Abstract

In the modern digital world, we have seen the emergence of enormous potential for electronic communication as well as diverse forms of information transfer between subscriber devices. As such, the need for a highly capable networking infrastructure to sustain this communication is a crucial factor for the further development of Poland?s economy. The present article describes the telecommunications market in Poland, and explores the organisation and infrastructure of Poland?s networks as well as the evolution of this sector within the last few decades. It attempts to put a number of issues in the Polish experience in perspective. This can be used to focus further efforts in both Poland and in other nations.

Introduction

Telecommunication networks have experienced rapid development over the past 40 years. Portable user devices have evolved from simple appliances that set up voice calls, to sophisticated computer equipment devices that combine the advantages of cheap communication offered by the Internet with the convenience of mobile phones. As digitalisation and new ICT technologies exert more and more influence on our lives?, the telecommunications sector has become a pillar of our modern economy. Founded on the basic elements of information and knowledge, telecommunications continues to maintain strategic importance, as its development stimulates growth and competition within the economy. It is clear that the successful advancement of the modern economy, as well as economic transformation, is dependent on the capability of networking infrastructure and services.

In this article we will present an overview of issues concerning the development of the telecommunications market in Poland. The paper will describe the organisation of the telecommunications sector, existing legislation, and authorities that manage market regulation. We discuss the evolution of that sector over the past 30 years, including the transformation period and the phase after accession to the European Union (EU). Following this we survey the existing infrastructure for communication networks and services. Prospects for development of the Poland?s telecommunications market are presented in the last section.

Telecommunication sector organisation and market regulation

It is widely recognised that proper conditions and the developmental level of networking infrastructure are a prerequisite for successful growth of a country?s economy. Immature (not fully developed) infrastructure is a major reason for economic underdevelopment in a number of sectors, not only within electronic communications. Other factors also have impact on the development of the telecommunications sector. Most of all, it is existing legislation and sector-specific regulations that influence the amount of investments and the state of communication infrastructure.

In Poland, the introduction of changes found within legislation and regulations concerning telecommunications (or more precisely, the electronic communications and media) began in the 1990s. The general direction of sector transformation was set taking into consideration the previous experience of Western European countries?, i.e. a liberalisation of the telecommunications sector was seen as a replacement of a comprehensive, state regulation by an open, competitive and self-regulating market into the future.

Legislation and institutions for market regulation

The first significant and innovative form of legislation was the Communications Act of 23 November 1990 (OECD 2003). This Act laid down the terms and conditions by which the Polish Post, Telephone and Telegraph (PPTT) enterprise was split into two separate companies: the Poczta Polska SA ? Polish Post, and the Telekomunikacja Polska SA (TP SA) ? Polish Telekom. As a result, this Act allowed independent entities entry into selected market segments. With regard to telecommunication undertakings, it was assumed that the phone call service market would be gradually released, starting from local calls, then regional calls, but still maintaining the monopoly for international calls. As a consequence, the so-called ?duo-pol? principle was implemented in the local call markets, i.e. except for the presence of dominant operator (TP SA), where the functioning of an extra service provider was permitted. In 1995, the amendment of the Communications Act allowed the regulatory authority (at that time a government communications department, later the Office for the Regulation of Telecommunications) to issue permits (licences) for private entities/undertakings in such segments of telecommunications as a mobile cellular and fixed-line telephony.

Development of communication technologies and the need to adjust Polish legislation to the regulations of the EU led to further changes in the law. The Telecommunication Law, enacted in 2000, significantly advanced business rules in the telecommunication sector. The most important changes included (Telecommunications 2000):

- the abolition of the obligation to obtain a licence for the provision of telecommunication services;

- the release of domestic phone calls market;

- establishment of the Office for the Regulation of Telecommunications that took over the regulation powers of the government communications department.

An amendment of the Telecommunications Act in 2003 was aimed at further harmonisation of Polish law with EU directives. It changed the definition, terms and conditions of the universal service obligation and released the market of fixed-to-mobile call connections (The Act 2003). In July 2004, Poland?s Parliament enacted a new Telecommunications Law (Telecommunications 2004), the purpose of which was to create better conditions for equal and effective competition on the telecommunications market, as well as clear rules for reserving frequencies and development of modern communication infrastructure. The new law enhanced the power of an independent telecommunications regulator ? the Office of Electronic Communications (UKE) ? and decreased the prices of telecommunication services.

The President of the UKE is the regulatory authority responsible for the telecommunications industry and market. His duties include frequency resource management and compliance with criteria relating to electromagnetic compatibility (e.g. the inspection of products and telecommunications equipment placed in the Polish market).

In order to prevent and, when necessary, eliminate disruption of both the functioning and development of competition and consumer protection in Poland, the Office of Competition Consumer Protection (UOKiK) was established. This organisation is a central government authority with activities financed from the state budget. The UOKiK acts as an independent consumer protection organisation, where it prevents competition-restricting practices (e.g. the abuse of a dominant position) and anticompetitive concentrations of network operators, service providers and telecommunications enterprises, e.g. the establishment of cartels (distortions of competition caused by overconcentration of frequencies in the hands of a given association or capital group), protects collective consumer interests, monitors state aid and ensures product safety, as well as monitoring the quality of products on sale.

The powers of UOKiK were laid down in the Competition and Consumer Protection Act of 16 February 2007 (The Act 2007), with the aim of the Act to protect competition from distortions resulting from the behaviour of enterprises operating in the market. The main values and mission of the UOKiK can be found in the Competition and Consumer Protection Policy (CCPP) adopted in September 2015 (Office 2015). Within this, for the first time, the strategy for protection of competition and the strategy for protection of consumers were combined in a single document, and thus defined as having a common goal, which is striving to ensure consumer welfare and creating conditions in which effective competition also means integrity in trader-consumer relationships.

In line with the basic principles of the CCPP, UOKiK focuses on information-sharing and taking coordinated measures by relevant authorities when a threat to consumer welfare becomes apparent. UOKiK analyses provided information concerning possible violation of competition law and infringement of consumer rights received from local government authorities, the Office of Electronic Communications (UKE), the Consumer Ombudsman, and the Commissioner for Human and Citizen Rights Protection (who also acts as the Independent Telecommunications Ombudsman) etc.. A crucial aspect of UOKiK is its role in the process of formulating legislation which protects consumers and supports the development of competition.

Sector-related regulations (i.e. laws targeted at undertakings/enterprises in individual sectors) also apply to the telecommunications market. The need for such regulations arises from a number of factors, such as the operation of a dominant company under natural monopoly conditions using indispensable (telecommunication) network infrastructures, who may block the market entry of new undertakings. The essence of a telecommunication sector regulation has been explained by the Supreme Court?s ruling of 19 October 2006, III SK 15/06, in a comment that states: ?Telecommunications law is an instrument by means of which the state authorities may create relevant conditions enabling equal and effective market competition? (Telecommunications 2004).

Hence, the sector regulation is often referred to as a regulation for competition or procompetitive regulation, as it aims to achieve a state of competition in the market. The state can use both telecommunications and competition law instruments to regulate the economy, though the provisions of the Telecommunications Law, as well as through the Act on Competition and Consumer Protection. These laws deal with competition within the telecommunications market from a different perspective. The competition law operates ex post and aims to protect competition by preventing those behaviours that restrict competition. The telecommunications sector regulation, in turn, is applied ex ante, and focuses on providing conditions that enhance competition. This is why the telecommunications sector is governed both by competition laws and sector-specific regulations.

Detailed description of the relations between competition protection law and telecommunication sector-specific regulation, as well as the cooperation between the Office of Competition and Consumer Protection, (UOKiK) and the national authority in charge of regulating the telecommunications (UKE), have been described in (Ku?ak 2014).

Development of telecommunications market in Poland

Before the development of systemic transformation, Poland?s telecommunication sector was severely underdeveloped, in both quantitative and qualitative aspects (Databases 2003; OECD 2003). The infrastructure of communication was also underdeveloped where a significant shortage of supply in communication services, was considered a distinctive feature of the telecommunications market. Since 1947, the long-established monopolist (PPTT) provided services at a substandard level for a relatively small number of subscribers (cf. Table 1).

Table 1 Telecommunications in CE Europe in 1989

|

|

Country |

Number of main lines (? 1000) |

Telephone density (%) |

|

|

Czechoslovakia |

2226 |

14.26 |

|

|

Romania |

2161 |

9.42 |

|

|

Poland |

3121 |

8.22 |

|

|

CE Europe |

13979 |

11.67 |

The number of subscribers per 100 inhabitants was 30% lower than the average density for Central Europe (CE), and more than five times lower than the average for OECD countries. The penetration level of fixed-line telephony in rural areas presented an even more dramatic problem, i.e. 2.69 lines per 100 inhabitants compared with 12.28 for urban subscribers in 1990 (OECD 2003).

Changes in the transformation period

The legal adjustments of the 1990s aimed at stimulating the expansion of the telecommunications industry through the liberalisation of the market, the introduction of transparent regulations, and the privatisation of the national operator (TP SA) as well as adjusting Polish regulations to EU directives.

The expansion period of the telecommunications sector can be divided into the following stages:

1) 1990 ? 1995: the opening phase, and

2) 1996 ? 2003: the phase of liberal reorientation.

In order to increase the supply of communication services to areas with a shortage of telecommunications infrastructure, the Ministry of Communications opted for the open formation of ?duopolies? in local markets. Through this duopoly approach, the Ministry acts as a regulator of the industry in the opening phase, while refraining from stimulating the market development at a central level. As a result, 23 new operators began providing services and TP SA have made numerous investments in infrastructure. At the same time, Poland?s telecommunications industry was privatised, i.e. the manufacture of telecommunication equipment was purchased by three international companies (Siemens, Alcatel and Lucent), which have become major producers and suppliers in the Polish market. The first operator of a mobile cellular network in Poland began operations in 1992 and used the analogue NMT450i system.

Self-regulation through local telecommunication markets was intended to increase the penetration rate in rural or underdeveloped areas but this was not achieved. In the mid 1990s, the government decided on the liberal reorientation of policy in the telecommunications sector, i.e. in order to increase the market power of independent operators, half of which were allowed to extend the operation to one region only while the second half received permission for business activity in more than two regions.

Apart from a considerable increase in the number of telephone lines and subscribers over the next 12 years, the penetration rate (32% for fixed-line telephony, and 45% for mobile cellular) was still below average European levels. Meanwhile industry liberalisation did not affect the dominant position of the national operator (TP SA), with its market share in the fixed-line telephony market at a level of 80 ? 90%. The three wireless (mobile cellular) network operators, on the other hand, carried out their activities in a competitive environment.

Although most alternative operators are new companies, they have already gained a considerable share of the Polish telecommunications market. Despite a difficult financial situation, new operators are developing their own access networks and connecting new users more efficiently. They also created main lines to be able to deliver long-distance services and to offer international connections after January, 2003. However the liberalisation of the Polish market came at least five years too late (Office 2002). This fact caused difficulties with the rising capital for investments in the telecommunications sector and difficulties with so-called ?last miles? (i.e. reaching distant customers).

Nevertheless, the still dominant national operator (TP SA) uses all legal possibilities to delay free competition in the most profitable sectors of the telecommunications market. This behaviour took place in the case of opening the long-distance market in 2001, and during the liberalisation of the international phone call connections market in January 2003.

In 2002, the total value of Poland?s telecommunications market was EUR 8.77 billion accounting for 4.4% of GDP, with half of the market falling within the fixed-line telephony, 39% ? within the mobile communication and the rest within data transmission and the Internet services (4th Report 2004).

At the end of the transformation period, barriers to the expansion of the telecommunication industry included (Office 2004):

- inefficient regulations,

- low societal living standards,

- high prices (which reduced demand for services),

- weak financial standing of new operators,

- a lack of appropriate expansion policies, especially in rural (i.e. non- urban) areas, and

- the dominant operation of TP SA (with its monopolistic practices).

During this period, independent operators specified a need for more effective engagements with regulatory authorities (URTiP in that time) and more efficient regulations. Ultimately, Poland?s Parliament enacted telecommunication legislation in 2004 (Telecommunications 2004).

The last decade and present status

After accession to the EU in 2004, Poland?s telecommunication market commenced its next phase of development, constituting a further extension of liberal reorientation, and the creation of new opportunities concerning the development of the telecommunications industry. As a result of the introduction of new sector-specific regulations in the realm of telecommunications, competition has become more advanced, where there has been a gradual increase in the level of investment made by new alternative operators.

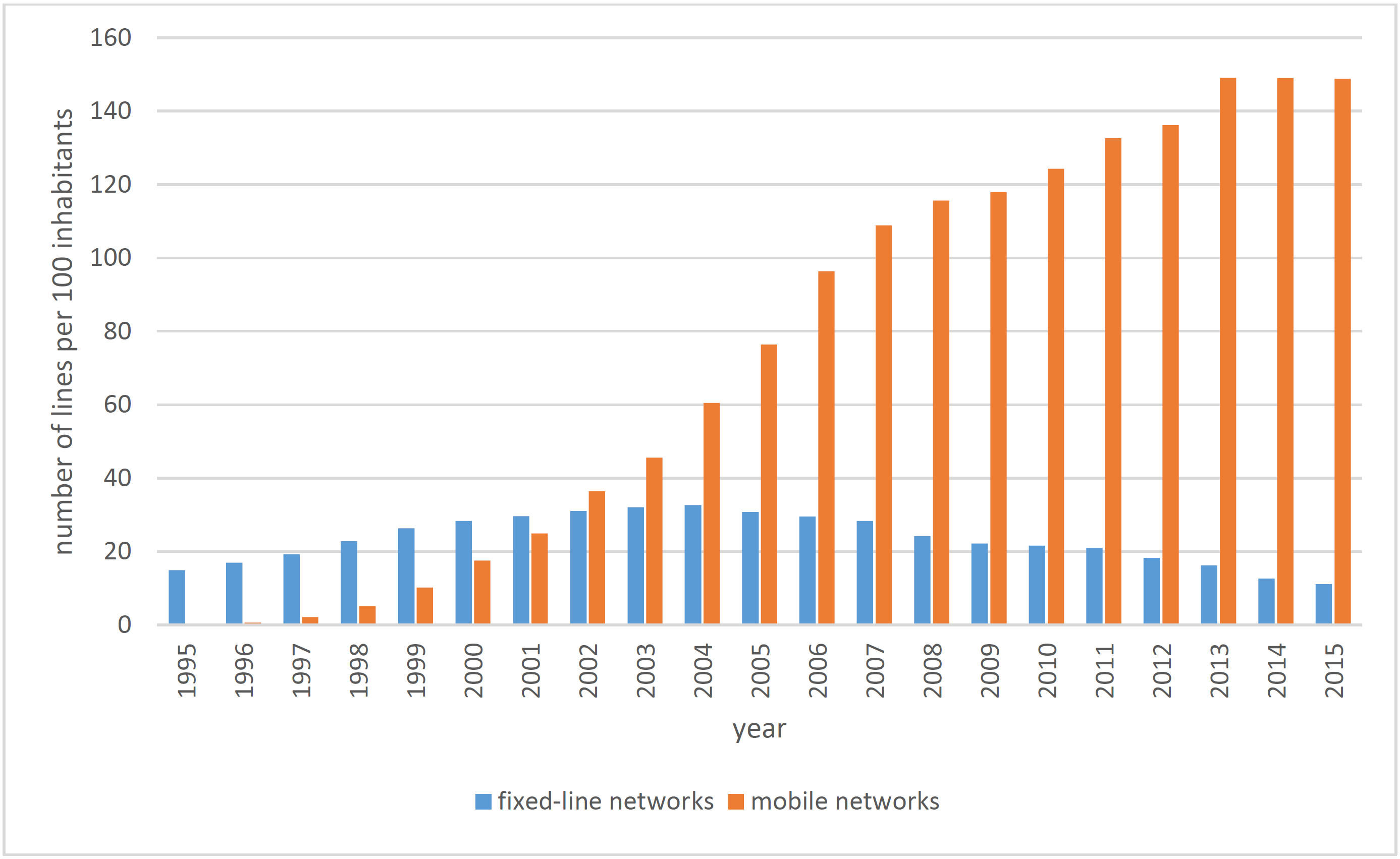

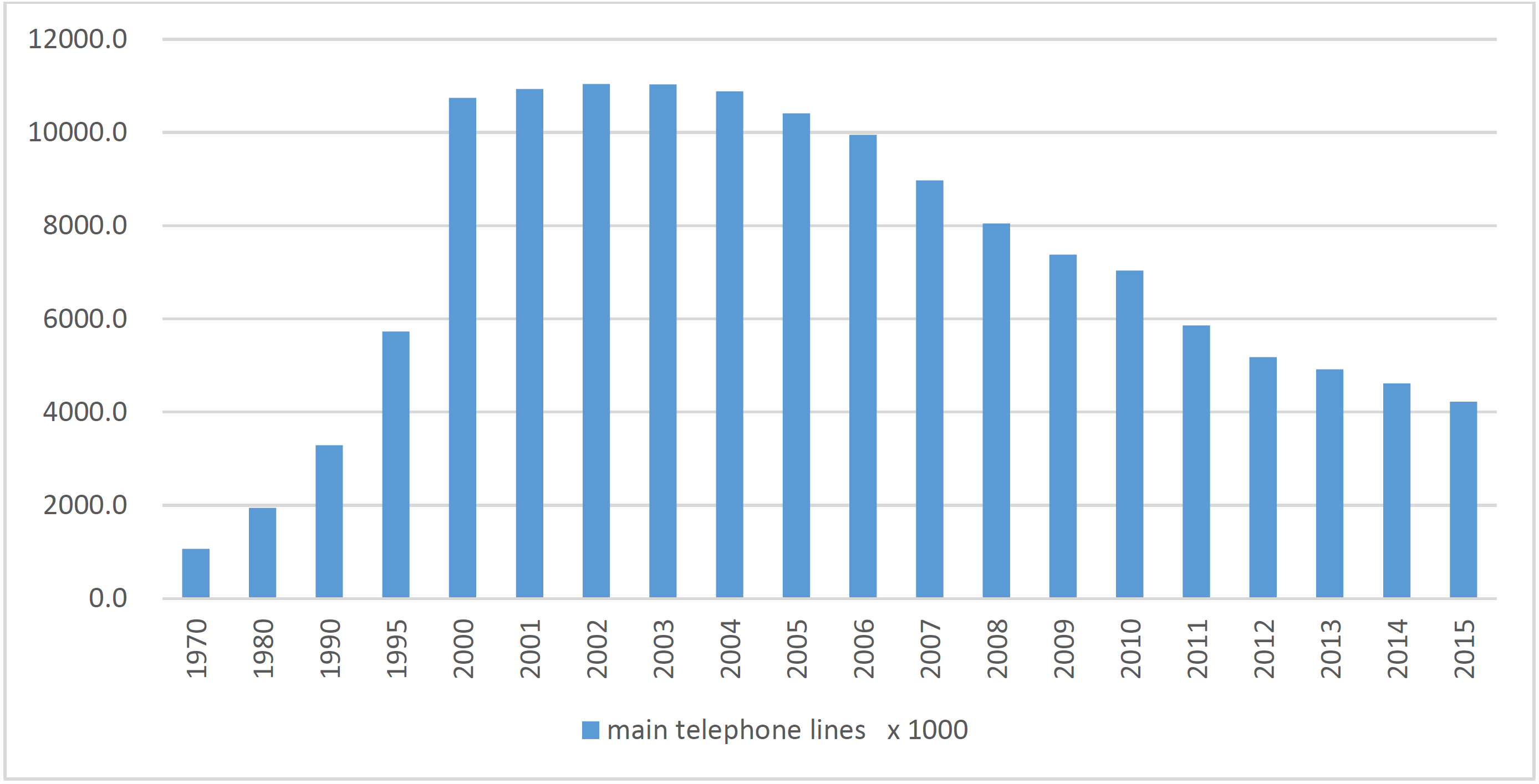

As found in 2010, fixed-line telephony services were supplied by 126 operators, which provided local, regional and international call connections (Office 2011). At the end of 2010, the number of fixed telephone lines (including ISDN access) amounted to 8.2 million, with 7.7 million found in urban areas. The penetration level of fixed voice services (i.e. the number of main telephone lines per 100 inhabitants or the telephone density) reached 21.6 % [cf. Fig. 1]. However, the highest number of main telephone lines in Poland (approx. 12 million) was when the country joined the EU (in 2004 the telephone density reached 32.7 % [cf. Fig. 2]). Due to this, there has been a gradual decrease in the penetration of fixed voice services, where there is insufficient usage of copper infrastructure within communication networks for the development of Internet services and the migration of users to alternative operators of mobile cellular networks.

Figure 1 Telephone density in Poland during the past two decades)

Figure 2 Development of Poland?s fixed voice networks ? number of main telephone lines (without ISDN)

The cause of penetration decline can be segregated into two factors.

First there was a lack of capital investments in the telecommunication infrastructure of the country with systematic transformation of Poland?s economy starting only in 1989. Second there was continuous development of mobile communication in Poland [cf. Fig. 1], which impacted on development strategies (provided by the dominant operator ? TP SA).

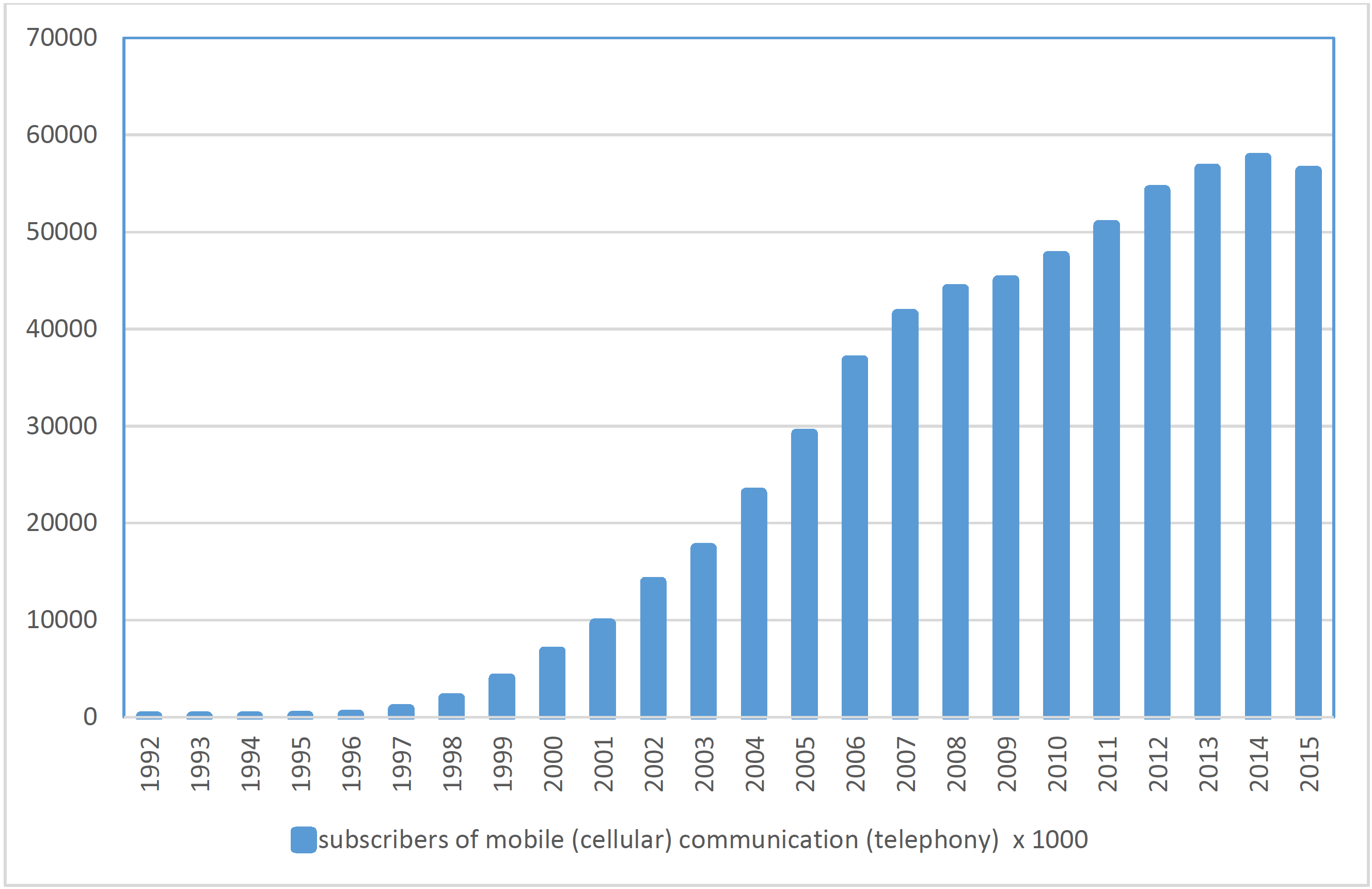

As opposed to fixed-lined telephony, during the past two decades a dynamic growth of mobile segregation in Poland?s telecommunications market occurred (as observed in cf. Fig 3).

Figure 3 Number of subscribers in Poland?s mobile networks

The number of users in mobile cellular networks has already exceeded the number of subscribers for a fixed-line telephony, where further development of that market sector depended on the entry of a fourth mobile network operator on the market. This occurred in 2007. Moreover, implementation of the TETRA (Terrestrial Trunked Radio) system in some sectors was crucial for the function of the state, also impacting on more dynamic developments concerning Poland?s market of electronic communication.

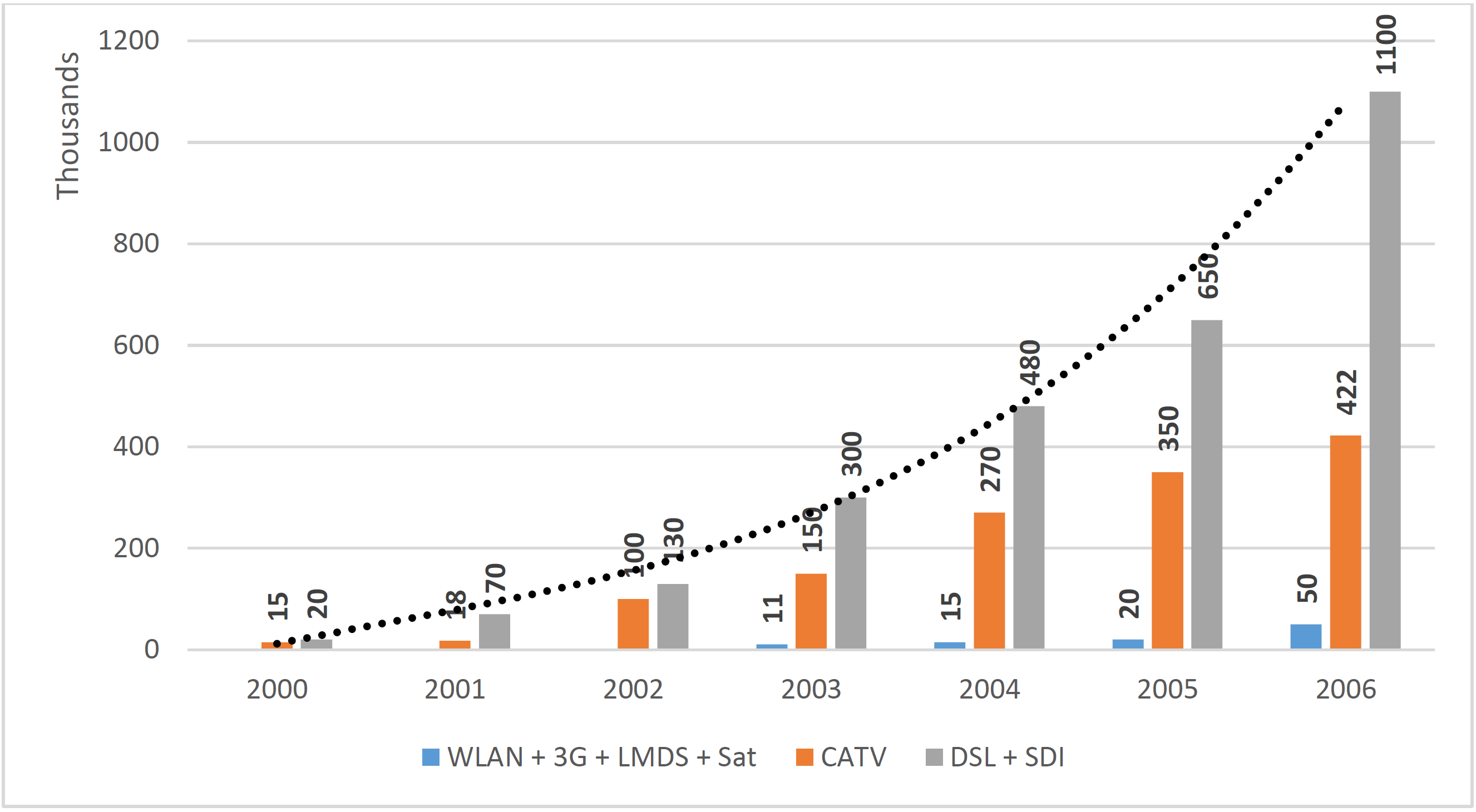

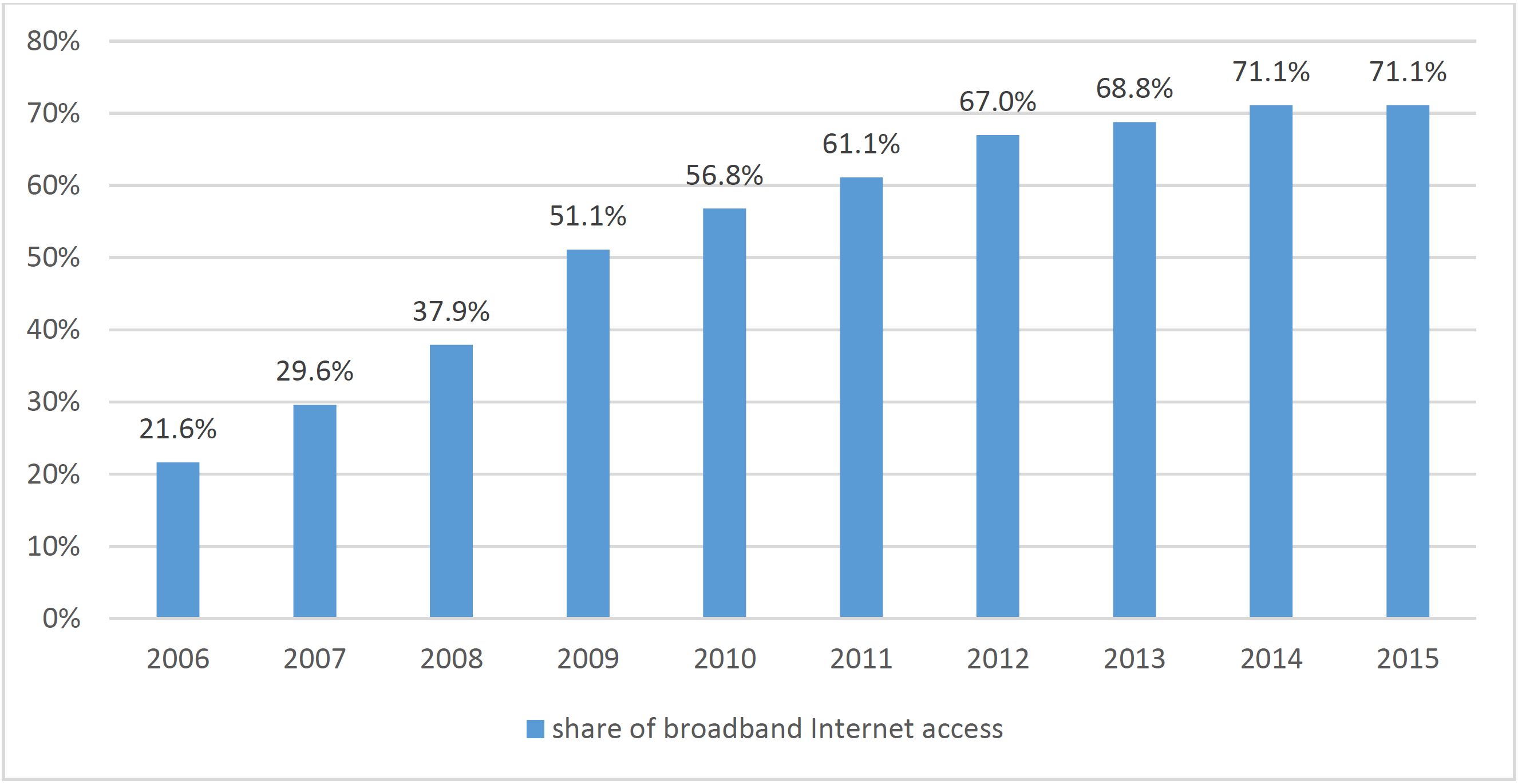

Similar to the mobile sector of the telecommunications market, internet access services were also rapidly developing: in particular, broadband access [cf. Fig 4]. During the time of Poland?s accession to EU, the rate of internet users reached an approximate 7.5 million, which penetrated such services by 20%. In Poland, Internet Service Providers (ISPs) use various technologies to supply broadband access services e.g. ADSL, SDI(ISDN), Wi-Fi, WLAN, CDMA, LMDS or satellite.

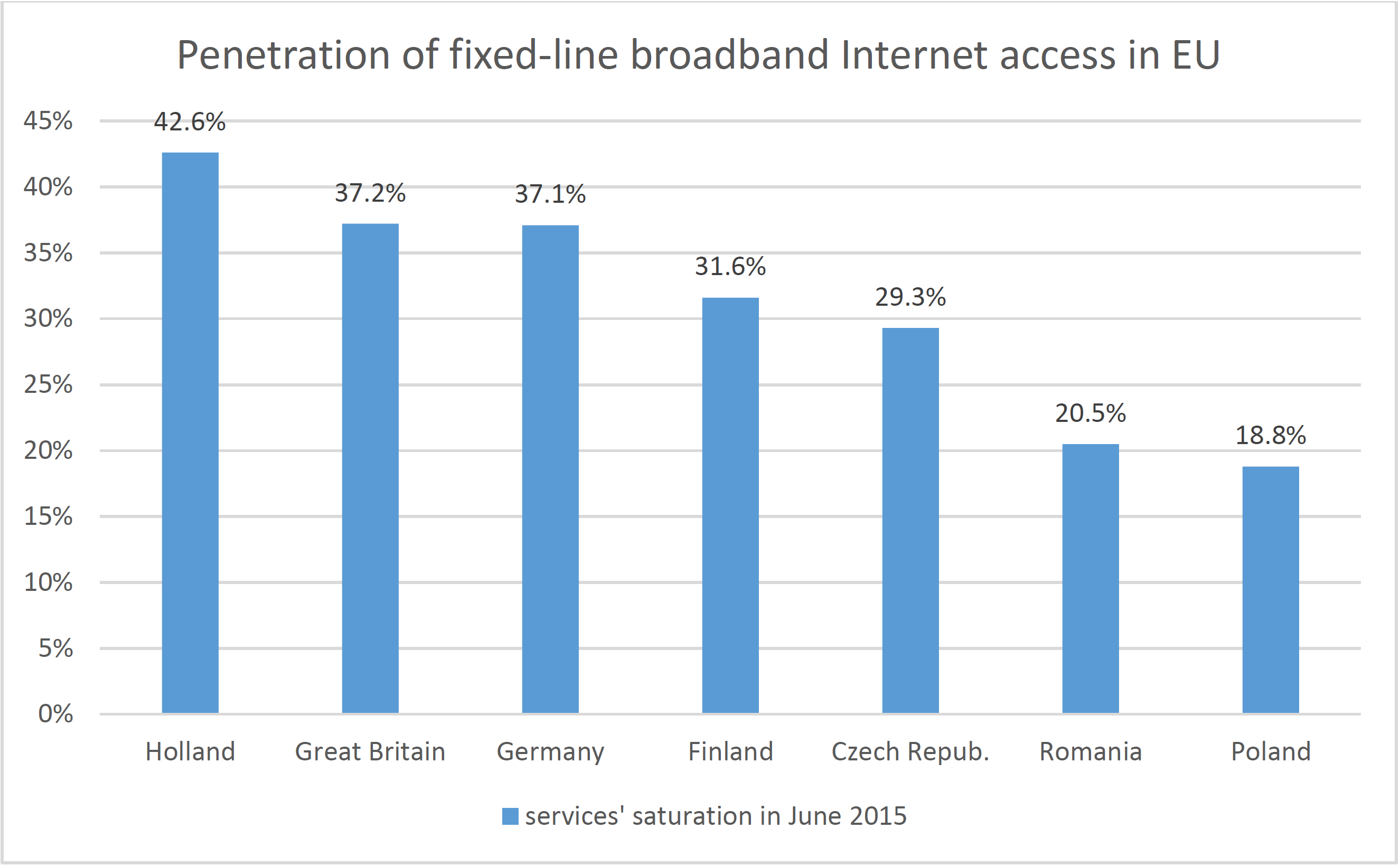

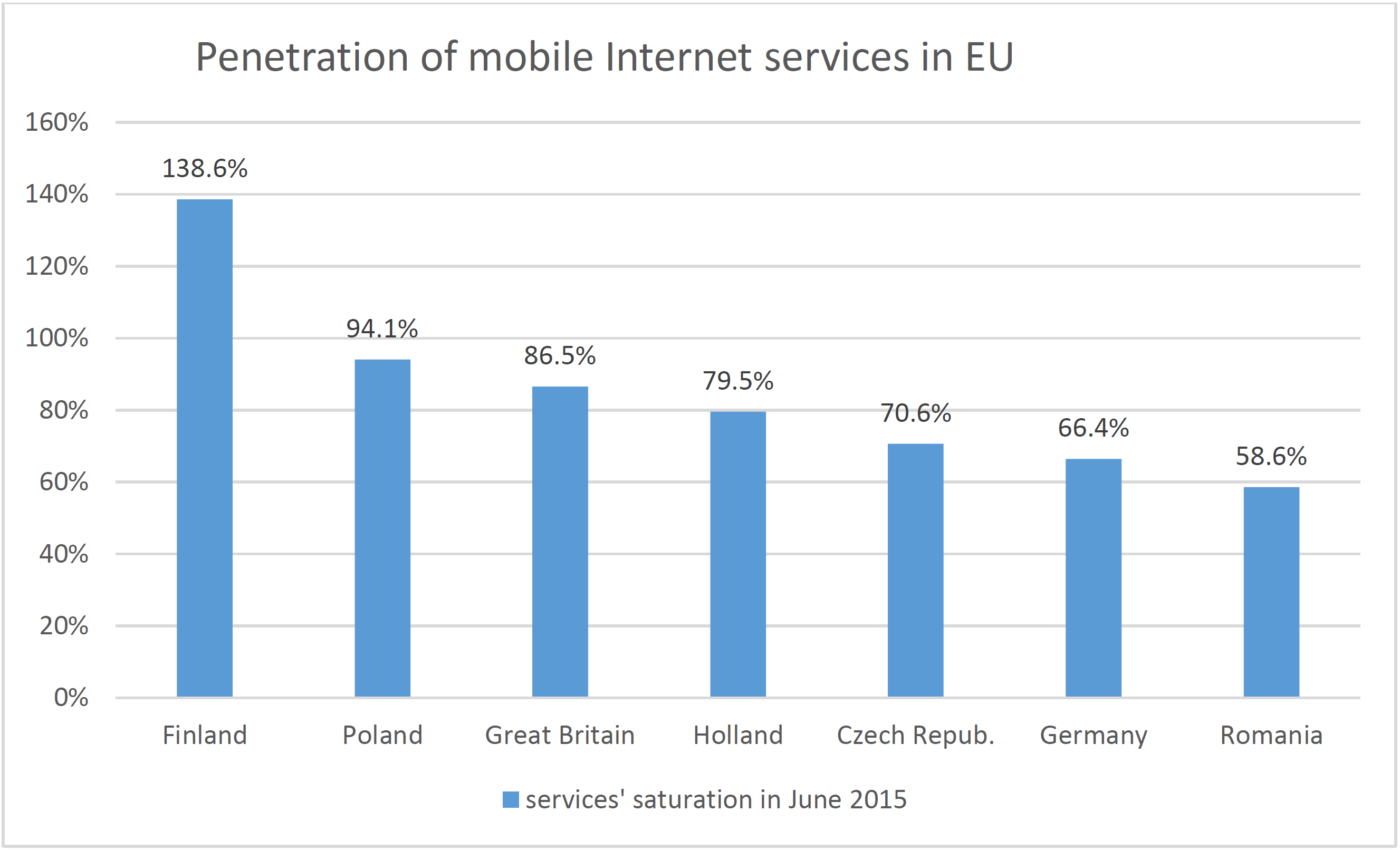

In order to stimulate faster development of broadband access for internet services, in December 2003 the Polish government accepted the National Strategy for Development of Broadband Access to the Internet (Office 2004). The legislation specified governmental aid of 140 million EUR, during undertakings in the country between 2004- 06. As a result of this, one could observe continuous development of broadband access for internet services [cf. Fig 5]; however in comparison to highly developed countries, the developmental level of fixed- line access in Poland is still significantly low [cf. Fig. 6], in contrast to the penetration rate of mobile Internet access [cf. Fig. 7].

Figure 4 Usage of broadband access technologies in Poland, before and after accession EU

Figure 5 Penetration rate of broadband Internet access services in Poland

Figure 5 Penetration rate of broadband Internet access services in Poland

As a consequence of increasing demands for wireless broadband data transmission, the issue of building Next Generation Access (NGA) networks for reaching rural areas, was subsequently addressed in the new National Broadband Plan of 2014- 2020 (Ministry 2014).

Figure 6 Penetration rate of broadband Internet access services in EU

Figure 6 Penetration rate of broadband Internet access services in EU

Figure 7 Penetration rate of mobile Internet access services in EU

Figure 7 Penetration rate of mobile Internet access services in EU

Through this, a rough estimate shows that NGA networks will be able to provide broadband services for all of Poland?s inhabitants by the year of 2020. However, this is only in areas where the estimated cost of connecting a subscriber is higher than 5000 PLN (approx. 1200 EUR) as highlighted by barriers of investment of ISPs and network operators. The requirements included in the new National Broadband Plan are also consistent with The Digital Agenda for Europe (Digital Agenda 2010).

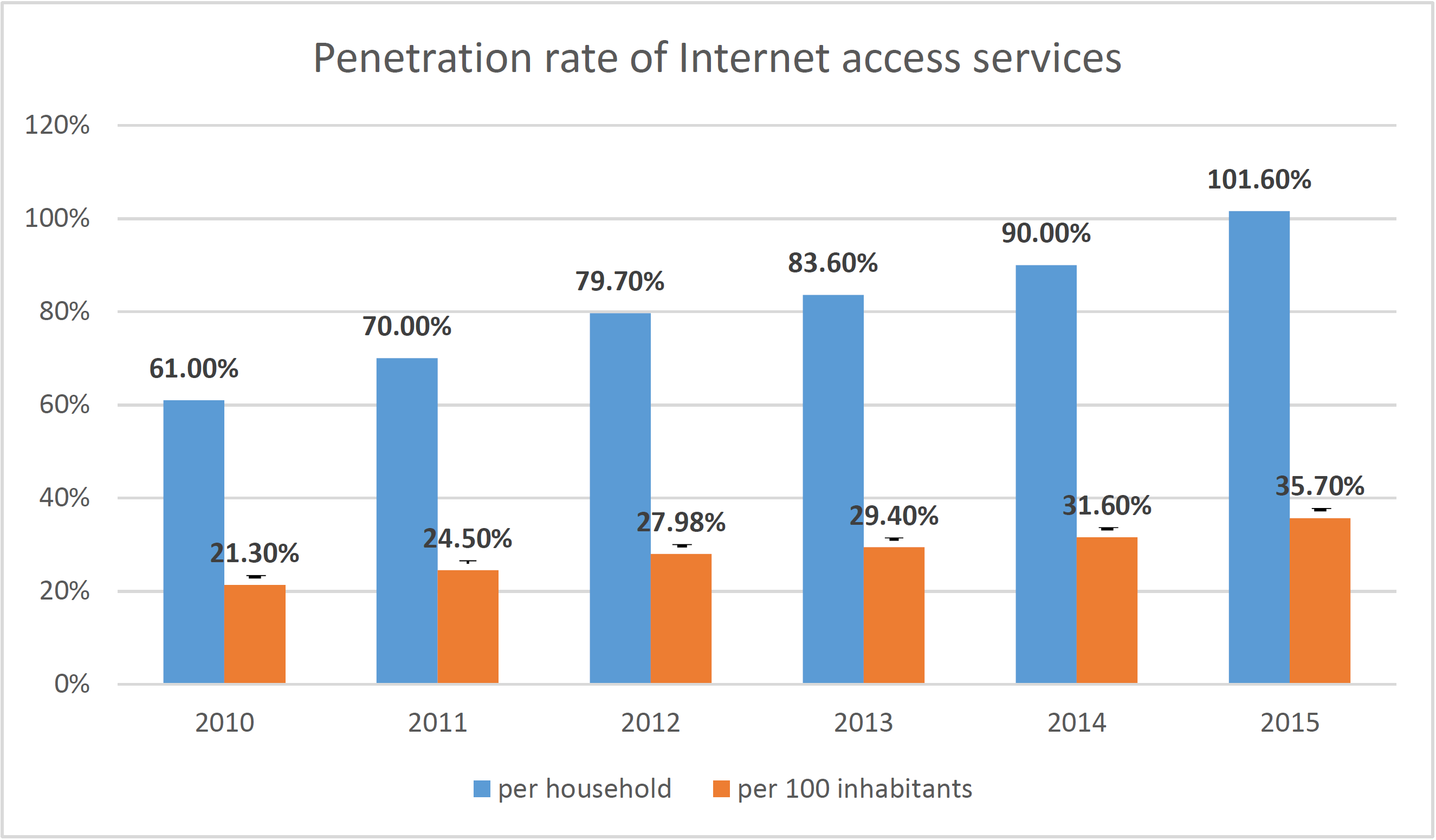

In 2015 there were almost 14 million internet users in Poland where the penetration rate of households with internet access services exceeded 100%. Internet penetration stood at a level of almost 102% at the end of 2015, which was 11.6% higher than in the previous year [cf. Fig. 8].

Figure 8 Penetration of Internet access services in Poland

Figure 8 Penetration of Internet access services in Poland

As found in prior years, more people relied on fixed-line Internet access (7.1 million), where the difference between fixed-line and mobile technologies became smaller. The number of lines with capacity of more than 10 Mbit/s increased up to 61% of all lines, where almost 11% of subscribers used faster Internet access exceeding 100 Mbit/s (Databases 2015; Office 2016). In 2015, 6.67 million customers used mobile Internet, which is around 0.5 million less than in the case of fixed-line access. This proves that the accessibility of fixed-line Internet improved thanks to investments in this technology. Market evolution also highlighted a significant growth due to revenues taking place in fibre-based Internet access services. The largest revenues were generated by mobile Internet access services provided by means of dedicated 2G/3G/4G devices.

The declining trend for fixed-line telephony continued, i.e. in 2015, where the number of subscribers decreased by approximately 0.5 million, while revenues generated by fixed-line services were more than 13% lower than in 2014. On the other hand, the number of VoIP service users increased up to 1.5 million in the past year where most (@64%) of them were served by operators in their own networks (Office 2016).

In 2015, due to subscriber database correction, the penetration rate of mobile services amounted to 147.2 % which was 3% less than the previous year (i.e. it was 56.6 million SIM cards in reality). Though 50.6 % of all mobile subscribers used the popular option pre-paid services, the revenues generated by those services were only 19 % of the total of operators? revenue (Office 2016). This statistic suggests rapid growth of data transmission segmentation within the mobile market. In contrast, the number of bundled service users also increased and stood at 5.9 million in 2015, (i.e. approximately 37% of Polish households subscribed to such services) featuring of the lowest prices in Europe.

In 2015, the total value of Poland?s telecommunications market amounted to PLN 39.5 billion (approx. 9.4 billion EUR) which was the first growth in revenues of the whole telecommunications sector in the last couple of years (Databases 2015; Office 2016). Yet, for some market segments, lower revenues were observed (excluding the rate found in 2014) where such a decline was compensated by migration to new services based on data transmission typical for a modern e-society.

In December 2013, TP SA and PTK Centertel merged into a single company known as Orange Polska SA which is now Poland?s leading telecommunications provider, operating in all segments of the domestic telecommunications market. The company owns the largest communication infrastructure in Poland, supporting the provision of different services (mobile, fixed voice, broadband, TV) for over 23 million customers (in 2015), and is the main provider of leased lines (with a standardised transmission band) for other telecom operators, government and financial institutions, and ISP providers.

Prospects for market development

While Poland?s telecommunications market continues to evolve through the advancement of new technologies, and the replacement of communication systems, service usage within Poland?s telecommunication market has reached its saturation level i.e. operators try to minimise any losses to their customer bases and maintain current users. This results in the permanent development in the market of bundled services, which continues to sustain a steady growth.

As such, the most significant impact on data transmission and market development was the formulation of cloud and big data, where a double increase in data transmission volume was ranked as the most rapid service development. Annual data transmission growth also influenced an influx of consumer awareness when utilising modern services, and the dissemination of smart phones. Operators are continually improving the quality of their networks, where for example, the share of M2M cards, allowing communication between machines or between humans and machines, is steadily becoming more popular. The influx of users within this form of service may, in the future, constitute a significant share in the total volume of individual services.

In 2015, mobile services in Poland were provided by 25 operators, five of which comprised undertakings operating on the basis of their own infrastructure (MNO). In terms of the volume of registered SIM cards, Orange Polska became the dominant leader, with a 27.7% share of the mobile market. The next three MNOs (Polkomtel, P4, T-Mobile) shared almost the rest of that market percentage, i.e. while virtual operators (MVNO) shared only 3.2% (Office 2016).

In the immediate future VoLTE services are expected to launch 4G networks. This advancement will allow improvements in the coverage and quality of calls. Taking into account the structure of the minority group undertaking investment plans, the next few years will bring a large influx of growth in services provided on the basis of fibre networks. This is a result of both the development of mobile networks, and the growing needs for high-speed lines, where the goal is to provide the best quality not only to mobile networks, but also to businesses.

As highlighted earlier, the decrease in revenues experienced by fixed-line telephony was a result of a substitution from mobile telephony, all while increasing popularity of VoIP services. This shows that a certain level of market saturation was reached, causing customers to attach greater importance to more advanced and bundled services.

Among the lines that support the provision of fixed-line telephony, POTS lines remained the most popular (57% of the subscribers) with CATV ranking as the second most popular (14%) (Databases 2015). Orange Polska had the largest market shares (approximately 55%), both in terms of the number of users and the level of revenues, where the next two operators of fixed voice services and market shares stood at almost 75% (Office 2016), irrespective of the 87 alternative entities operating in that same market division.

The analysis of investment data in terms of applied technologies showed a clear trend in replacing cable with fibre technologies. However, a significant proportion (25%) of complete investment in access networks came from public funds, found available under the Innovative Economy Operational Programme and the Eastern Poland Operational Programme, which commenced in December 2015. In conjunction, market evolution significantly influenced the growth of revenues, specifically within fibre-based Internet access services; and over the next few years, further rapid growth in data transmission can be expected. This can be observed in particular, through data download, and also where there is a higher frequency of users sharing large files (photos, videos) with each other for purposes such as social media. Due to the future-oriented trend of the so-called "Internet of things" ? i.e. the possibility to connect to a larger number of devices within a network, the telecommunications market will in the near future, most likely be dominated by Internet services ? in particular, mobile internet. Along with this, satellite access to Internet services could be an attractive alternative, which is currently supplied by Eutelsat, where such services are already available in Poland (provided by Europasat Poland).

In order to meet the goals of the Polish National Broadband Plan, there is not only a requirement for new technologies, but also new innovative solutions in the area of telecommunications, e.g. innovative, cost-effective micro base stations such as LTE-Advanced, working within a 3.4 ? 3.8 GHz frequency band, with a high transmission power (10W +), which can be highlighted as an attractive solution for building Next Generation Access networks in urban and rural areas.

Conclusions

The broadband infrastructure (fixed, mobile and satellite) of the telecommunications field creates new capabilities for the transmission of information in diverse forms, e.g. IPTV, where at the same time it allows for the programming of other electronic communications media outlets, i.e. DVB and DAB. Through this, there is a need for the continuous development and modernisation of the telecommunications infrastructure as it is a crucial factor in determining the growth of any sector of the economy.

Throughout this paper, the development of Poland?s telecommunications sector has been described, taking into account different aspects such as existing legislation and regulations, consumer protection, and a suggested upgrade of networking infrastructure to provide a portfolio of diverse communication services. It has been argued that through legislation the market has become liberalised with the introduction of transparent sector-specific regulations, as well as the privatisation of the national operator (TP SA), all while adjusting Polish regulations to match EU directives. The telecommunications industry has become more advanced since its underdevelopment in the 1990?s, through the stimulation of continuous expansion and persistent development.

Where market segments of the telecommunications sector are open, there is still a requirement to control such areas in order to preserve continuous competition and to protect consumers. Such tasks are performed by independent authorities, which have been established by the Government. Guided market forces can achieve positive outcomes for national communications infrastructure, as recent experience in Poland shows.

Despite the significant transformations and improvements of the telecommunications industry over the past 30 years, there still remains a need for technological innovation in order to sustain the national economy, where Poland?s telecommunications market is still subject to further stimulation. While other nations have varied situations, a core element of stimulating market forces appears to be common for strong outcomes.

References

Databases of Central Statistical Office of Poland (GUS). 2003. ?Poland macroeconomic indicators in 2003?. Warsaw: GUS.

Databases of Central Statistical Office of Poland (GUS). 2015. ?Poland macroeconomic indicators in 2015?. Warsaw: GUS. Available from: http://stat.gov.pl/en/topics/transport-and-communications/communications/communication-activity-results-in-2015,1,11.html

Ku?ak, P. 2014. ?Cooperation between the competition protection authorities and sector regulators?, in Dimensions of Competition Law and Policy ? A Collection of Essays, UOKiK, Warsaw, pp. 33-42.

Ministry of Administration and Digitization (MAC). 2014. ?Narodowy Plan Szerokopas-mowy 2014?2020?. Warsaw. Available from: https://mac.gov.pl/files/narodowy_plan_szerokopasmowy_-_08.01.2014_przyjety_przez_rm.pdf .

OECD. 2003. ?OECD Communications Outlook 2003?. Paris: OECD .

Office of Competition and Consumer Protection (UOKiK). 2015. ?Competition and Consumer Protection?. Report on activities UOKiK ? 2015. Warsaw. Available from: https://www.uokik.gov.pl/download.php?plik=18519 .

Office of Electronic Communications (UKE). 2011. Report on the telecommunications market in Poland in 2010. Warsaw. Available from: https://en.uke.gov.pl/report-on-the-telecommunications-market-in-poland-in-2010-699 .

Office of Electronic Communications (UKE). 2016. Report on the telecommunications market in Poland in 2015. Warsaw. Available from: https://en.uke.gov.pl/report-on-the-telecommunications-market-in-poland-in-2015-20119 .

Office of Telecommunications and Post Regulation (URTiP). 2002. Report from the meeting of the President of URTiP with representatives of independent telecommunications operators. Warsaw. Available from: http://en.uke.gov.pl/polish-telecommunications-market-needs-more-activity-of-alternative-telephone-services-operators-37 .

Office of Telecommunications and Post Regulation (URTiP). 2004. ?Annual Report 2003?. Warsaw. Available from: http://en.uke.gov.pl/annual-report-2004-109 .

Telecommunications Law of 21 July 2000 , Journal of Acts of 2000, No. 73, item 852 .

Telecommunications Law of 16 July 2004 , Journal of Acts of 2014, No. 171, item 1800 .

The Act on Change the Telecommunications Law of 22 May 2003, Journal of Acts of 2003, No. 113, item 1070 .

The Act on Communications of 23 November 1990, Journal of Acts of 1990, No. 86, item 504.

The Act on Competition and Consumer Protection, Journal of Acts of 2007, No. 50, item 1634.

The Digital Agenda for Europe. 2010. Communication from the Commission (26/08/2010). Available from: https://ec.europa.eu/digital-single-?gital-agenda-europe-key-publication .

4th Report on Monitoring of Candidate Countries (Telecommunications Services Sector). 2004. Brussels?Luxembourg: ECSC?EC?EAEC .