Abstract

Today Australia's telecommunications market is strongly contested. Competitors with highly skilled, experienced and focused marketing teams battle for market position, market share and profit growth. This has not always been so. Telecom Australia was established in 1975 as the government-owned national telecommunications carrier. Protected by regulated monopolies for network services and customer premises equipment, Telecom held perhaps 90% of the market. The predominantly engineering culture believed that it only needed a nominal marketing department and no sales force. In 1981 the monopolies were threatened. Telecom decided that it needed a sales force ? quickly. This is a brief story of the building of that sales force over the first five years. In a government-owned business steeped in the public service culture, strongly influenced by the public service unions, and under a Labor Government it was a grinding task. After five years the "subscribers" were more widely addressed and treated as "customers" and the sales force was operational. It was to be at least another six years before the sales force made the customers the focus of the business, and the skills, experience, management and culture of the force could match serious competitors in a de-regulated market.

Introduction

The Australian Telecommunications Commission (Telecom) was established in June, 1975, as a statutory authority owned by the Commonwealth Government. It was required to "best meet the social, industrial and commercial needs of the Australian people for telecommunications services" and 'make those services available throughout Australia for all people who reasonably required those services' including the special needs for telecommunications of those who resided or carried on business outside the cities.?

The Act introduced the concept of a ?Universal Service? ? the provision of a baseline telephone service to every resident in the nation to a minimum quality of service at affordable nationwide rates. This meant that rates charged for the telephone service would be the same for customers in urban, rural and outback areas, even though the telephone service outside the cities and major towns operated at a loss. To finance the cross-subsidy arrangement, regulated monopolies enjoyed by the Post Master General's Department (PMG) ? building and operating the national telecommunications network and the sale, rental and maintenance of certain customer premises equipment ? were continued for Telecom. More transparent forms of funding the cross-subsidy were overlooked, the main aim appearing to be to reassure Telecom's management, staff and unions so as to achieve a smooth transition from the PMG to Telecom.

The new Telecom was a massive business. It was the largest capital enterprise in the country, with assets almost double those of Australia?s biggest private company, BHP. In the first year revenue was $1.4 billion, profit was $152 million and there were over 87,000 employees.

Disclosure

This is not an academic paper; it is a brief history which will be a curiosity to today's marketing and sales professionals.

The paper is supported by a number of records of the period, including business plans, business cases, and trading statements, as listed under "References". The records are incomplete but are sufficient to support the points made. A number of these records no longer exist or are not easily accessible, such as those in the archives of the Australian Telecommunications Commission and Telstra.

Opinions and judgments are mine unless otherwise stated. Assessments of Telecom are expressed using standard private sector criteria including growth, market share, customer service and profit, rather than using public service criteria.

The Establishment of Telecom in 1975

In 1974 the Vernon Royal Commission of Inquiry into the Australian Post Office (the PMG) recommended to the Whitlam Labor Government that the PMG be split into two businesses, the Australian Telecommunications Commission (Telecom Australia) and the Australian Postal Commission (Australia Post). The two businesses were to be operated on "commercial business principles", with personnel and other employment policies, including industrial relations, suited to the new businesses and independent of the Public Service Board.

The new Telecom was designed and implemented in 1975 by senior managers transferring from the PMG. A number of key recommendations of the Vernon Report were not implemented: for example, the new district organisation was based on state boundaries rather than on commercial principles; the one senior manager appointed from the private sector had little commercial experience; and the personnel and other employment policies, processes, and culture of the public service were retained.

From 1975 until 1989, except for a brief period, there was only one senior manager in Telecom who had a significant commercial, private sector experience.

The resulting business was minimally commercial in organisation, skills, focus, priorities and processes. Telecom, with its monopolies, union constraints and public sector legacy, preferred change on its own terms with minimal risk; it was familiar with managed technical change but not commercial change.

This background is crucial to understanding Telecom's reaction to the introduction of a sales force.

Telecom in 1982

In 1982 Telecom's Annual Report stated that top management was pleased with its progress in the first six years.

The business was booming; the annual growth rate from 1975 ranged from 8 to 13%, 12% in the last year to $3.08 billion. Telephone services had increased from 3.7 million to 5.3 million. 80% of homes in Australia now had phones, up from 62% in 1975.

In 1975 the public network primarily carried voice traffic with a low volume of data traffic, but by 1982 a major data market began to emerge. Government and business networks were growing in size and complexity. Since 1975 Telecom's Datel modem services had "rocketed" from 9,000 to 56,000, but many more new digital connections were in operation. A new mobile telephone service had been launched in 1981 and two new data services ? the Digital Data Service (DDS) and AUSTPAC ? would be launched later in 1982. The use of facsimile machines was growing, approaching 500,000 in operation.

There had been some improvement in the quality of customer service. Access charges and local and long distance call rates for the telephone service had been held constant for six years, but there were increases during the last year for all but the longer distance calls. Productivity improvements had maintained staff numbers roughly constant at 88,000.

In an internal information paper ? ?Management of Telecom Australia in the Early 1980?s? ? the Deputy Chief General Manager (DCGM) in late 1980 assessed that "Telecom needs to shift its production orientation towards a market orientation and to do this implies an increase of marketing expertise and marketing personnel, [some will be] trained and experienced internal managers but external recruitment will also be necessary?.

Apparently, it had taken five years for Telecom's management to appreciate what the Vernon Commission recommended: that Telecom should adopt a marketing and commercial approach, supported by recruiting from outside the relevant management skills and experience. To date Telecom had employed none of these people and minimal such internal training was done.

By 1981 there was mounting pressure for competition in Australia's telecommunications market and a strong prospect that Telecom could lose some or all of its monopolies. A strong marketing team and powerful sales force could be needed soon.

The Mounting Pressure for Competition

Despite the confidence in Telecom's 1982 Annual Report there were strong calls from a number of sources for de-regulation of the Australian telecommunications market. The main pressures were from customers, potential service providers and changes in technology. Briefly these included:

- since 1975 the network monopoly was being eroded by governments. An increasing number of government organisations ? health, education, railways, power, gas, police and emergency services ? were permitted to operate telecommunications networks for their own use, provided they did not carry traffic for others or for the public at large,

- large business customers, notably those in the media, telecommunications and computer industries, were demanding an extensive easing of Telecom's network monopolies so that they could offer public services to customers through own carriage, (Telecom) leased lines and "value added" services, including the emerging videotex type of services.

- since 1975 the number, size and complexity of private networks using Telecom?s leased lines and the public network had more than trebled, increasing the potential rewards to business of network de-regulation.

- although Telecom was planning to launch new digital and packet switched networks during 1982, large business customers believed the timetable for the introduction and deployment of these and other emerging services was too slow.

- many large business customers were impatient with the limited capabilities of the Datel services introduced in 1969 and highly critical of Telecom?s introduction of the Common Data Network (CUDN), a technical and commercial failure, which Telecom closed down in 1977.

- a number of large businesses formed the Australian Equipment Suppliers Association in 1979 which demanded a public data network with private sector involvement. In 1980 Business Telecommunications Services (BTS) was launched, a consortium of 12 diverse and large businesses including BHP, IBM and AMP, ostensibly as a research group, but with the real intention of providing advanced telecommunications services for Australian business.

- trends in network traffic were lowering the cost of entry for competitors to attack as much as 70% of Telecom's revenue from public network services. Traffic was becoming more concentrated on the 'east coast spine' - the links between the three largest metropolitan centres, Sydney, Melbourne and Brisbane, and with Canberra. Most overseas traffic travelled through a handful of undersea cables, concentrating at the main terminations in Sydney and Melbourne.

- emerging technologies, particularly digitisation, optic fibre and computer controlled exchanges, offered a wider range of services and significantly lowered capital and operating costs. In the USA, both AT&T and GTE began deploying optic fibre from the late 1970s while Telecom was still planning for this in Australia towards the mid-1980s.

- many in the government, commerce and industry were incensed at the immense, unprecedented disruption to the public network during 1978 caused by the Australian Telecommunications Employees Association (ATEA), and the extraordinary vulnerability of the network to industrial action. The action was aggressive and massively damaging, causing some areas of the network to approach collapse within one week with the crisis quickly spreading across the nation.

- a high proportion of customers, particularly large business customers, regarded Telecom's provision and restoring of services as slow. The most common complaints were Telecom's "lack of responsiveness" to user concerns and an "unwillingness to concede that users had real problems".

- the position of Telecom as both service provider and regulator for the "permitted attachment" policy was under increasing criticism. This policy, managed by Telecom, required that anyone wanting to attach a line or equipment to the network could only do so with Telecom's permission. Telecom also made by-laws which set standards for any equipment or services to be attached to its network. This limited and delayed the range of equipment available to the market at a time when the capabilities of telephones, small business systems and PABX's were rapidly expanding.

- the private sector was pressing for an independent regulator and the removal of Telecom's monopoly in customer premises

- videotext services were being introduced in France (Minitel) and the UK (Prestel) during 1980. Telecom's proposal to introduce a national service ? which implied a monopoly ? was strongly opposed by the private sector.

- around the world there was a widespread trend for de-regulation of national telecommunications. The Uruguay Round of the General Agreement on Tariffs and Trade (GATT) negotiations, which included trade in services, added to the pressure for liberalisation of national telecommunications services.

In short, in the six years since Telecom was formed, not only had the market changed radically, but technology and other factors, including industrial action, seemed to make the relaxation of Telecom?s network and permitted attachments monopolies almost inevitable.

The Davidson Inquiry

In 1981 the Fraser Coalition Government commissioned an inquiry into ?Telecommunications Services in Australia? ? the Davidson Inquiry ? to determine the desired level of involvement of the private sector in the delivery of existing and proposed telecommunications services, including "value added" services.

The following year Davidson recommended far-reaching reforms in Australia's telecommunications market. The four most important were: introducing network competition; the interconnection of private networks with the public network; quantifying and funding the cross subsidy of the country customers by metropolitan customers; and introducing full competition for the marketing and maintenance in the terminal and value added services markets. An independent regulator would approve attachments to the network.

The Davidson report raised Telecom's worst fears. Telecom had minimal commercial capability and no sales capability. Competition, depending on the form and timetable, foreshadowed a rapid decline in market share. Deregulation of the telecommunications market in the USA indicated that Telecom could conceivably lose well over 30% of its market share within a decade ? a revenue loss of over $3 billion in year 10.

In March, 1983, the incoming Hawke Labor Government shelved almost all of Davidson's recommendations except for some relaxation of the regulation in the marketing, connection and maintenance of terminals such as telephones, small business systems, PABX?s, and modems. This at least provided some time for Telecom to become more competitive.

Telecom's Move towards Marketing

While the Davidson Inquiry was in progress Telecom created a new Commercial Services Department to strengthen marketing in the business, and appointed Greg Crew as the General Manager.

Crew was one of several engineering graduates recruited through the PMG's cadetship program, introduced to the business through the Research Laboratories, developed experience in the Engineering stream, and became considered as a candidate for higher management; others included Laurie Mackechnie and Mel Ward.

Crew saw the need for a stronger commercial function in Telecom, particularly if Davidson recommended partial or widespread de-regulation. Crew had noted the strong business strategy, planning, product management, marketing, sales and management concepts introduced in Telecom's directory publishing business and the resulting commercial success. He extended product management across the customer premises equipment range and obtained corporate approval to develop a national sales force.

The Rationale for a Sales Force

With no sales capability and the possibility of de-regulation, there were at least four compelling pressures for a sales force:

- While the monopolies continued, the sales force would provide higher, more reliable revenue growth. This was relevant because Telecom appeared likely to miss its revenue targets for the next two years - 1981/83 - by at least $40 million each year due to a change in economic conditions. A sales force would at least ease, if not avoid this.

- The sales force was profitable on an incremental basis in a monopoly market; in 1983/84, the first full year of operation, the sales force was estimated to generate almost $600 million in additional revenue for a marginal cost of about $550 million.

- Very crude estimates of the "business at risk" or "avoided revenue loss" in a competitive market were up to $400 million in the first year rising to perhaps $1 billion in year five, depending on the nature, extent and timing of de-regulation.

- Revenue from customer premises equipment sales, installation and maintenance would likely be lost first, followed by revenue from long distance and international calls, and private networks.

- The sales force in operation would accelerate Telecom towards a "real" rather than token customer focus and service culture, and press for faster, more focused product and service innovation.

It didn?t matter which rationale was used; as long as the modelling assumptions were reasonable a sales force could be economically justified. The only issues to be decided were the quality, scale and timing of the deployment of the sales force. The quality of people and scale of the sales force affected both revenue and operating costs, and the timing was determined by practical implementation factors.

Establishing Credibility through AT&T

At that time a characteristic of Telecom's top managers was that they were sceptical about major proposals from the lower ranks for non-engineering projects, and strongly suspicious about any proposal with which they had no experience ? such as a sales force ? unless it was supported by a credible consultant.

Consultants operating in Australia were unsatisfactory; the top end were too theoretical and had little direct experience with the task, and others who might be more practical lacked credibility in doing the job and gaining acceptance in Telecom.

The obvious choice was a telecommunication business in the USA which had experience in tackling deregulation and the emerging competition. AT&T was by far the most credible candidate. At this time AT&T was negotiating with the U.S. government about an anti-trust action which would result in a major increase in competition in the US telecommunications market. At the same time AT&T was strengthening its marketing and sales forces in preparation for that inevitable, more intense competition. The new market structure in the USA was launched in January, 1984.

AT&T International was selected as the consultant, not only because it would provide the best outcome, but because the involvement of AT&T provided the best prospect of acceptance by Telecom for implementation. AT&T was the acknowledged leader in telecommunications operations, research and manufacturing in the world?s telecommunications community. It was successful in the most competitive market in the world in customer premises equipment, network equipment, long-distance carriage and data networks. AT&T?s assets were eight times those of Telecom. AT&T had unmatchable credibility, and most of the executives in Telecom conceded this.

When AT&T inevitably found that Telecom?s customer service or any other area of performance was unsatisfactory and made a recommendation, Telecom?s ?engineering cult? was in no position to reject it either factually, philosophically or culturally.

AT&T was engaged to work with a small, new Telecom sales team to produce a business strategy and related implementation plan. In addition, at no cost, AT&T would provide access to all sales documentation, processes, systems and software relating to the AT&T sales forces operating in the USA. This minimised the need to re-invent these materials in Australia and reduced the time needed to establish Telecom's sales force.

Two AT&T International consultants and four Telecom people worked on the study:

- to assess the performance of Telecom's customer contact, sales support and order-processing staff to satisfy, throughout Australia, customer enquiries and needs for telecommunications and services,

- to recommend a national development strategy and program to improve customer service and sales performance as required.

The functions of customer contact, order processing and customer service were included, not only because of their relevance to sales, but also to satisfy Telecom?s predisposition to service rather than ?distasteful? sales.

The AT&T ?National Customer Service and Sales Operations Review?

The sales team report was titled the ?National Customer Service & Sales Operations Review?, under the brand of AT&T International, and was AT&T International?s uncensored opinion.

There were no surprises, with the report stating the obvious in a way that could not be dismissed:

?Telecom faced a step function change in the market when competition begins. To meet customer needs and hold sales against competitors, Telecom must have a competitive, nationwide sales force.?

In both Headquarters and the States the team found ?a passive service culture? and, apart from a small number of poorly focussed, untrained and unsupported account managers in NSW, no significant sales capability.

Any senior marketing manager in the private sector private sector would have been amused at the obvious nature of the conclusions of the report, but to Telecom?s engineering and process-dominated management they were a new and unwelcome message. Briefly some of the conclusions were that, in a competitive market:

- major new competitors will enter the telecommunications market, likely including IBM;

- the initial attack by competitors will be on large and medium customers in metropolitan areas,

- business customers will be pursued by sales persons from private enterprise and will be less inclined as a matter of course to approach Telecom for products and services,

- private enterprise sales persons will be ?professional? in their approach and in many cases will be offering ?industry specific? solutions to communications problems,

- Telecom?s installed base of business systems and telephones will be under severe attack, and control over changeover rates will be lost,

- private enterprise phone shops will appear in prime locations,

- residential products will be available in department stores, supermarkets and specialty shops,

- customer (and private sector) participation in installation and maintenance will increase dramatically,

- price competition will occur and a wider choice of payment options will be available.

All of this will be accelerated by an increasing rate of technological change and consequently shorter product life cycles.

The key recommendations followed, all familiar to the private sector:

- Telecom's top management must commit to a corporate sales philosophy which changes the organisation from a passive service provider to an active selling enterprise, and strongly communicate this throughout the business;

- product management is currently weak and must be strengthened, particularly in business planning and ?bottom up? budgeting and control;

- the sales structure across customer sectors in Headquarters, the States and the Districts is almost non-existent and must be created quickly;

- sales management and selling skills are almost non-existent across the customer sectors and in Headquarters, the States and the Districts;

- ?industry specific? sales plans must be developed for the top industries as a basis for deciding approaches to customers and allocation of accounts management resources;

- account management must be radically improved with a strong account planning and review process;

- a business sales force must be developed for business customers under the key and major customer threshold;

- a retail network must be developed to sell to the residential market, including radically improving the current Telecom shop fronts and introducing telesales persons. Too many of the existing shop fronts are poorly located and all are ineffective as sales outlets;

- an attractive sales career path must be developed to allow superior performers to progress up the sales force;

- initially, at least 20% of appointees to all sales positions must be from outside Telecom. (The "20%" was a compromise from 50% to reduce the shock);

- qualification, selection, recruitment, probation and evaluation processes must be developed to obtain the required capabilities, and develop and reward sales people;

- employment and reward systems must be developed to retain the superior performers and reward based on merit;

- sales support people and systems are needed to allow front line sale people to spend the bulk of their time with their customers, to deliver sales promises to customers, and strengthen planning, management and review of the sales force;

- a range of support measures including sales management and support systems to budget, manage and control the sales effort across the nation;

- a national training capability.

Full organisation charts were proposed for both Headquarters and the States. Detailed recommendations were made about how each of the main components of the national sales force should be developed. Interfaces between the new sales systems and Telecom?s computer systems were listed with descriptions of how the sales systems would link and operate. A detailed time table was laid out for implementation.

The Reaction of Telecom?s Management

Spurred by rumours of the outcome of the Davidson Inquiry, there was a strong consensus within the top management for an active and effective sales force in principle.

The Managing Director commented that he ?fully supported the program and the Telecom Commission would likely wish to go faster?. He warned that a ?visible expression of corporate support cannot be given prior to the publication of the Davidson Inquiry Report?, and that management ?must not allow the sales force to appear a 'Cinderella'; "it?s good for everyone in Telecom and depends on everyone to succeed?. The third top manager in Telecom, the Deputy Chief General Manager, ?fully supported the project . . . the sales career structure and some reasonable outside recruitment, but outside advertising must be sensible. Development actions (should be taken) with minimal external visibility?.

The two departments crucial for implementation ? Personnel and Industrial Relations ? were also positive. The General Manager (Personnel) ?didn?t see any problems and his department will do what needs to be done?. The General Manager (Industrial Relations) ?doesn?t expect sales incentive pay to be a significant problem . . . and didn?t expect public service policies to be a major issue?.

With the Managing Director, the Deputy Chief General Manager and the two enabling departments expressing support, it was assumed that the implementation timetable was reasonable; within two years the sales force structure and related infrastructure, and 50% of the people in the field should be operating, and within five years the completed sales force would be fully operational.

The Davidson Report was issued several months later increasing the urgency for the sales force.

In the last half of 1983 two events almost terminated the sales force project. In mid-1983, the new Hawke Labor Government rejected most of Davidson's recommendations which removed the pressure for change, and Greg Crew, the advocate for the program, left Telecom. The project continued but, with the bureaucracy and the unions reverting to "business as usual", progress was slower and much more difficult to achieve.

AT&T Supporting Documentation & Software

A key factor in the AT&T consultancy was the provision of AT&T's sales force documentation used in the USA. This was provided free before implementation began so that adaption could commence immediately.

This included force structures; planning and management; job descriptions; selection processes; training approaches and courses; performance appraisal processes; pay and conditions of employment; budgeting and control; practices and procedures; and measurement and reporting. Also included was software for processes such as sales force performance management, budgeting, reporting and training. The documentation and software discs and manuals filled a number of four-drawer filing cabinets, and adaptation to Telecom and Australian conditions began immediately.

Some examples of the AT&T sales force documentation provided were:

- Volume 1: Bell Marketing System ? business management systems, account planning, market action plan guidelines.

- Volume 2: Bell Marketing System ? business, staff guidelines and support

- 1982 Banking Market Action Plan

- 1981 Metal Fabrication Industry Market Action Plan

- AT&T 1979 Staffing Ratios for the Bell Marketing System

- AT&T Business Case for Establishing a Centralised Marketing Training Centre

- Account Executives Basic Selling Skills Course

- AT&T Selection of Sales Persons by Means of an Assessment Centre

- The Phone Store Implementation Package

- New York Telephone Service Order Processing System and Customer Data Base.

The quality and amount of information supplied greatly exceeded expectations.

An additional benefit was that AT&T's lead consultant would continue for implementation. Dick Brandt was an excellent example of the type of sales person for whom Telecom should aim. He was in his mid-thirties, positive, discrete and customer-sensitive, thoroughly trained, highly motivated and results-oriented. When Telecom people at senior levels in Headquarters and the States met him they were impressed. He was a role model for the new Telecom sales person.

Implementation

The aim was to have the sales force implemented and fully operational by June, 1987. (See the planning assumptions later)

An AT&T team worked with an expanded Telecom team to assist in a number of areas. For example:

- selection of new sales people until Telecom selection teams were trained;

- establishment of the new sales training centres and training of Telecom and external trainers until the local people could take over;

- training in the development of ?industry specific? sales plans suitable for the Australian market, using the AT&T plans as models, until the new account managers were competent;

- development of sales management processes suitable for the new Telecom sales force, including a budgeting and control system and payment and incentives systems until the Telecom team could take over;

- a phone shop business case and an implementation plan;

- assisting Telecom's systems people to develop marketing and sales computer systems until sufficient Telecom people were competent;

Some of the actions were to be operating by June, 1983. For example:

- the national selection and training centres in place and operational;

- perhaps 50% of the account managers and 30% field sales staff in place, trained and selling;

- ?first order? industry sales plans in place and operational for six industry groups;

- the phone shop business case completed and approved;

- a national sales tracking system operational;

- a comprehensive national sales systems development program operational.

The Customer Base

As with all sales forces, Telecom's was designed around the customer base, and this was segmented by revenue as shown in Table 1 below. Telecom's systems could allocate revenue to services but a broad allocation of costs to each service was only done at the end of each year.

Marketing, sales and customer service resources were allocated on the basis of estimated profit contribution and other commercial criteria such as revenue growth and the complexity of the customer's network. The Telecom public service tradition of dealing with ?subscribers? moved towards serving "customers". Also changed was Telecom's egalitarian view that all customers were "equal"; the new paradigm was that some customers were much more important than others, both for generating profits and defending against competitors.

The billing records were accurate for billing but relatively crude for this type of business analysis.

Table 1: Telecom Australia - Revenue Profile of Telecom?s Business Customers - 1980/81

(Billed revenue)

|

Type of Customer |

Revenue Range ($millions) |

Number of Business Customers in this range |

Total Billed Revenue ($ millions) |

% |

||

|

|

|

|

|

|

|

|

|

Key Customers |

10+ |

7 |

|

109 |

|

|

|

(Over $2m p.a.) |

7 - 10 |

3 |

|

28 |

|

|

|

|

6 - 8 |

7 |

|

51 |

|

|

|

|

4 - 6 |

19 |

|

91 |

|

|

|

|

2 - 4 |

58 |

|

155 |

|

|

|

Sub Total |

|

|

94 |

|

435 |

25 |

|

|

|

|

|

|

|

|

|

Major Customers |

1.5 - 2.0 |

38 |

|

64 |

|

|

|

($0.1m - $2m p.a.) |

1.0 - 1.5 |

67 |

|

46 |

|

|

|

|

0.5 - 1.0 |

227 |

|

156 |

|

|

|

|

0.2 - 0.5 |

449 |

|

142 |

|

|

|

|

0.1 - 0.2 |

347 |

|

50 |

|

|

|

Sub Total |

|

|

1,088 |

|

494 |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Business Customers |

|

|

500,000 |

|

802 |

46 |

|

(Less than $0.1 m p.a.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

500,000 |

|

1730 |

100 |

Key customers were the largest in terms of revenue and presented some interesting issues. For example, consider a bank which was a nationally significant key customer with offices and branches in every state and a number of subsidiaries and associated businesses in Australia, such as the ANZ bank:

- the Bank headquarters in Melbourne was billed as one customer, as was each of the main state offices. At that time the hundreds of branches were all separately billed,

- the Bank had subsidiaries which were also in the banking business, and minority shareholdings in other finance businesses that operated separately from the bank.

In each case ? the Bank's central headquarters, state headquarters, branches, subsidiaries or affiliates ? a decision had to be made as to whether to consolidate the revenue from these businesses into Telecom's business plan for the Bank. The key factor was whether the Bank wished then, or might decide in the future, to adopt a comprehensive, coordinated strategy for its telecommunications needs. Even if the Bank did not, there may have been value in Telecom being able to offer alternative strategic approaches to better meet the customer's current and future business requirements.

A related issue was the number of large businesses in Australia which were branch offices or subsidiaries of owners located offshore, such as Ford, Siemens, Alcatel, Cadburys and Barclays Bank. For these Telecom needed to know whether the telecommunications requirements in Australia were decided by the offshore parent or independently in Australia.

Planning Assumptions for the Sales Force

In mid-1982, before the Davidson Report was published, the gossip was that strong competition would be recommended (and it was). The key planning assumptions were about the nature and timing of the arrival of competition and the product and service range to be sold, as follows:

Planning Assumption 1

In three years, by about 1985, an independent industry authority would be established to regulate the market including networks, the universal service arrangements, customer premises equipment, value added services and related trade practices.

During this time there would be consultation with the industry, enacting legislation, and establishing the regulatory regime and the new framework which would note developments in the USA and the UK.

Planning Assumption 2.

In five years, by about 1987, two years after the regulator was established, one landline competitor would be licensed with no universal service obligation to operate anywhere in Australia and the right to interconnect with the Telecom network under reasonable (to the competitor) rules.

The competitor would first attack the landline business market in Sydney and Melbourne in the CBD's and the business clusters in the suburbs. In 1988 Brisbane, the Gold Coast and Canberra would follow.

Planning Assumption 3.

In five years, by about 1987, there would be one mobile competitor licensed to operate anywhere in Australia with the right to interconnect with the Telecom network under reasonable (to the competitor) rules. This assumed that Australia would follow the duopoly regulatory model for cellular mobile markets adopted in the Nordic countries in 1982 and the USA in 1983.

The competitor's strategy would be similar to that used for the landline but would be paralleled by a thrust at small and medium business customers and residential customers in the same areas.

Planning Assumption 4.

In four years, by about 1986, there would be open competition for customer premises equipment, regulated by the new independent authority.

Any extension of Telecom's product range beyond the traditional customer premises equipment ? for example, towards office equipment ? would be considered from the feedback from the account managers and field sales people as they established relationships with the business customers.

Planning Assumption 5.

In four years, by about 1986, there would be open competition in value added services with transport on the licensed carriers under favourable (to the service providers) terms.

Telecom's investment in the deployment of videotex and related information services would continue as planned with refinement as feedback from the account managers became available.

Planning Assumption 6.

In 1987 competitors would attack the residential market for the highly profitable long distance and international calls, but the nature of the attack was unclear. An effective defence needed to be developed over the next year.

Most of these assumptions were broadly correct in substance (except for the number of mobile operators) but wildly inaccurate in timing.

Although the incoming Hawke government rejected Davidson's recommendation for strong competition in 1983, the assumptions were left unchanged for implementing the sales force.

Based on these assumptions the plan was to have 50% of the sales force operating in three years (1985) and be at full strength, and close to being competitive against an "AT&T strength" sales force, in five years (1987).

So that the sales force could better understand the customers' future needs it was decided to provide some training in products which were not currently in Telecom's product and service range. These included word processors, office systems such as computer terminals and information systems.

The Future Product and Service Range and Market Priorities

The sales force was designed and deployed to sell a range of products and services against competitors to meet revenue and profit growth while containing the inevitable loss of market share. About 90% of Telecom's revenue in 1982 was protected by monopolies.

At that time telecommunications was estimated to be the largest of the "information age" markets ? see Table 2.

Table: 2: Estimated Computers "Information Age" & Related Markets in Australia - 1981/82

Source: International Data Corporation, USA, 1982.

|

|

$ billions (est) |

Growth (est.) % |

|

Market |

|

|

|

Telecommunications |

3.5 |

12-15 |

|

Computers & Office Equipment |

1.0 |

20+ |

|

Media (TV, Cable TV etc) |

2.2 |

20+ |

|

Information Services |

0.1 |

100+ |

|

|

|

|

|

Main Players |

|

|

|

Telecom |

3.1 |

|

|

Others - News Corp |

1.3 |

|

|

Media: PBL (0.3); Consolidated Press (0.4); Herald & Weekly Times (0.3) |

1.0 |

|

|

IBM |

0.3 |

|

The office equipment market was estimated to be the fastest growing after information services, the latter from a very small base ? see Table 3 below.

Table 3: Estimated Growth in Office Systems in the USA - 1980/86

Source: International Data Corporation, USA, 1982.

|

|

US Shipments |

||

|

|

$ millions |

Growth |

|

|

|

1980 |

1986 |

(% pa) |

|

Business & Professional Desktop Computers |

925 |

12,500 |

54 |

|

Word Processors |

1140 |

4640 |

26 |

|

Electronic Typewriters |

240 |

1080 |

28 |

|

PBX?s |

925 |

1815 |

12 |

|

Copiers |

3165 |

3310 |

-2 |

|

Medium Speed non-impact Printers |

130 |

765 |

35 |

|

Facsimile |

190 |

400 |

13 |

Tables 2 and 3 only partly illustrate the product and service range issue. Readers with a wealth of knowledge about these markets and services today might keep in mind that these thoughts were wrestled with in 1982.

In 1982 Telecom had no clear understanding of the product and service range needed in, say, five to ten years' time and was ill-prepared and reluctant to address the subject. For example, in five years' time in a competitive market would Telecom's traditional customer premises range ? telephones, key systems, PABX's ? be sufficient to strongly defend and grow the network against competitors? To better defend and grow the network should Telecom extend the range into computer terminals, other office equipment, local area networks, mainframe computer hubs and facilities management, and information generation and distribution? How strongly would equipment vendors such as IBM, Wang and others extend beyond equipment sales to enter the networks market against Telecom?

Another concern was that forecasts of many new services ? such as mobile services, electronic point of sales, electronic funds transfer, electronic mail (email), videotext services and information services ? were largely speculative, and it was not clear how best to enter and secure these new markets against competition while generating early profits. For example, France had demonstrated that the investment of billions could quickly deploy Minitel and its services, stimulating an early and rapidly growing demand for a large range of new services, but how could this be done without a huge subsidy in Australia?

Media, computing and information vendors were already demanding entry into the telecommunications market. Public Broadcasting Limited (PBL), owned by the Packer family, had approached the Government on several occasions to be permitted to build a private network. PBL had also offered to buy all or part of the directory business from Telecom as a first step into the information business. Others, including IBM, had also approached the Government to be allowed to build private networks.

As indicated in Planning Assumptions 4 and 5, decisions about the customer premises equipment and value added services range would continue as planned with refinement as feedback became available from the account managers.

Market Positioning

A market positioning statement attempts to explain in a few words to the market, the customers and the sales force the business Telecom is offering. Table 4 below shows some statements which were used at the time by some of the network services operators and equipment vendors to position in the telecommunications and adjacent markets.

Table 4: Some Market Positioning Statements - 1982

|

Office Equipment Vendors |

Wang, IBM, Xerox |

?information, communications and computing? |

|

|

|

|

|

AT&T |

|

?Services which combine computers and communications technology? |

|

|

|

|

|

Non Communications |

BHP |

?The Big Australian? |

|

Businesses |

BP |

?The Quiet Achiever? |

|

|

Toyota |

?Now You're Really Moving? |

|

|

|

|

|

Computers |

Digital |

?So Easy to Work With? |

|

|

|

|

|

Communications |

Mitel |

?Building Better Communications? |

|

|

STC |

?Winning the Information Revolution? |

|

|

IBM |

?Information, Communications & Computing? |

|

|

Wang |

?Communications & Computing? |

Telecom did not have a positioning statement and, after the danger of Davidson had passed, refused to consider one. The AT&T statement was adopted informally until one was decided.

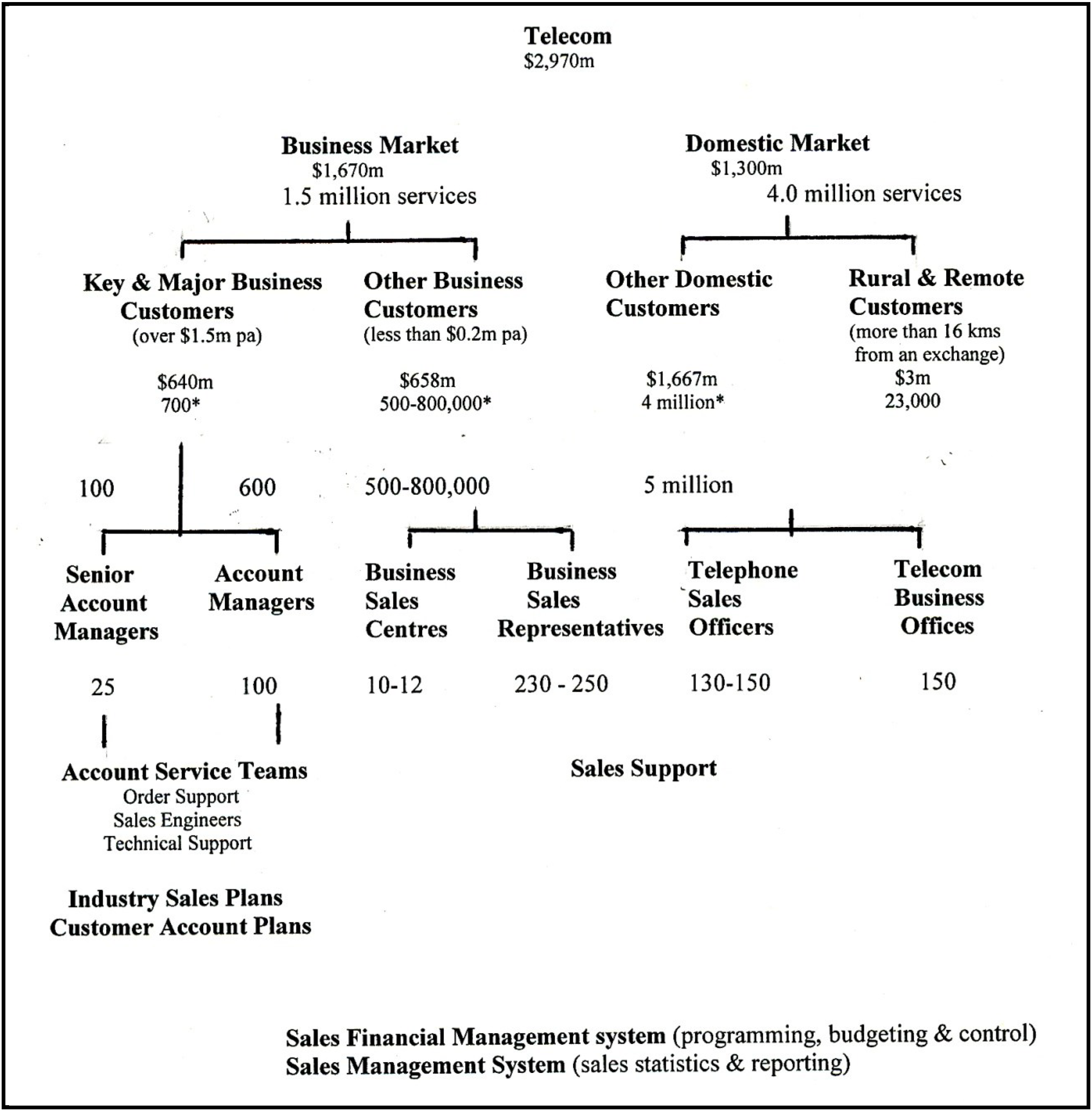

The New Sales Force Structure

Figure 1 outlines the structure which aligned sales and service resources to the customer base.

Table 5 provides a very approximate build-up of numbers.

The numbers of account managers, sales representatives and other classes of sales persons initially decided were exploratory and subject to experience gained over time. A particular worry was that the effort needed to embed the account managers into the telecommunications strategy of the largest customers might be underestimated.

Figure 1: Telecom's Sales Force Deployment over the Customer Base - 1981/82

Figure 1: Telecom's Sales Force Deployment over the Customer Base - 1981/82

* Customers within 16 kilometres of a Telecom Exchange

Table 5: Indicative Business Sales Force Buildup

|

Year ending 30 June |

1983 |

1985 |

1987 |

|

|

Account management |

|

|

|

|

|

|

Account managers |

60 |

100 |

125 |

|

|

Sales engineers |

25 |

40 |

50 |

|

Field Sales Force |

|

|

|

|

|

|

Business sales representative |

100 |

150 |

150 |

|

|

Sales engineers |

100 |

150 |

150 |

|

|

Telephone sales officers |

100 |

150 |

150 |

|

|

|

|

|

|

Broadly, the top 100 customers were labelled ?Key? and were to be initially serviced by 25 senior account managers. The next 600 customers were labelled ?Major?, serviced by 100 account managers. The Key and Major customers were supported by account service teams comprising the account manager and, depending on the need, consultants, sales and technical engineers and back office sales order and service processing people.

The 500-800,000 "other" business customers were serviced by 230-250 field sales representatives and telemarketing sales people, also supported by technical and back office service teams.

The Business Sales Centres in the capital cities and large regional cities would be used for presentations, product and service launches, customer entertainment and customer training, mainly for the business sector but also for community events.

About 130-150 telemarketing people would actively sell to the residential market, which was also supported by the (about 150) Telecom Business Offices in the capital cities and large regional cities and towns. These were in addition to the existing officers currently handling new service connections and cancellations and fault repairs.

Two new management systems would be introduced to administer the sales force nationally. A Sales Financial System covered matters such as costing and budgeting and control of revenues and costs. A Sales Management System controlled customer classification (Key, Major or Other), deployed the sales people to Key or Major customers or geographic areas, resource allocation, set sales standards and budgets, tracked performance against standards and budgets, and paid on results.

The numbers shown in Table 5 for the sales force and the timetable for recruitment, selection, training and deployment were highly speculative and flexible. They depended on several factors including the experience gained in meeting customer expectations, the timing of deregulation and achieving a sensible agreement with the unions. Early deregulation would shorten the timetable and impractical union demands would extend the timetable.

Key and Major Business Customers

The largest business customers were the first priority. They had the highest growth potential, were the most profitable, the most vulnerable to competition, the first users of the new emerging technologies, the most demanding in improving service, and would provide sales with a higher return on investment.

As mentioned, for the first few years Key customers were arbitrarily defined as those with revenue exceeding $1.5million, and Major customers as those over $200,000.

Table 6 shows the top 20 Key Customers. Table 7 shows how heavily the headquarters of the top business customers were clustered in Sydney, Melbourne and Canberra, and why the attack from competition would begin in those cities in the CBD's and business clusters in the suburbs.

Table 6: Telecom?s Top 20 Customers ? 1983

|

Top Ten |

Next Ten |

||

|

Revenue ($m) |

Revenue ($m) |

||

|

Department of Defence |

24 |

Department of Aviation |

8 |

|

Westpac |

18 |

Dept. of Employment & Industrial Relations |

7 |

|

Dept. Public Works - NSW |

16 |

Police - NSW |

5 |

|

Department of Social Security |

15 |

Australia Post |

5 |

|

ABC |

14 |

BHP |

5 |

|

National Bank |

13 |

Dept. of Transport & Construction |

5 |

|

ANZ |

12 |

Myer |

5 |

|

Commonwealth Bank |

10 |

TNT Transport |

5 |

|

Overseas Telecomms Commission |

10 |

TAA |

4 |

|

Ansett Airlines |

10 |

Public Works - Queensland |

3 |

|

Total Top Ten |

139 |

Total Next Ten |

54 |

Large businesses which were authorised to build, own and operate their own networks such as the State Departments of Education and Health and the State owned utilities (power, railways, water, gas and emergency services) are not included as their revenue was less than those in the top twenty.

Crucial statistics relating to the business market were:

- In 1981/82 Telecom?s business market was 44% of total revenue and the top 600 customers - the Key and Major customers - contributed about 21%;

- It was roughly estimated that the business market contributed over 90% of Telecom?s gross profit and the top customers about 50%;

- In 1983/84 Telecom?s revenue growth from key customers exceeded 30% compared with 15% for all customers.

Table 7: Location of the Headquarters of Telecom?s Top 100 Business Customers - 1982/83

|

|

Top 100 Business Customers |

|

|

|

Number |

% of Revenue |

|

Sydney |

50 |

45 |

|

Melbourne |

26 |

28 |

|

Canberra |

20 |

25 |

|

Brisbane |

4 |

2 |

|

Total |

100 |

100 |

The largest business customers were assigned a priority depending primarily on revenue but also on strategic issues such as vulnerability to competitors, early adopters of important new services and technologies, and political pressures (e.g. the Australian Tax Office).

Typical characteristics of Key business customers were:

- National operations;

- Very high levels of investment in and a higher dependency on communications and computer technology for business operations;

- At the leading edge in applying computer and communications systems and technology. The investment was in large private networks (often including AUSSAT when available), office automation, manufacturing process automation and value added services. Fewer than the top 100 customers accounted for 30% of data and private lines usage;

- A diminishing reliance on Telecom as a primary source of advice on information technology requirements. For example, during 1984, more than 10 Federal Government departments invited submissions on office automation and related equipment. Most sourced advice from private sector consultants and office automation or computer suppliers, with Telecom usually being overlooked or approached as an afterthought;

- The most demanding for delivery and service;

- The highest growth potential and ?even after discounting prices due to competition ? the most profitable.

Apart from their contribution to growth and profits, Key customers were absolutely critical to Telecom as they were the opinion formers, influencers and leaders in the telecommunications industry, and were more likely to consider moving to a competitor for a better deal.

These customers would be handled by the highly trained Senior Account Managers with impressive personal presentation, superior marketing and selling skills, a reasonable technical understanding, and strong self-management, all necessary to deal at the top and policy levels.

The largest accounts had an account team comprising a senior account manager, perhaps two account managers (based in each of Sydney and Melbourne), and if needed sales engineers and sales support people. A larger team would be needed for a bank which was planning to deploy a new nationwide EFTPOS network and the team would likely include a packet switching engineer.

Dedicated sales support people were needed for some key customers to handle large volumes of transactions. For example, the banks were continually changing branch locations and upgrading capabilities which required changes in services such as telephone and data access. In addition, at that time the major banks were deploying electronic funds transfer at point of sale (EFTPOS) capabilities ? credit and debit card payment systems ? which required support from Telecom. Finally, if a bank location, including a branch, experienced a problem with a Telecom service, it could contact a ?fast track? number to obtain prompt service.

Initially the top business customers were structured into twelve industry groups for account management organisation and the development of industry plans:

|

Federal Government |

|

Electronic Equipment and Security |

|

State Government |

|

Light Manufacturing |

|

Finance (including the banks) |

|

Heavy Manufacturing |

|

Distribution |

|

Energy and Resources |

|

Media, Publishing, Recreation Hotels |

|

Hospitals and Advanced Education |

|

Transport, Insurance |

|

Legal and Accounting |

Industry-specific plans were developed for each of the twelve industries, and account managers prepared their account sales plans within the appropriate industry plan.

Product managers at Headquarters would use the industry plans to plan and budget product sales and new product deployment by industry and for each large account.

For the first time in Telecom -- product development and investment in and construction of the network would be driven by the customers. As feedback was received from the sales force, particularly the account managers, product and network development and investment would be refined.

The account managers' first priority was to embed Telecom in the network strategy of the top customers and ensure that the product and service range, particularly for network services, would anticipate the demand. In the first year the customers targeted were the most important with headquarters in the CBD's in the Sydney, Melbourne, Canberra and Brisbane, broadly in that order, then spreading out to the business clusters in those cities. In the second year the next most important customers on those areas were targeted as well as extending to the Gold Coast, Perth, and Adelaide. Other major business centres such as Newcastle, Wollongong and Geelong were covered in the following years.

Major customers had some similarities with Key customers and those with lower revenue tended to have more local business operations, and were usually less dependent on computers and communications. These customers were to be served by less senior account managers, each within the appropriate industry business plan.

Other Business Customers

Other business customers were a huge variety of businesses ranging from regional to local, and from stock exchange listed to single proprietor/operator. These were important to Telecom?s success, particularly in the metropolitan and urban areas. These customers tended to be more demanding for emerging services, expected a more responsive standard of service, incurred a lower cost of sales and service, and were more vulnerable to competitors.

Large (other) business customers were to be managed by a business sales representative deployed in a geographic area, and smaller customers were to be managed by a telephone sales person. Sales calls, either in person or by phone, were programmed so that higher revenue customers were contacted more frequently and to support new product and service launches and sales budgets.

If a larger customer needed technical support, the sales person could call on a sales engineer for assistance.

Residential Customers

In a similar way to the smaller business customers, but on a far smaller scale, higher revenue residential customers were serviced on a geographic basis by telephone sales people. As usual, all residential customers could still seek service over the telephone for new service connections, faults, bill queries and bill payments, and they could also approach a Telecom Sales Office or Telecom Shop.

Customer Perceptions of Telecom

In all of their dealings with their customers, Telecom's Sales people needed to be aware of the views held by customers of Telecom.

Table 8 reports that customers ranked Telecom?s quality of service behind banks, butcher shops and service stations, and only ahead of department stores and cheap supermarkets ? a stunning critique.

Table 8: Are We Being Served? - Customer Ratings of Service - November, 1983

(Ogilvy & Mather Advertising Agency)

|

|

Excellent |

Average to Good |

Poor to Terrible |

Don?t Know /Don?t Use |

Total (%) |

|

Banks |

59 |

23 |

16 |

4 |

100 |

|

Butcher Shops |

58 |

16 |

6 |

21 |

|

|

Restaurants |

49 |

24 |

5 |

22 |

100 |

|

Australia Post |

42 |

28 |

19 |

11 |

100 |

|

Tradesmen |

36 |

22 |

22 |

20 |

100 |

|

Service Stations |

33 |

35 |

25 |

7 |

100 |

|

Telecom |

31 |

31 |

26 |

10 |

100 |

|

Major Department Stores |

26 |

36 |

31 |

7 |

100 |

|

Cheap Supermarkets |

22 |

33 |

25 |

21 |

100 |

Apart from studies commissioned by Telecom, research companies and periodicals at the time reported a range of perceptions that the business community held of Telecom and other businesses. A study published in the USA in 1982 reported that potential competitors, such as IBM, Wang and AT&T, were highly ranked in the USA by their peers, customers and competitors on a range of attributes. At that time they would likely have been similarly ranked in Australia with Telecom lower on the scale.

Tables 9 & 10 report that customer perceptions of Telecom were mixed and, on the whole, unacceptable for a competitive market. It was intolerable that over a third of business customers said that service repairs took too long, and almost one fifth complained about the quality of lines. It was alarming that Telecom's most profitable and fastest growing customers, Key and Major, judged that Telecom was not dynamic and innovative, and didn?t sell its services and products well.

Table 9: Business Customers? Views of Telecom - NSW & Victoria - June, 1982

(SRG Australia Pty Ltd, June, 1982)

|

What is the single problem business customers have with Telecom? |

% |

|

Service (fault repair/maintenance) takes too long |

37 |

|

Quality of Lines |

18 |

|

Bureaucratic Attitude |

7 |

|

Installation Wait |

4 |

|

Other Problems |

15 |

|

No Problems |

19 |

|

Total |

100 |

Table 10: Key & Major Customers Ratings of Telecom - February, 1983

(REARK Market Research)

|

|

|

High Level of Agreement |

High Level of Disagreement |

|

Provision of Products & Services |

|

|

|

|

|

Provides good value for money |

X |

|

|

|

Is quick to deal with complaints |

X |

|

|

Corporate Stance |

|

|

|

|

|

Is dynamic |

|

X |

|

|

Is innovative |

|

X |

|

|

Can be trusted in dealings with customers |

X |

|

|

|

Is friendly |

|

X |

|

Integration with Society |

|

|

|

|

|

Contributes to Australia?s welfare |

X |

|

|

|

Contributes to Australia?s progress |

X |

|

|

Promotion & Advertising |

|

|

|

|

|

Keeps the public well informed |

|

X |

|

|

Sells its services & products well |

|

X |

|

Self-Respect & Self-Assessment |

|

|

|

|

|

Is proud of its achievements |

X |

|

|

|

Believes in the quality of its service |

X |

|

|

|

Concerned to make a profit |

X |

|

|

Attitudes to Development |

|

|

|

|

|

Looks to the future |

X |

|

|

|

Keeps abreast of what is going on overseas |

X |

|

The new sales force was expected to be a crucial agent in changing those negative customer perceptions, and was fully briefed on the market and customer perceptions of Telecom during training and regularly afterwards.

Business Sales Centres

A Business Sales Centre (BSC) was a venue for the account managers and the business sales force to market to business customers. It could be used for sales presentations, product and service demonstrations, sales promotions, customer entertainment, media briefings and announcements, and training of customers? and Telecom staff.

A centre consisted of offices and conference rooms, a demonstration area, hospitality facilities and advanced audio-visual aids.

The experience of AT&T and the Bell companies with BSC?s in the USA was impressive. In the first year of operation in three BSC?s in the mid-West, 75% of customers visiting the centre purchased new or additional equipment and services. New revenue of about $1 million per month was generated from each centre. 74% of customers invited to the centre attended.

The centres were to be located in the business concentrations of Australia. Because the Key and Major business customers were strongly clustered in Sydney and Melbourne as were other large customers, two centres were to be established in each of Sydney and Melbourne and others would quickly follow in Canberra and Brisbane. With the confidence gained in these centres, the refined model was be deployed to the other capital and regional cities as financially viable. By 1987 12 centres were operating and it was clear that more were needed.

Telecom Sales Offices

A small number of existing pilot shops were planned to expand to a retail network of 150 Telecom Business Offices (TBO) to sell to the residential market.

The first priority was to locate TBO's in the large retail shopping malls in the capital cities and then the malls in the main rural cities. AT&T had assessed that many of the existing shop fronts were poorly located and all were ineffective as sales outlets, so these were either to be radically upgraded or relocated to sites of higher potential. The employees were trained in sales as well as service

Due to the priority placed on the business market, particularly the Key and Major customers and a number of other factors, the number of shop fronts of the new standard was less than 100 in 1987.

Recruitment and Selection

Recruitment, selection, training and deployment of the sales force was an enormous task.

AT&T provided job descriptions and requirements for each of the categories of sales people and a carefully designed, documented and tested process for recruitment, selection, training and qualification. This was edited to take into account local factors including the Australian telecommunications market, Telecom?s range of products and services, and Telecom?s business support systems such as those for order processing and billing.

Taking into account Telecom's public service culture, the intention was to recruit more than 50% of the account managers and 40% of the business sales representatives from outside Telecom. This was unacceptable to the unions and only 20% were initially allowed to be employed from the private sector, provided that inside people had the opportunity to fill the remainder. In the first year or so the actual recruitment from outside was less than 10%.

The high cost of training new people and the opportunity cost of employing people unsuited to sales compelled a rigorous selection process. The estimated cost of training an account manager to the required level of expertise and motivation was of the order of $50,000 (about $150,000 in 2016 dollars), including salary during training, and even for a support person could reach $10,000 (about $30,000 in 2016 dollars). As most of the new sales people would be recruited from inside, it was even more important to eliminate unsuitable applicants.

The recruitment process relied on the fact that successful sales people have identifiable qualities that contribute to their achievement. Among these are confidence, self-motivation and organisation, empathy and a genuine interest in people. Superior sales people are strongly output and goal oriented. In addition, there are technical factors such as mastery of selling skills, product and service knowledge and customer and industry knowledge. The depth and range of skills required varied across the sales force with the highest needed in account managers and the lowest in support staff.

The recruitment process for assessing applicants was adapted from that used by AT&T, and consisted of three stages.

- Stage 1 was an initial interview,

- Stage 2 was a simple ?paper & pencil? test of language, mathematics, logic and aptitudes.

- Stage 3 was an assessment centre where candidates took part in a series of interviews and role plays of sales situations, mainly to test personal presentation and inter-personal skills.

In the first year the pass rates for internal applicants for account management and the business sales force were very low; for the business sales force only one in eight were accepted and far fewer for account managers. Most were rejected due to inadequate customer orientation, service culture or personal motivation. The unions were dismayed that so many of their members could not qualify, but could hardly object about objectivity.

The acceptance rates for technical and support staff were higher; for support staff the pass rate approached 40% in the first year and rose in the following years.

The training program was also based on the adaption of the AT&T model, and AT&T provided fully designed and documented courses and curricula for each sales category. The courses covered the expected range of subjects as outlined below:

- Telecom philosophy, objectives and policies

- Market structure and expected competition

- Selling skills at a number of graduated levels

- Product and service knowledge from basic to advanced ? products & services, prices and pricing structures, applications.

- Industry knowledge and industry sales plans

- Business processes - orders, invoicing, installation, service restoration, credit.

- Customer knowledge

- Sales management

- Sales processes - customer records, customer management, budgeting reporting

- Self-management and motivation

- Remuneration and conditions of employment

At least 50% of the training was through computer-assisted learning, a relatively new process at the time in Australia. AT&T provided the software to adapt these computer courses to the local situation. Limitations in the training development software resulted in each hour of course time requiring over 20 hours of development time.

The planning of the numbers to be recruited, selected and trained over the first five years was very difficult. The numbers could vary greatly, the main variables being the numbers qualifying through the selection process and at each level of training, the numbers failing to reach the required standard after deployment in the field, and the numbers leaving for positions elsewhere. Table 11 is a very early "order of scale" attempt to estimate the selection and training load and provide some idea of the issue. There is no information of the actual numbers involved such as those entering the selection process, selected, recruited from outside, trained, and leaving through unsatisfactory performance or to other employers.

As can be seen, the projection depended on the pass rates and wastage rates which were high in the first two years and fell in the following years. For example, the Table assumes that, for the first wave of account managers, 90% of applicants, mostly expected to be from within Telecom, would fail the selection process. Thus, some 1250 applicants were required to be assessed. The failure rate was roughly correct but Telecom, with pressure from the unions, lowered the standard for many of the first appointments. With competition expected, perhaps in five years, wastage of more than 25% for account managers might occur. More ?second wave? recruits would be from the private sector and they might achieve a higher pass rate during selection. This scenario requires a training volume for account managers approaching 200 over five years.

Overall, the Selection Centre initial in-take might process 10,000 applicants for the first wave of the sales force and the Training Centre process some 1,000 sales people.

Table 11: Rough Estimates of Sales Force Numbers to be Recruited & Trained in the First Wave

Source: Sales force project team working papers

|

First Wave of the Sales Force |

||||

|

|

Number Required |

Assumed Pass Rate (%) |

Applicants Required |

Assumed Wastage over 5 years (%) |

|

Account managers |

125 |

10 |

1250 |

25 |

|

Business Sales Representatives |

250 |

10 |

2500 |

60 |

|

Sales Engineers |

75 |

40 |

300 |

20 |

|

Telephone Sales Persons |

150 |

30 |

4500 |

50 |

|

Support Staff |

400 |

40 |

1600 |

40 |

|

Total |

950 |

|

9850 |

|

The staff turnover was particularly difficult to estimate. With high internal recruitment for account managers and business sales representatives, serious culling of unsatisfactory performers in the field in the first five years might be expected. Table 12 assumes a failure rate of 25% for account managers and 60% for business sales people. This was resisted by the public service rules and the unions. A significant number, probably the better performers, might leave for more attractive employment as they grow their skills, gain confidence and achieve a record of success.

Over 50% of the training was delivered in Sydney and Melbourne; the rest was done by flying visits of a week or so to other capital cities and by computer-based learning. People completing a training course were tested, and if passed, were certified for appointment and deployment in the sales force.

As more people were recruited from the private sector, many with previous sales or technical experience, a ?fast track? was introduced in the training program to take their skill level and previous experience into account.

Sales Force Motivation

Most sales forces work best within a clearly stated framework of values reinforced by management behaviour and a motivation program. Apart from salaries based on results, sales force motivation programs were relatively uncommon in the late 1970?s, and unknown in the public service and Telecom in the early 1980?s.

The aim was that in five years the sales people would have a deep and unparalleled understanding of the market, the industry, the customers and Telecom's products and services. They would have superior selling and self-management skills, hopefully be acknowledged as among the best in the industry, and would live the values of customer service and financial performance which were reinforced daily by the management, the remuneration plan and an incentive program.

The framework of sales values was quantified in measures of customer service standards and sales budgets. Because Telecom was a public service business, only a modest motivation program was offered; initially the top 10% of account managers and sales representatives and their life partners qualified for an all-expenses paid week at an attractive holiday destination such as the Gold Coast and Hamilton Island.

Remuneration & Conditions of Employment

The remuneration, conditions of employment and related culture and policies required for the sales force were hugely different from those of Telecom and the public service.

The Telecom negotiating team had little encouragement from management and experienced outright opposition from the unions.

The Deputy Chief General Manager (DCGM) was vague and equivocal:

?..personnel policies should be suitable for a leading government business undertaking and should generally be comparable with those in the private sector especially the private telecommunications sector taking all conditions of service into account.? . . . ?You will need to approach discussions with the unions on the basis that there is no firm commitment in advance by top management to remuneration policies/flexible classifications, transport expenses etc.?

With a Labor Government in office the Telecom unions were strongly obstructive. The timing was four years after the ATEA technology dispute in 1978 and one year after the ATEA wages dispute in 1982, both "won" by the ATEA.

The main unions vigorously objected to the proposed sales force philosophy, arrangements and conditions of employment. Their main argument was that the sales force principles struck at the heart of public sector employment, and this was a first step in a wider attack by Telecom on the public service and Telecom's conditions of employment. For example, in the words of the author:

Security of Tenure

- In Telecom (and the public service) the appointed officer "owned" a position in a specific organisation and geographic location. The officer had a high degree of security, almost regardless of performance, with maintenance of income and conditions if a re-organisation eliminated the position.

- Sales people's continued tenure depended on performance.

- Against strong union opposition, the new sales structure had a "pool" of sales positions established for the number of sales people needed, with no person "owning" a particular position. The pool also allowed sensible re-assignment and redeployment of sales staff with changes in the market.

- Sales people whose performance was unsatisfactory, after reasonable further coaching and training, were returned to the traditional Telecom employment structure at their previous pay and conditions.

Salary Levels

- Salary levels in Telecom were consistent with those of the public service. Lower positions were reasonably generously paid compared to similar jobs in the private sector, but salaries were uncompetitive for senior sales and management positions.

- Sales force salary levels needed to be consistent with the market to attract and retain the quality of people needed to be competitive in the industry.

- In the new sales structure salary levels for senior sales and management positions were higher than allowed by traditional Telecom policies but still short of being competitive with the private sector. The hope was that with time this gap could be reduced or closed.

Performance Assessment

- In Telecom the performance of officers was almost never assessed. Sales people's performance is continually under assessment.

- The unions finally accepted continuing performance appraisal, against targets and budgets at least monthly and more comprehensively annually, provided it was limited to the sales force and not regarded as a precedent for elsewhere in Telecom.

- Also accepted were annual performance reviews.