to $87.50 for 5Mbps of bandwidth.

It is easy to see why currently on average only 1.18Mbps is being provided to end users for their NBN service. Whilst this might be acceptable for today?s consumer needs, it is expected that within the next few years more Australians will consume TV and movies in Ultra HD (also known as 4K) with 40% of TVs expected to be 4K by 2020 (Player 2016).

Consider also that the number of Australians with Subscription Video on Demand (SVOD) services has now reached 2.7 million (Telsyte 2016) and is expected to more than double to 4.7 million subscriptions by the end of 2019 (Ovum 2015). This means the industry will see a higher number of Australians requiring a greater amount of data and demanding more bandwidth to deliver Ultra HD quality.

Given that Netflix recommend a connection providing 25Mbps bandwidth to watch ultra HD content, the cost of purchasing this bandwidth to provide this experience to the end user will be unsustainable for most RSPs.

It is perhaps not surprising that Presto, a Video on Demand (VOD) service, when it launched in Australia in 2015 postponed their offering of 4K content as they did not believe NBN would be able to provide the bandwidth required to watch 4K TV (Dudley-Nicholson 2015).

Network Backhaul

Backhaul put simply is the cost of transporting Internet data from a series of locations back to a more centralised location; i.e. from an NBN POI to a company?s core network PoPs.

It is difficult to provide an estimate of the costs of backhaul due to commercial in confidence reasons; hence this cost has not been considered in the total cost of providing an NBN service.

Other

The document setting out the Coalition?s plan for fast broadband and an affordable NBN stated that they assumed retail prices to include a margin of $28 as this is the current approximate figure (Federal Coalition 2013). Consider that this $28 should not only cover the costs of labour, overheads, marketing and other costs, but it should also provide some profit margin to the provider.

Total cost of providing an NBN service

A company will pay a monthly fee for an NBN plan (AVC), a charge for CVC bandwidth, and network backhaul costs to transport data.

If we take the entry level plan available from NBN ? a 12/1Mbps plan priced at $24 ex GST ? and add the 5Mbps of CVC bandwidth cost, but not including the backhaul cost, the total cost of that plan to an RSP is $111.50.

Note that this is based on a Tier 1 provider accessing NBNs UNWP pricing; any provider not directly connected with NBN buying from a Tier 2 provider will pay more than this.

Adding the $28 margin that NBN included in its document (Federal Coalition 2013) plus GST gives the final retail cost of an NBN service for an end user of $153.45.

|

AVC charge |

$24 |

|

CVC charge (5Mbps) |

$87.50 |

|

Backhaul costs |

Not specified |

|

Sub total |

$ 111.50 |

|

Margin |

$28 |

|

GST |

$13.95 |

|

Total cost to end user |

$153.45 |

Figure 3 ? The total costs of providing a 12/1Mbps plan.

Looking at a selection of telecommunication providers in the marketplace, many companies are selling an entry level (12/1Mbps) unlimited NBN plan for around $60 to $70, including GST. This could indicate that providers are selling at a loss to gain market share, or they may be selling contended services which means there is likely to be congestion on the network at peak times.

One might wonder why we are not seeing prices already at the $153.45 price point if that is how much it is costing providers to supply that service to the end user. The reason for this is that companies are not currently providing consumers with 5Mbps of bandwidth as per their requirements; instead they are providing approximately 1.18Mbps. Whilst this means that the company can afford to provide the service and the end user can afford to buy it; in reality, the end user may experience some buffering and slow speeds, especially during peak times such as when most people are home and using their Internet connection in the evenings.

It should be noted that the CVC charge used in the calculation does not take into consideration the CVC rebate recently announced by the NBN (NBN 2016a). NBN Co claims that CVC costs could be reduced to $11.50 per Mbps; however, this reduction in price is dependent on the average CVC bandwidth that is provisioned to end users across the industry. Therefore the price that an RSP will pay for CVC bandwidth is determined by what the Tier 1 providers directly interconnected with the NBN are choosing to provision for their end users. Even if the calculations were based on the lowest CVC charge possible of $11.50, the total cost to the end user for the plan demonstrated would be $120.45.

It should also be noted that the new DBD pricing model has been put in place to ?reward retailers with a discount (determined at an industry level) for delivering a better customer experience through the better allocation of CVC to end users.? (NBN 2016a). This indicates that NBN Co are aware that services are being sold contended and that this will lead to a poor customer experience and ramifications for the success of the NBN project. The author is of the opinion that the new DBD pricing does not go far enough to address the issue of high CVC usage based charging.

NBN Business case under threat

A risk to the NBN business model is the threat from alternative broadband technologies such as wireless mobile phones and tablets, or alternative fibre access providers such as TPG and Lightning Broadband.

NBN itself has also highlighted this risk in its corporate plan: ?competition could intensify from both wireless mobile service providers and alternative fixed providers? ( NBN 2015).

Improvements in the speed of data downloads on wireless mobile devices are already positioning wireless access services as a viable alternative to the NBN. Mobile phone plans in the market are continually offering more data inclusions whilst maintaining current retail price points; this will ultimately make wireless mobile an affordable household alternative to an NBN service.

As demonstrated above, NBN plan charges at a retail level are likely to increase as demand for higher bandwidth and data consumption needs to be meet. The CVC pricing model means that theoretically NBN plan fees will become prohibitive and either consumers will not buy them, or RSPs will not offer them, resulting in consumer?s choosing alternative technologies.

This will compound the issue of high NBN prices even further, as fewer consumers share the cost of the NBN, meaning that either retail prices will remain high, or the time it takes for the NBN to pay back its cost will be extended.

The MNF Group ? A Wholesaler's View on the NBN

The MNF Group has been operating in the Australian telecommunications market since 2004 and was listed on the ASX exchange in 2006 (ASX:MNF).

The NBN rollout presents exciting opportunities for businesses across the industry as well as bringing a better digital future for the Australian population.

It is important that companies and individual advocates in the industry have a voice to lobby for change. When the NBN network model was being discussed in industry, companies were invited to submit their responses to the ACCC. Many in the industry understood that the large number of Points of Interconnect (POIs) that were being proposed would result in a market where only the largest companies would be able to afford the investment required to connect to all of the POIs around the country, as has been demonstrated above.

In addition, the majority of the proposed POIs were based in Telstra?s existing infrastructure, giving Telstra immediate competitive advantage over other companies as they had the required infrastructure and backhaul in place already. This arrangement gave them a head start in the marketplace over others who would have taken time to set up these arrangements and agree commercials.

The next major challenge presented in the business case for the NBN was the change of Government and following on from that, the change to the technology types that would be used to deliver the NBN to Australians nationwide.

The change of technologies hasn?t necessarily presented commercial challenges to RSPs but there are additional operational difficulties to overcome.

Using the existing copper means that the transition for an end user from DSL to NBN is likely to result in downtime (time without an Internet service) giving a poorer end user experience during the changeover. This is unlikely to be as much of an issue for Telstra who have full control over the copper network and the migration of services and can offer a more seamless experience. This provides another competitive advantage for the incumbent carrier.

It is now generally accepted that there is little to be gained from continuing to lobby against these challenges since the rollout is too far advanced, although former NBN CEO Mike Quigley has recently brought this issue back into the spotlight by ?pleading for a return to the NBN to the FTTH (FTTP) model? (Communications Day 2016) and the Labor Party has revealed its plans for the NBN if it were to be voted into power in the recent election.

In addition to these challenges, there are still elements of the current business plan that continue to cause concern.

The NBN Co?s approach to CVC pricing could seriously undermine the business case for the NBN and cause prohibitive and unsustainable pricing. In turn, this will lead to a strengthening of the case for alternative technologies (this is discussed further below).

The release of the pre-election budget presented an opportunity for the Government to write off some of the costs of the NBN network build, which would help to stabilise the future business model for the NBN rollout.

The write-off of some of the build cost would mean that NBN would not have to pay back so much in revenue, and a review of the way NBN services are priced could have been undertaken. Instead what we will see is prohibitive price increases as customers require more data.

The MNF Group - A Retail Experience

The MNF Group is a multi-tenanted business, owning a Tier 1 Voice over Internet Protocol (VoIP) network, several consumer retail brands, and on-sells wholesale services.

This range of service offerings gives a wide ranging and unique insight into the impact of the NBN across several different market disciplines.

The way telecommunication companies sell services

The Australian Bureau of Statistics (ABS) reports the average broadband downloads grew more than 33 per cent from December 2013 to December 2014 (ABS 2014). Perhaps even more impressive is that the amount Australians downloaded jumped 50% between December 2014 and December 2015 (ABS 2015).

This change in consumer data consumption will have been experienced by nearly all providers across the industry, especially since the introduction of Netflix in Australia. NBN has referenced this change in its corporate plan: ?continued double-digit growth in volume through changed consumer behaviour (e.g. new subscription video services, 4K streaming, devices per household, etc.)? in the context that they expect this to contribute to higher CVC earnings for the NBN (NBN 2015).

Given that many companies in the industry have modelled their commercial offerings on a usage-based cost, this change in consumer behaviour will dramatically affect how DSL and NBN plans are sold and priced.

As an example, consider that an unlimited plan might have been sold in 2013 for $49.95 including GST, but the cost modelling for this plan would be based on the fact that the end user will probably only download around 45.6GB per month (ABS 2014). If the consumer increased their data usage in line with the statistics shown be the AVS, it is likely that three years later a provider would lose money on a plan modelled this way.

In 2015 the average data download on NBN was 112GB (?Half Year Results? NBN 2016c); ? that is nearly 2.5 times the amount of data compared with the previous year. Consumer data consumption will continue to increase as VOD and other online services become more mainstream, and as technology such as 4K Ultra HD TVs enable the faster consumption of data.

Consumer Expectations

There are several things that influence consumer expectations when it comes to determining what they expect from a broadband service and what they expect to pay for it, particularly when it comes to the NBN:

- The market

- Politicians

- Netflix effect

The Market

Consumers have long been able to access cheap, unlimited broadband plans thanks to the pricing strategy described above and the lowering cost of data on DSL services.

Prices for unlimited DSL prices are fairly stable at around $40-$50. The cheapest prices for NBN entry level plans (12/1Mbps) have settled in the market at around $50-$60, although as demonstrated above, customers are most likely only receiving 1.18Mbps based on the current contracted CVC and number of subscribers.

Politicians

The Parties on both sides of politics have been promising to deliver fast and affordable broadband for all Australians. The Coalition Party even specified a price point in their plan for fast broadband and an affordable NBN policy document of $66 (Federal Coalition 2013).

The Netflix Effect

The Netflix effect is a term adopted to describe the shift in consumer consumption of TV and movies since the introduction of Video on Demand (VOD) services such as Netflix, Stan, Presto and others. Netflix even ranks RSPs based on how good their download speeds are (https://ispspeedindex.netflix.com/).

The burgeoning Video on Demand industry has allowed consumers to watch content through their TV, meaning that they are consuming more data than ever before and yet they would have seen no change to the price of the broadband plan (assuming they are on an unlimited plan) as their RSP would bear the cost as a result of the cost modelling described above.

Figure 4- the different influences on consumer expectations.

Resulting Expectations

Considering these influences, it is easy to understand why the consumer expectation is that they should be able to buy an unlimited Internet plan, regardless of technology type, and be able to watch Netflix and other Video Services on Demand (VSOD) as much as they like in HD for around $66.

For many RSPs this means that they are selling NBN services at a price point to meet consumer expectations with minimal if any margin. It is likely that RSPs are selling at break-even pricing (or below) with the intention of gaining market share and making their profit from other services that they can offer.

Whilst this paints a somewhat gloomy picture for telecommunication companies trying to compete, it also presents opportunities and forces companies to find new ways to differentiate themselves.

How to succeed as an RSP

Fixed wholesale pricing in the NBN model was intended to deliver fair pricing for all providers and to remove the ability to be able to compete on price. With a multi-tier industry, where the smaller RSPs are not able to buy directly from NBN, price competition hasn?t been removed, and it is more difficult to offer the cheapest plan if you are not a Tier 1 company.

Price is not the only factor that a company considers when differentiating itself from its competitors. In an industry where everyone is selling the same underlying service, RSPs must look for other points of difference to give them a competitive edge.

Pricing

Whilst many providers offer very cheap pricing for an entry level plan, it has also been proven that you don?t have to be the cheapest to be able to sell NBN services. Telstra is not the cheapest provider and yet they have gained the largest market share.

The important thing is to ensure that you are not the most expensive either, which may be challenging for some providers who have very low margins. Therefore, being able to obtain revenue and profit margin from other avenues and products is important.

Value proposition

Aside from pricing, there are other ways that an RSP can ensure they offer differentiation in the marketplace. This paper does not explore marketing theories in depth, however it will demonstrate a Company?s point of view which is specific to the telecommunications industry.

A value proposition is made up of multiple facets which enable a company to provide additional perceived value to their end user. Sometimes this additional value is quantifiable, for example a promise to answer calls in a certain amount of time can be measured by both an organisation and a consumer. An example of a non-quantifiable benefit would be the quality of the customer service that a company provides to their end user.

Service and systems

Within the MNF Group, iBoss is a Tier 2 wholesaler that provides wholesale services (such as NBN); these services are ordered, provisioned and managed via an online portal.

By offering a wholesale customer (the RSP) superior and intuitive systems that are easy to use to, iBoss is able to differentiate itself from its competitors. In turn, the benefit to the RSP is efficient systems that reduce their manual workload and the amount of operational staff required. The RSP will be able to operate more leanly, which will provide cost benefits in the form of lower operational overheads.

An RSP will also usually use a billing system to bill their end user and to provide the end user with the capability to manage their service and billing account. An RSP is able to leverage iBoss? billing systems to provide automated ordering solutions to their end users, meaning that the end user can have control over ordering their service and managing it. Invoicing and billing is also integrated and automated, enabling the RSP to effectively run their businesses with minimal human input.

Superior software systems will provide an enhanced customer experience, and ultimately can reduce the overhead costs for an RSP.

Support

The quality of customer service and technical support that an RSP provides to its end users will provide a non-quantifiable customer benefit. Providing a quality and knowledgeable support service to the end user is an important part of a service offering in telecommunications as services can often present technical complications.

The way an RSP can achieve this is by providing high quality training to their customer support team. Implementing procedures to ensure that customer complaints or technical issues are escalated in the correct way and are resolved in a timely manner is an important element of customer service and relates back to the systems an RSP uses to manage their business.

Quality

When it comes to quality of service, it might seem difficult to differentiate on the quality of an NBN service being provided to an end user, since the underlying infrastructure and product is the same for all providers. However, RSPs can differentiate on quality by purchasing more CVC bandwidth for their end users, which would provide a better download experience and reduced likelihood of buffering. This will be difficult for any RSP that is not a Tier 1 provider interconnected directly with the NBN, as they will not have control over the amount of bandwidth that is being purchased for its end users.

So whilst it is difficult to compete on the quality of the service being provided, it does come into play when you consider that RSPs could be selling a service that is buffering and hence provides a poorer customer experience.

Netflix itself provides a rating system on its website to show the RSP that it says is performing the best in providing download speeds (see: https://ispspeedindex.netflix.com/)

This makes RSPs accountable for the quality of service that they offer, and will ultimately apply pressure to ensure providers at all tier levels do not sell contended services. This adds weight to the argument that CVC costs are not sustainable and need to be reviewed in order to provide end users with the experience they expect at a price they can afford to pay.

Add-ons

Telecommunication providers will need to look for innovative solutions and products that they can add-on to an NBN service to provide a point of difference to their competitors. An example of an add-on that would provide extra perceived value would be including a voice service with calls as part of a bundle offer, or providing free Netflix or another similar VOD service.

Niche suppliers

The rollout of the NBN has offered new opportunities to geographical and niche suppliers. Small local providers have been able to capitalise on the opportunity presented by the mass switch-on of fibre services in their local area. This has provided a competitive edge as they have captured the early adopters who wanted to migrate to the NBN network as soon as it was available. The vast amount of data available from NBN on rollout areas and estimated switch?on dates has enabled specific targeting of customers in specific areas. This unique opportunity will become much less relevant once the rollout is complete.

Conclusions/Recommendations

Early market indicators from the telecommunications industry show some worrying trends. The NBN market is dominated by four large players, and it is expected that small RSPs will exit the market as they find it too difficult to compete; this will lead to more consolidation and less choice for consumers.

There are widespread concerns across industry about the pricing model for NBN which has been proven to be flawed. By examining the challenges posed by the pricing model, the author has demonstrated that the quality of the service being provided to consumers is diminished.

The author predicts that without modification of this pricing model, not only will this result in reduced competition, but consumer adoption of the NBN is likely to falter as alternative technologies pave a faster, more affordable path to high quality, fast speed data connections.

The NBN rollout is expected to be completed in 2020 by which time the data demands from households will be much higher than we see today; without change to the pricing model consumer perception will be that the NBN rollout has been a failure.

References

Australian Bureau of Statistics. 2014. "Internet Activity, Australia, December 2014". Available at: http://www.abs.gov.au/AUSSTATS/abs@.nsf/Previousproducts/8153.0Main%20Features5December%202014?opendocument&tabname=Summary&prodno=8153.0&issue=December%202014&num=&view=

Australian Bureau of Statistics. 2015. "Internet Activity, Australia, December 2015". Available at: http://www.abs.gov.au/AUSSTATS/abs@.nsf/Latestproducts/8153.0Main%20Features4December%202015?opendocument&tabname=Summary&prodno=8153.0&issue=December%202015&num=&view=

Australian Coalition Parties. 2013. "The Coalition?s plan for fast broadband and an affordable NBN". Available at: http://lpa.webcontent.s3.amazonaws.com/NBN/The%20Coalition%E2%80%99s%20Plan%20for%20Fast%20Broadband%20and%20an%20Affordable%20NBN.pdf

Australian Communications and Media Authority. 2012. "Television sets in Australian households 2011". Available at: http://www.acma.gov.au/~/media/Research%20and%20Analysis/Research/pdf/Television%20sets%20in%20Australian%20households%202011.PDF

Australian Competition and Consumer Commission. 2015a. "ACCC to not oppose acquisition of iiNet by TPG". Available at: https://www.accc.gov.au/media-release/accc-to-not-oppose-acquisition-of-iinet-by-tpg

Australian Competition and Consumer Commission. 2015b. "ACCC will not oppose Vocus? proposed acquisition of M2". Available at: https://www.accc.gov.au/media-release/accc-will-not-oppose-vocus%E2%80%99s-proposed-acquisition-of-m2

Australian Competition and Consumer Commission. 2016a."Competition in the Australian Telecommunications Sector". Available at: https://www.accc.gov.au/system/files/ACCC%20Telecommunications%20reports%202014%E2%80%9315_Div%2011%20and%2012_web_FA.pdf

Australian Competition and Consumer Commission. 2016b. April 29. "NBN Wholesale Market Indicators Report". Available at: https://www.accc.gov.au/regulated-infrastructure/communications/national-broadband-network-nbn/nbn-wholesale-market-indicators-report/initial-report

Communications Day. 2016. "Quigley makes another election campaign plea for pervasive FTTH". Issue 5155. June 2016

Dudley-Nicholson, J. 2015. News Corp Australian Network, August 31. "Presto says Australia?s internet speeds too slow for 4K content and blames new NBN." Available at: http://www.news.com.au/technology/presto-says-australias-internet-speeds-too-slow-for-4k-content-and-blames-new-nbn/news-story/f08d9845d708bdaa0556ddc3e7251f6f

NBN Co. 2010. Corporate Plan 2011 ? 2013. Available at: http://www.nbnco.com.au/content/dam/nbnco/documents/nbn-co-3-year-gbe-corporate-plan-final-17-dec-10.pdf

NBN Co. 2015. NBN Corporate Plan 2016. Available at: http://www.nbnco.com.au/content/dam/nbnco2/documents/nbn-corporate-plan-2016.pdf

NBN Co. 2016a. "New discount-based pricing to encourage enhanced broadband experience." Available at: http://www.nbnco.com.au/corporate-information/media-centre/media-releases/New-discount-based-pricing-to-encourage-enhanced-broadband-experience.html

NBN Co. 2016b. Price List, Wholesale Broadband Agreement. Available at: http://www.nbnco.com.au/content/dam/nbnco2/documents/sfaa-wba2-product-catalogue-price-list_20160616.pdf

NBN Co. 2016c. Half Year Results 2016. Available at: http://www.nbnco.com.au/content/dam/nbnco2/documents/nbn%20half%20year%20financial%20results%202016%20-%20presentation.pdf

NBN Co.2016d. "List of NBN service providers. 2016". Available at: http://www.nbnco.com.au/connect-home-or-business/information-for-home/whats-involved-in-getting-connected/service-provider-list.html

Netflix Australia. 2016a. ISP Leaderboard, May 2016. Available at: https://ispspeedindex.netflix.com/country/australia/ (accessed 24th June).

Netflix Inc. 2016b. "Internet Connection Speed Recommendations". Available at: https://help.netflix.com/en/node/306

Ovum. 2015. "Australian OTT Video ? Creating a New TV Market." Available from: http://www.nbnco.com.au/content/dam/nbnco2/documents/ott-video-in-australia-creating-a-new-market.pdf

Player, C. 2016. ARN June 20. "Cisco internet traffic forecasts expose further flaws in Govt's NBN rollout". Available at: http://www.arnnet.com.au/article/602027/internet-traffic-forecasts-expose-further-flaws-government-nbn/?utm_campaign=daily-pm-edition-2016-06-20&utm_medium=newsletter&eid=-4152&utm_source=daily-pm-edition

Sadauskas, A. 2015. itnews, September 1, 2016. "ACCC defends approval of TPG/iiNet merger". Available at: http://www.itnews.com.au/news/accc-defends-approval-of-tpg-iinet-merger-408744

Telsyte. 2016. Telsyte News, June 27 2016. "Strong SVOD growth create opportunities for content providers and resellers in Australia". Available at: http://www.telsyte.com.au/announcements/2016/6/27/strong-svod-growth-create-opportunities-for-content-providers-and-resellers-in-australia

Endnotes

[i] Examples of mergers and acquisitions in the telecommunications market between 2010 and 2016:

- iiNet acquired AAPTs consumer division in 2010 https://aapt.com.au/aapt/about-aapt

- iiNet acquired internode in 2011 http://www.internode.on.net/news/2011/12/259.php

- iiNet acquired TransACT in 2011 http://www.iinet.net.au/about/history/

- iiNet acquired Adam internet in 2013 http://www.iinet.net.au/about/history/

- iiNet acquired 60% of Tech2 in 2014 http://tech2home.com.au/

- TPG acquired AAPT in 2014 https://aapt.com.au/aapt/about-aapt

- TPG acquired iiNet in 2015 https://www.tpg.com.au/about/profile.php

- M2 acquired Primus in 2012 http://www.iprimus.com.au/legal/about-us/

- M2 acquired dodo and Eftel in 2013 (https://en.wikipedia.org/wiki/M2_Group

- Vocus acquired Amcom in 2015 http://www.vocus.com.au/news/vocus-and-amcom-faqs

- Vocus acquired M2 in 2015 http://www.vocus.com.au/news/vocus-and-m2-merger-approved